The Secret to Scaling Your Small Business to New Heights

June 10, 2024Unlock the hidden strategies for taking your small business to the next level and watch it soar to new heights.

Image courtesy of Pixabay via Pexels

Table of Contents

Running a successful business involves much more than just providing quality products or services. One of the key aspects that can make or break a business is its financial strategy. By implementing the right financial strategies, small businesses can not only grow but also sustain their operations in the long run. In this blog post, we will delve into the top financial strategies that can help small businesses achieve growth and sustainability.

Cash Flow Management

Cash flow management is essential for businesses of all sizes, but it is particularly crucial for small businesses that may have limited resources. Monitoring expenses and revenue streams on a regular basis can help businesses identify potential cash flow issues before they become major problems. By keeping a close eye on cash flow, businesses can ensure that they have enough liquidity to cover expenses and invest in growth opportunities.

Investment Strategies

Investing wisely can help small businesses grow their wealth and achieve long-term financial stability. Whether it’s investing in stocks, bonds, or real estate, diversifying investments can help businesses manage risk and maximize returns. Businesses should carefully consider their risk tolerance and investment goals before deciding on the most suitable investment options. By developing a well-rounded investment portfolio, businesses can secure their financial future.

Budgeting Tips

Creating a budget is essential for businesses to track their expenses, allocate resources efficiently, and achieve financial goals. When developing a budget, businesses should consider both short-term and long-term expenses, as well as any unexpected costs that may arise. By setting realistic budgeting goals and regularly reviewing their financial performance, businesses can make informed decisions to drive growth and profitability.

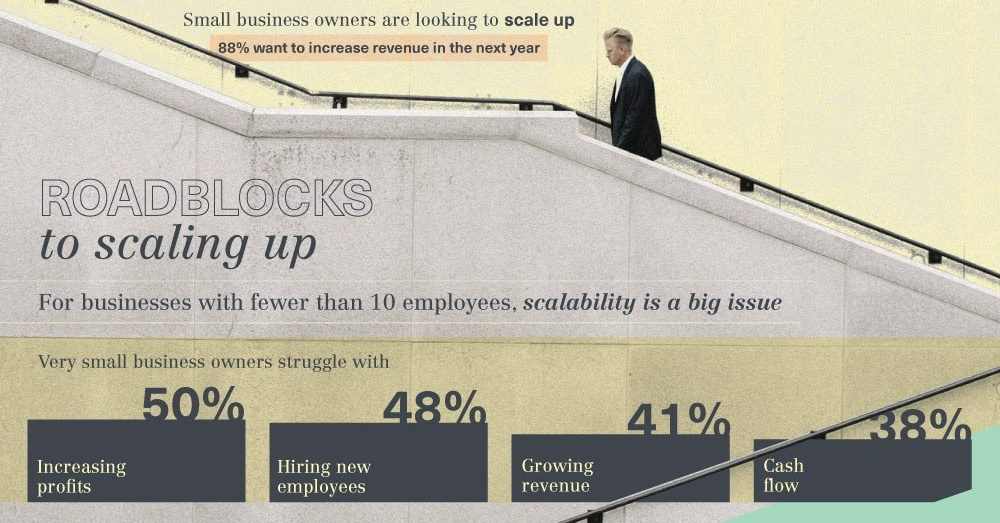

Image courtesy of www.visualcapitalist.com via Google Images

Debt Management

While taking on debt may be necessary for small businesses to fund growth initiatives, managing debt effectively is crucial to avoid financial strain. Businesses should carefully assess their borrowing needs and explore different options for financing, such as loans or credit lines. By developing a strategic debt management plan that includes repayment schedules and interest rates, businesses can prevent debt from becoming a burden on their financial health.

Financial Planning for Growth

Financial planning is a strategic process that helps businesses outline their financial goals and develop a roadmap to achieve them. By aligning financial plans with business objectives, small businesses can set themselves up for success and navigate challenges effectively. Regularly reviewing and adjusting financial plans in response to changing market conditions can help businesses stay agile and seize growth opportunities.

In conclusion, implementing the right financial strategies is crucial for small businesses looking to scale and sustain their operations. By focusing on cash flow management, investment strategies, budgeting, debt management, and financial planning, businesses can create a solid foundation for growth and success. By proactively managing their finances and making informed decisions, small businesses can unlock their full potential and reach new heights in the competitive business landscape.