The Ultimate Guide to Starting a Successful Business

May 20, 2024Unlock the secrets to building a thriving business from scratch with our comprehensive step-by-step guide to entrepreneurial success!

Image courtesy of Asiama Junior via Pexels

Table of Contents

Starting a successful business in today’s competitive market requires more than just a good idea – it also requires a solid financial foundation. Finance plays a crucial role in every aspect of a business, from managing cash flow to making strategic decisions for growth. In this blog post, we will explore the impact of technology on finance businesses and how it has transformed the industry in recent years.

Automation in Finance Businesses

Automation has become a key driver of efficiency and cost savings in finance businesses. By automating processes such as payment processing and account management, companies can streamline operations and reduce the risk of human error. This not only saves time and money but also allows finance professionals to focus on more strategic tasks that add value to the business.

Cybersecurity Measures

With the increasing reliance on technology for financial transactions, cybersecurity has become a top priority for finance businesses. Data breaches and cyber attacks can have devastating consequences, leading to financial loss and reputational damage. As a result, finance businesses are investing in robust cybersecurity measures to protect sensitive information and safeguard against potential threats.

Fintech Innovations

The rise of fintech companies has disrupted the traditional finance industry by offering innovative solutions that cater to the evolving needs of consumers. Fintech innovations, such as mobile payment apps and robo-advisors, have provided customers with more convenient and accessible financial services. This has forced traditional finance businesses to adapt and embrace technology to stay competitive in the market.

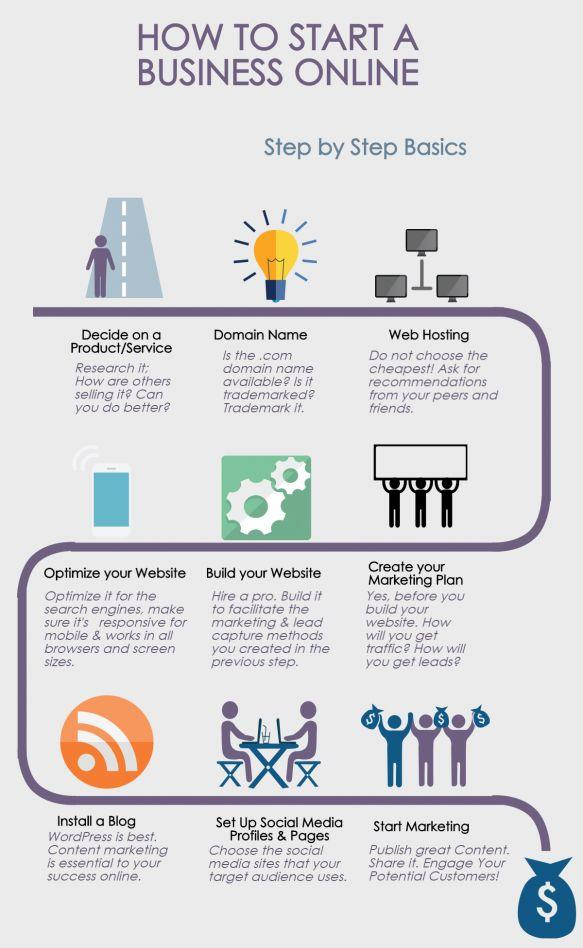

Image courtesy of blog.herrealtors.com via Google Images

Data Analytics in Finance

Data analytics has become a powerful tool for finance businesses to gain insights into customer behavior and market trends. By analyzing large volumes of data, companies can make more informed decisions that drive business growth and profitability. Data-driven decision-making is becoming increasingly important in the finance industry as businesses strive to stay ahead of the competition.

Future Trends in Finance Technology

Looking ahead, the finance industry is poised for further technological disruption. Emerging trends such as blockchain technology and artificial intelligence are expected to revolutionize the way financial services are delivered. Finance businesses that embrace these technological advancements will be better positioned to capitalize on new opportunities and drive innovation in the industry.

In conclusion, technology has had a profound impact on finance businesses, transforming the way they operate and deliver services to customers. By leveraging automation, cybersecurity measures, fintech innovations, data analytics, and future trends in technology, finance businesses can position themselves for success in a rapidly evolving industry. As technology continues to advance, finance businesses must adapt and innovate to stay ahead of the curve and achieve sustainable growth in the long term.