The Ultimate Guide to Financial Freedom: Strategies for Building Wealth

June 15, 2024Unlock the secrets to financial freedom with these 10 proven strategies for building wealth and securing your financial future.

Image courtesy of Ivan Babydov via Pexels

Table of Contents

Managing your business finances effectively is crucial for the long-term success and sustainability of your venture. In this guide, we will explore key strategies and tips to help you successfully manage your business finances and work towards achieving financial freedom.

Setting Financial Goals

Before diving into the nitty-gritty details of managing your business finances, it’s essential to establish clear financial goals for your business. Whether your goal is to increase revenue, reduce expenses, or improve cash flow, having a roadmap in place will guide your financial decisions and keep you on track.

Budgeting

Developing a comprehensive budget is a fundamental aspect of effective financial management. A detailed budget should account for all income and expenses, providing you with a clear picture of your financial standing. Regularly reviewing and adjusting your budget will help you stay within your financial limits and make informed decisions.

Tracking Expenses

Tracking expenses is a critical component of managing your business finances. By keeping a record of all business expenses, both fixed and variable costs, you can identify areas where you may be overspending and make necessary adjustments. Utilizing accounting software or spreadsheets can help you stay organized and monitor your expenses efficiently.

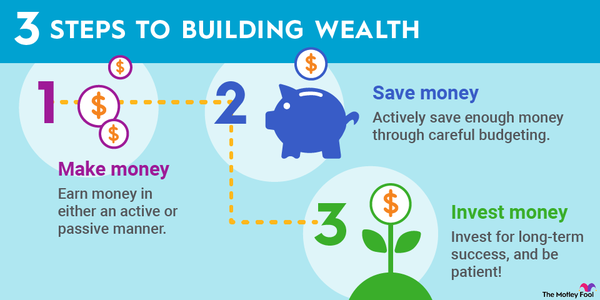

Image courtesy of www.fool.com via Google Images

Managing Cash Flow

Monitoring your cash flow is vital to ensure your business has enough liquidity to cover expenses and sustain its operations. Regularly reviewing your cash flow statements will help you identify potential cash shortages or surpluses and take proactive measures to address them. Consider establishing a line of credit or emergency fund to safeguard your business against unexpected financial challenges.

Seeking Professional Help

While managing your business finances independently is commendable, seeking professional advice can provide valuable insights and expertise. Consulting with a financial advisor or accountant can help you navigate complex financial decisions and optimize your financial strategies. Additionally, exploring resources and tools tailored for small business owners, such as financial management apps or online courses, can further enhance your financial literacy.

Image courtesy of www.financialmentor.com via Google Images

Conclusion

Successfully managing your business finances is a continuous journey that requires dedication, discipline, and strategic planning. By setting clear financial goals, developing a comprehensive budget, tracking expenses, managing cash flow effectively, and seeking professional help when needed, you can position your business for long-term financial success and ultimately achieve financial freedom. Implementing the strategies outlined in this guide will empower you to make informed financial decisions and steer your business towards a path of financial stability and growth.