The Secret to Saving Money: Simple Tips for Building a Strong Financial Future

June 7, 2024Discover the hidden strategies that experts use to achieve financial success and set yourself up for long-term stability and growth.

Image courtesy of maitree rimthong via Pexels

Table of Contents

As a small business owner, financial planning is crucial for the success and sustainability of your business. By setting clear financial goals, creating a budget, managing cash flow effectively, investing for growth, tax planning, and regularly monitoring and adjusting your financial plan, you can navigate the complexities of running a business while ensuring a strong financial future.

Setting Financial Goals

Before diving into financial planning, it’s essential to identify your business’s short-term and long-term financial goals. These goals will serve as a roadmap for your financial decisions and help you stay on track towards achieving success. Whether it’s increasing revenue, expanding into new markets, or reducing expenses, setting specific and measurable goals will give you a clear direction.

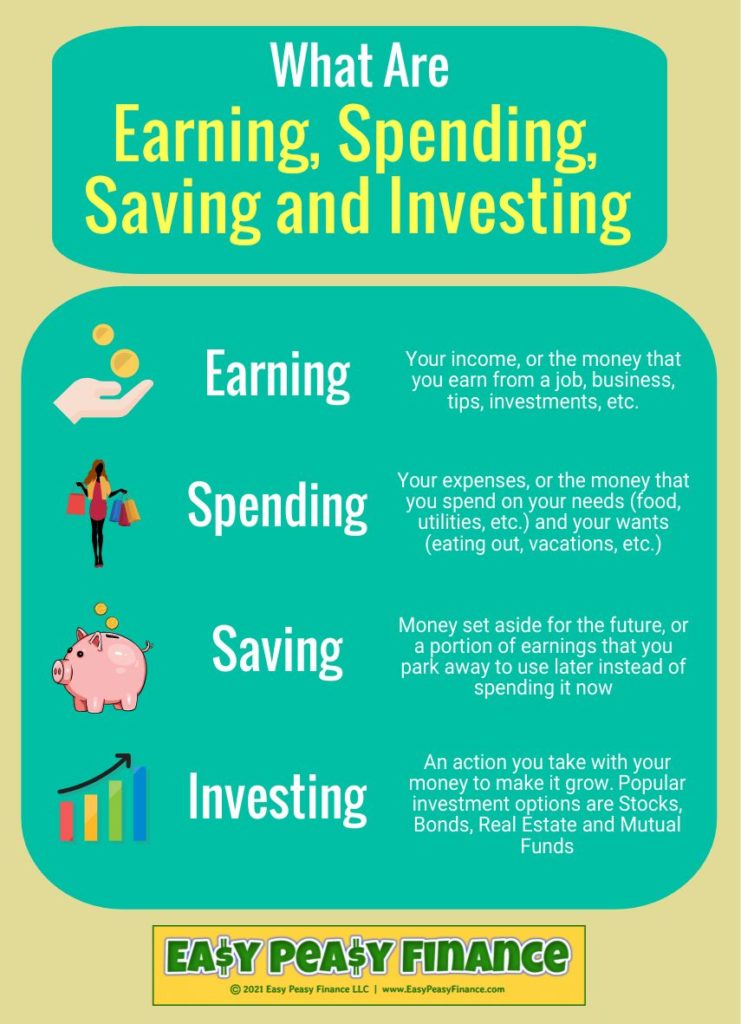

Budgeting and Cash Flow Management

Creating a budget is fundamental to financial planning for small business owners. A budget helps you track your income and expenses, identify areas where you can cut costs, and ensure that you have enough cash on hand to cover your business’s operational needs. Cash flow management is equally important, as it involves monitoring the money coming in and going out of your business to maintain financial stability.

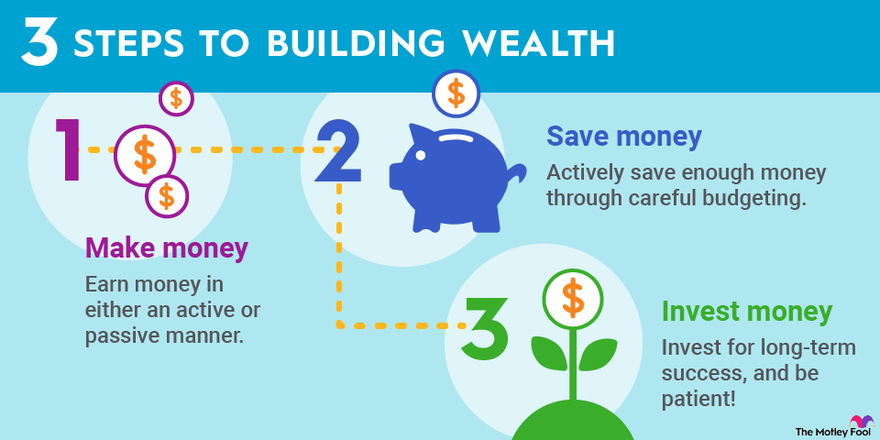

Investing for Growth

Investing for growth is a key component of financial planning for small business owners. Whether it’s investing in new technology, expanding your product line, or entering new markets, strategic investments can help your business grow and thrive. Before making any investment decisions, it’s essential to assess the risks involved and choose investments that align with your business goals and long-term vision.

Image courtesy of via Google Images

Tax Planning

Tax planning is a critical aspect of financial planning for small business owners. By understanding the tax implications of your business decisions and utilizing available deductions and credits, you can minimize your tax liabilities and maximize your business’s profitability. Working with a tax professional can help you navigate the complexities of tax laws and ensure that you are compliant with regulations.

Monitoring and Adjusting Your Financial Plan

Financial planning is an ongoing process that requires regular monitoring and adjustments. By reviewing your financial plan periodically, you can assess your progress towards your goals, identify any areas of concern, and make necessary changes to stay on track. Whether it’s adjusting your budget, reallocating investments, or revising your tax strategy, staying proactive in managing your finances is key to long-term success.

Image courtesy of via Google Images

Conclusion

Financial planning is essential for the success and sustainability of your small business. By setting clear financial goals, creating a budget, managing cash flow effectively, investing for growth, tax planning, and regularly monitoring and adjusting your financial plan, you can position your business for long-term success. Prioritize financial planning as a strategic tool to navigate the challenges of running a business and build a strong financial future.