The Ultimate Guide to Eliminating Debt and Building Wealth

May 29, 2024Discover the foolproof strategies for getting rid of debt and achieving financial freedom with this comprehensive guide to wealth-building.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing finances is a critical aspect of running a successful business. For business owners, the ability to eliminate debt and build wealth is essential for long-term sustainability and growth. In this guide, we will provide you with six essential tips to improve your financial health and secure a prosperous future for your business.

Assess Your Current Financial Situation

Before you can take steps to eliminate debt and build wealth, it’s crucial to understand your current financial standing. Conduct a thorough audit of your business finances, including cash flow, profitability, and debt levels. This assessment will lay the foundation for creating a strategic financial plan.

Set Financial Goals

Setting clear financial goals is key to achieving success in business. Define both short-term and long-term objectives that are specific, measurable, achievable, relevant, and time-bound (SMART). Whether it’s increasing revenue, reducing expenses, or paying off debt, having well-defined goals will keep you focused and motivated.

Create a Budget and Stick to It

A budget is a powerful tool for managing your finances effectively. Develop a detailed budget that outlines your income sources and expenses. Monitor your budget regularly and make adjustments as needed to ensure you stay within your financial limits. By adhering to your budget, you can control spending and allocate resources efficiently.

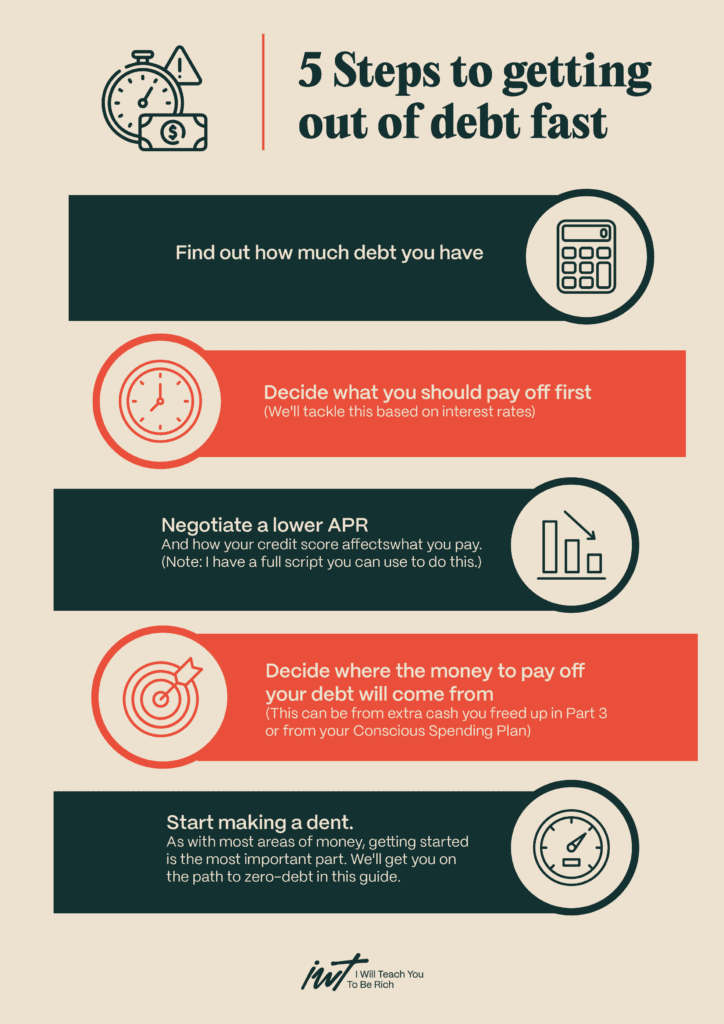

Image courtesy of www.iwillteachyoutoberich.com via Google Images

Diversify Your Income Streams

Generating multiple income streams can provide stability and growth opportunities for your business. Explore different ways to diversify your revenue, such as offering new products or services, entering new markets, or investing in income-generating assets. By expanding your income sources, you can reduce reliance on a single revenue stream and increase your overall financial resilience.

Build an Emergency Fund and Plan for the Future

Unexpected expenses and emergencies can disrupt your business operations and financial stability. Therefore, it’s essential to set aside funds for emergencies by building an emergency fund. Additionally, plan for the future by establishing a retirement savings plan for yourself and your employees. By preparing for unforeseen events and securing your financial future, you can protect your business from potential risks and uncertainties.

Image courtesy of www.financialmentor.com via Google Images

Conclusion

Improving your financial health as a business owner requires diligence, discipline, and strategic planning. By assessing your current financial situation, setting clear goals, creating a budget, diversifying income streams, and building an emergency fund, you can eliminate debt and build wealth for your business. Take proactive steps to secure a prosperous future for your business and achieve long-term financial success.