Unleashing the Power of Networking in Business

July 2, 2024Discover how harnessing the incredible power of networking can revolutionize your business success in ways you never imagined.

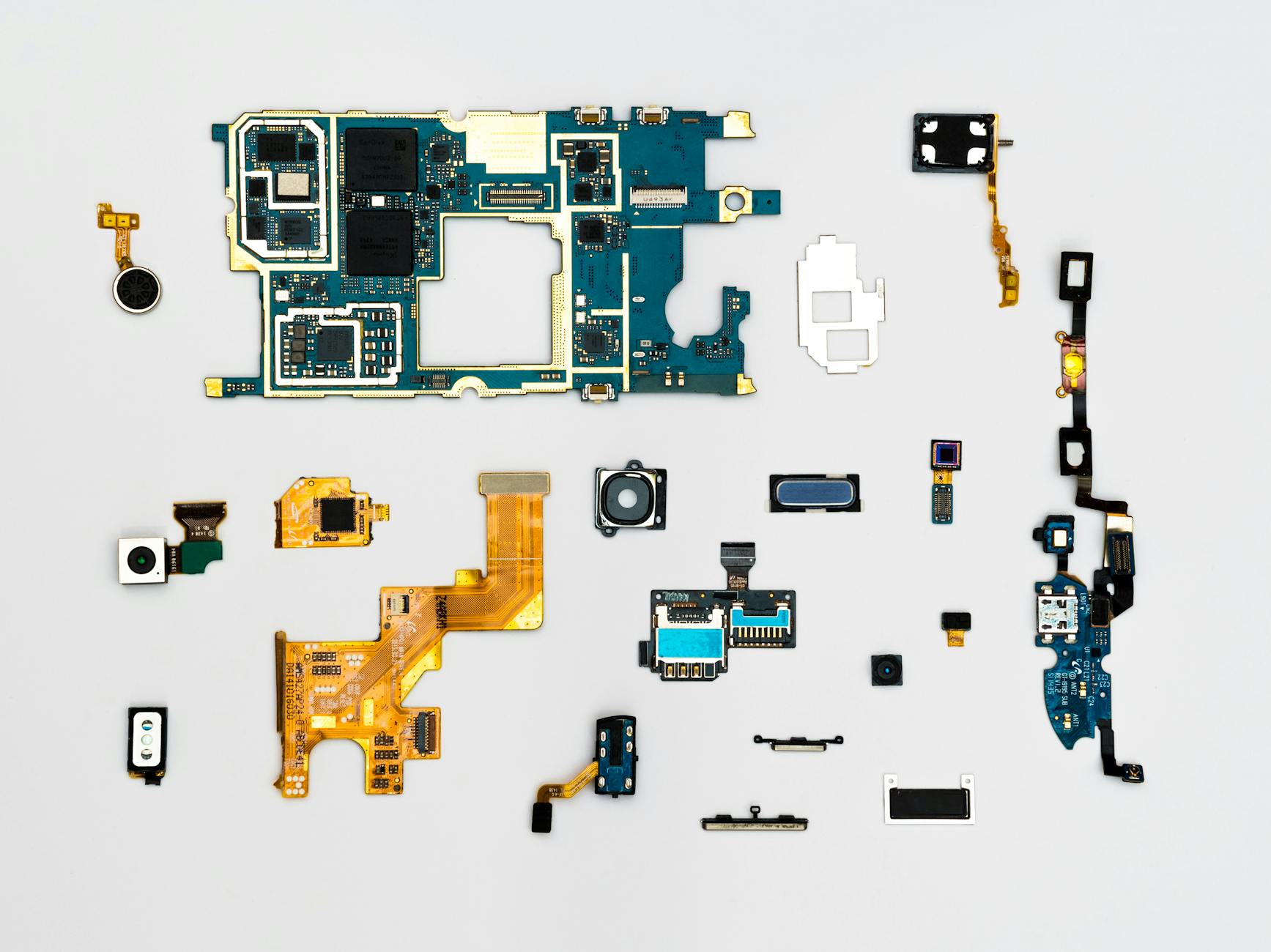

Image courtesy of Dan Cristian Pădureț via Pexels

Table of Contents

Finance is the lifeblood of any business. It is the foundation upon which all operations are built, and without proper management of finances, a business may struggle to survive and thrive in today’s competitive market. Navigating the world of finance can be a daunting task, especially for those new to the business sector. In this blog post, we will explore some key tips and strategies to help individuals succeed in managing finances in the business world.

Understanding Financial Statements

Financial statements are crucial for assessing the financial health of a business. The income statement, balance sheet, and cash flow statement provide valuable insights into the company’s performance and help stakeholders make informed decisions. Analyzing these statements can give a clear picture of the business’s profitability, liquidity, and overall financial position.

Budgeting and Forecasting

Creating a budget is essential for any business to track expenses, manage cash flow, and plan for the future. Budgeting allows businesses to allocate resources effectively and set financial goals. Forecasting, on the other hand, involves predicting future financial performance based on historical data and market trends. By combining budgeting and forecasting, businesses can make strategic decisions that drive growth and success.

Managing Cash Flow

Cash flow management is vital for the day-to-day operations of a business. Maintaining a healthy cash flow ensures that the business can meet its financial obligations, pay suppliers, and invest in growth opportunities. By monitoring cash flow regularly, businesses can identify potential cash shortages and take proactive measures to mitigate risks.

Investment Strategies

Investing surplus funds is a key component of financial management for businesses. There are various investment options available, including stocks, bonds, real estate, and mutual funds. It is essential for businesses to diversify their investment portfolio to spread risk and maximize returns. When making investment decisions, businesses should consider factors such as risk tolerance, investment goals, and time horizon.

Risk Management

Managing financial risks is crucial for the long-term sustainability of a business. By identifying and mitigating risks, businesses can protect themselves from unforeseen events that could impact their financial stability. Risk management strategies may include insurance coverage, hedging techniques, and contingency planning. It is essential for businesses to develop a comprehensive risk management plan to safeguard their financial assets.

In conclusion, navigating the world of finance in the business sector requires a combination of knowledge, skills, and strategic thinking. By understanding financial statements, budgeting effectively, managing cash flow, implementing investment strategies, and mitigating risks, individuals can position themselves for success in the competitive business landscape. It is essential for businesses to prioritize financial management and make informed decisions that drive growth and profitability. By following the tips and strategies outlined in this blog post, individuals can unleash the power of networking in business and achieve their financial goals.