The Ultimate Guide to Mastering Your Finances: Tips and Tricks for Success

May 17, 2024Unlock the secrets to financial success with these 20 expert tips and tricks that will transform your money management skills.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Finance can be a daunting topic for many business owners, but understanding the basics is essential for ensuring the success and longevity of your company. In this comprehensive guide, we will explore key concepts in finance and provide practical tips for managing your business’s finances effectively.

Understanding the Basics of Finance

When it comes to finance, there are a few key terms that every business owner should be familiar with. Revenue refers to the total income generated by your business, while expenses are the costs incurred in running your operation. Profit, on the other hand, is the difference between revenue and expenses, representing the financial health of your business. Finally, cash flow is the movement of money in and out of your business, which is crucial for maintaining liquidity.

Creating a budget is a fundamental aspect of financial management. By outlining your expected revenue and expenses, you can gain insight into your financial situation and make more informed decisions. Tracking your financial transactions is also essential for identifying areas where you can cut costs or increase revenue.

Managing Cash Flow Effectively

One of the most common challenges for business owners is managing cash flow. To improve cash flow, consider offering discounts for early payment or incentivizing prompt customer payments. It’s also important to monitor your cash flow regularly to identify any potential issues before they become problematic.

Making Informed Financial Decisions

When it comes to making financial decisions, it’s crucial to evaluate investment opportunities and risks carefully. Consider the potential return on investment (ROI) and the level of risk involved before committing to any financial decisions. Additionally, differentiate between short-term and long-term financial goals to ensure that your decisions align with your business’s objectives.

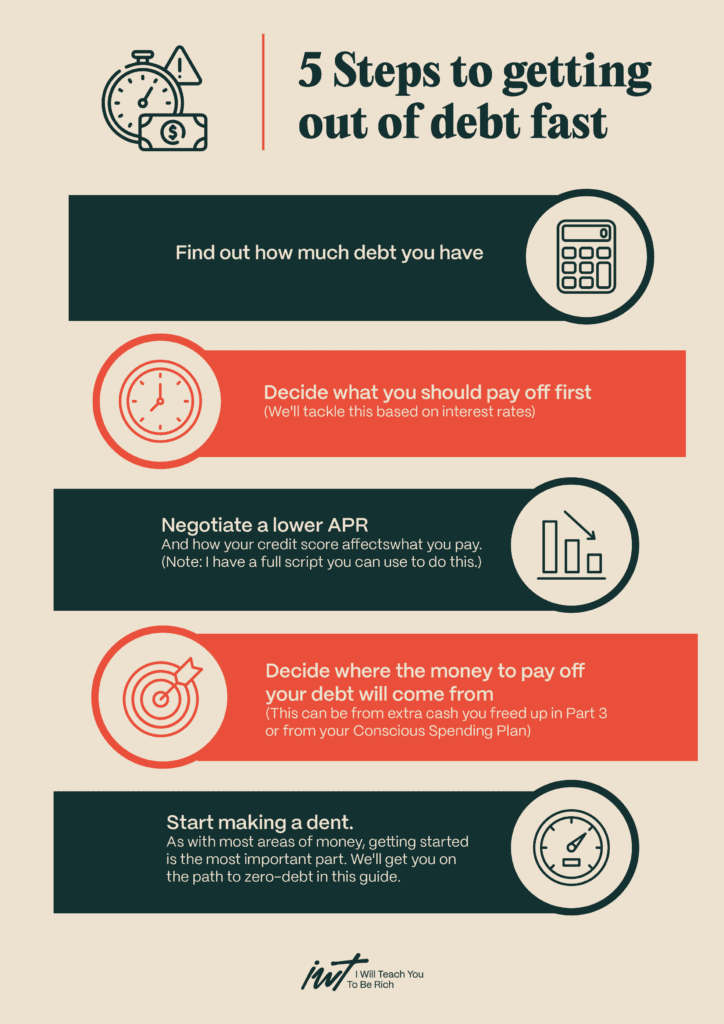

Image courtesy of www.iwillteachyoutoberich.com via Google Images

Securing Financing for Business Growth

Securing financing is often necessary for business growth, but it can be a complex process. Explore different sources of financing, such as loans, lines of credit, or investors, to determine the best option for your business. When presenting a financial case to potential investors or lenders, be sure to highlight the potential return on investment and the value proposition of your business.

Tools and Resources for Managing Finances

Fortunately, there are a variety of tools and resources available to help you manage your finances more effectively. Popular accounting software such as QuickBooks or Xero can streamline your financial processes and provide valuable insights into your business’s financial health. Additionally, there are numerous resources for further education on finance and business management, including online courses, workshops, and seminars.

Image courtesy of www.amazon.com via Google Images

Conclusion

Mastering your finances as a business owner is a continuous learning process. By understanding the basics of finance, managing cash flow effectively, making informed financial decisions, securing financing for growth, and utilizing tools and resources, you can position your business for long-term success. Remember that financial literacy is a key component of business success, so continue to educate yourself and seek out opportunities for growth and improvement.