Maximizing Profits: Strategies Every Business Owner Should Know

June 13, 2024Uncover the hidden secrets of maximizing profits with these essential strategies that every business owner needs to succeed.

Image courtesy of Pixabay via Pexels

Table of Contents

Running a successful business is not just about offering great products or services. It also involves effective financial management. As a business owner, understanding and implementing sound financial strategies is crucial for long-term success. In this guide, we will explore key finance principles that every business owner should know to maximize profits and ensure sustainable growth.

Setting Financial Goals

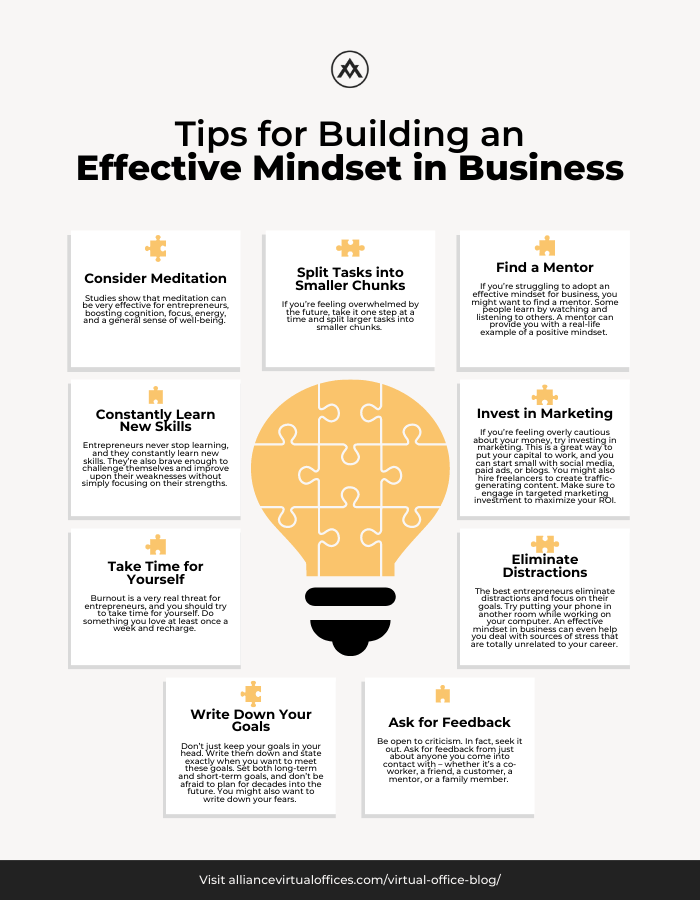

Setting clear financial goals is the foundation of a solid financial strategy. Without well-defined objectives, it’s challenging to track progress and make informed decisions. Start by identifying specific, measurable, achievable, relevant, and time-bound (SMART) financial goals for your business. Whether it’s increasing revenue, reducing expenses, or improving profit margins, having a roadmap will help you stay focused and motivated.

Budgeting and Forecasting

Budgeting is an essential tool for managing your business’s financial resources effectively. By creating a budget that outlines your projected income and expenses, you can track where your money is going and make adjustments as needed. Additionally, forecasting allows you to anticipate financial trends and plan for potential challenges. Regularly review your budget and forecasts to ensure they align with your business goals and make data-driven decisions.

Managing Cash Flow

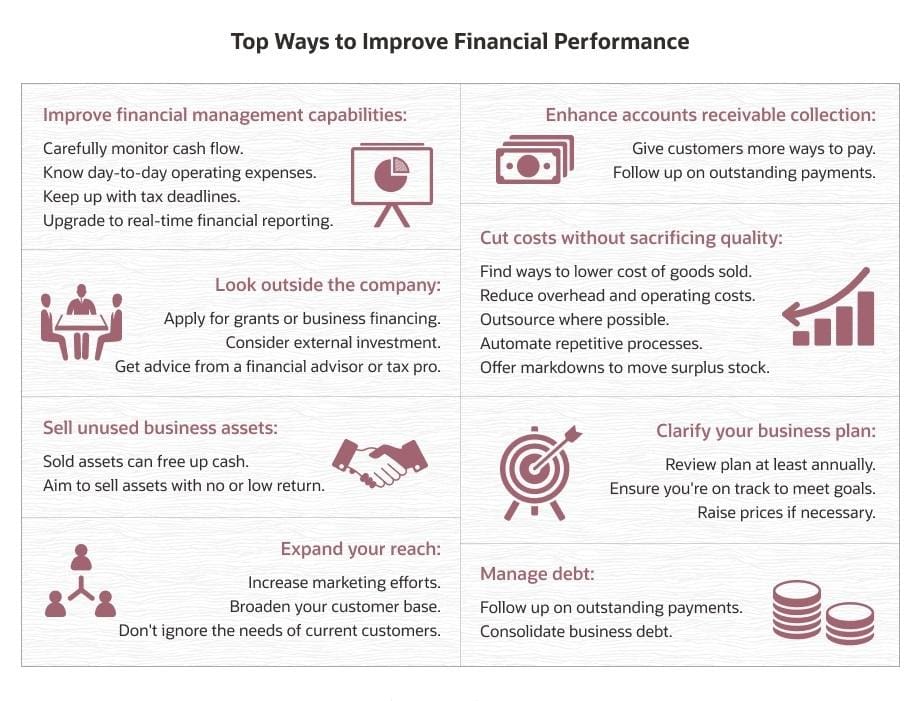

Cash flow is the lifeblood of your business. It’s essential to maintain a healthy cash flow to cover day-to-day expenses, invest in growth opportunities, and weather unexpected financial downturns. Monitor your accounts receivable and accounts payable to ensure timely payments and optimize your cash flow cycle. Implementing cash flow management strategies can help you avoid cash crunches and keep your business financially stable.

Investment and Growth

Investing wisely is key to driving business growth. Whether it’s expanding your product line, entering new markets, or upgrading your infrastructure, strategic investments can propel your business forward. Consider various investment options, such as equipment upgrades, marketing campaigns, or employee training, that align with your long-term goals. Evaluate the potential return on investment (ROI) and weigh the risks and benefits before committing your resources.

Engaging with Financial Professionals

Seeking guidance from financial professionals can provide valuable insights and expertise to support your business’s financial health. Consider consulting with financial advisors, accountants, or tax specialists to help you navigate complex financial matters and make informed decisions. Choose professionals who understand your industry and business goals and can offer customized solutions to address your specific needs. Collaborating with experts can help you optimize your financial strategies and position your business for success.

Image courtesy of via Google Images

Conclusion

Maximizing profits and ensuring financial stability are essential components of running a successful business. By setting clear financial goals, budgeting and forecasting effectively, managing cash flow, making strategic investments, and engaging with financial professionals, you can build a solid financial foundation for your business. Remember that financial management is an ongoing process that requires regular monitoring, evaluation, and adjustment. By prioritizing sound financial practices, you can position your business for sustainable growth and long-term success.