The Ultimate Guide to Crushing Your Business Goals in 2021

June 1, 2024Unlock the secret to dominating your business goals in 2021 with this ultimate guide filled with actionable strategies and tips.

Image courtesy of Pixabay via Pexels

Table of Contents

In the fast-paced world of business, one of the most critical factors for success is effective financial planning. Whether you are a small startup or a well-established corporation, having a solid financial plan in place can make all the difference in achieving your business goals. In this blog post, we will explore the key components of financial planning, its role in business success, common challenges faced, and strategies for overcoming them.

What is Financial Planning?

Financial planning is the process of setting goals, assessing current financial status, and creating a roadmap to achieve those goals. In a business context, financial planning involves budgeting, cash flow management, forecasting, and investment planning. By having a clear financial plan, businesses can make informed decisions, allocate resources effectively, and navigate economic uncertainties with greater ease.

Key Components of Financial Planning

Budgeting: One of the fundamental components of financial planning is creating a budget. A budget outlines expected revenues and expenses over a specific period, helping businesses track their financial performance and make adjustments as needed.

Cash Flow Management: Effective cash flow management is essential for business sustainability. By monitoring cash inflows and outflows, businesses can ensure they have enough liquidity to meet their obligations and seize growth opportunities.

Forecasting: Financial forecasting involves predicting future financial performance based on historical data and market trends. Accurate forecasting allows businesses to anticipate challenges, identify opportunities, and make proactive decisions.

Investment Planning: Investing surplus funds wisely can help businesses generate additional income and build long-term wealth. From stocks and bonds to real estate and business expansion, investment planning plays a crucial role in achieving financial goals.

The Role of Financial Planning in Business Success

Businesses that prioritize financial planning are better positioned to achieve long-term success. By having a clear financial roadmap, businesses can make informed decisions, allocate resources efficiently, and adapt to changing market conditions. Financial planning also enables businesses to identify potential risks and take proactive measures to mitigate them.

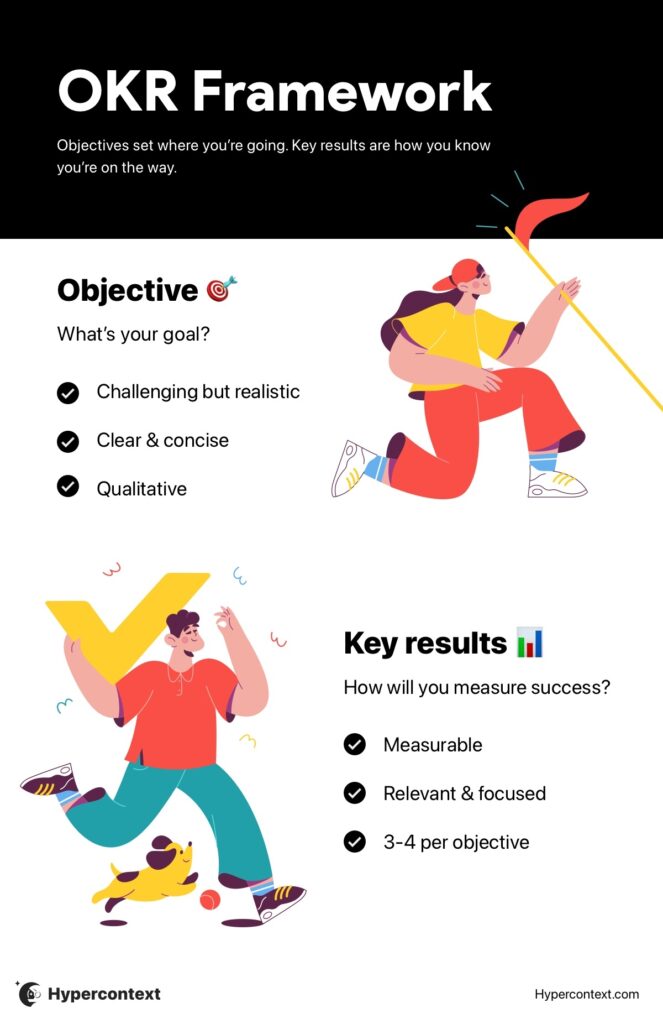

Image courtesy of hypercontext.com via Google Images

Case studies have shown that businesses with robust financial planning processes are more resilient during economic downturns. By having a solid financial foundation, businesses can weather financial crises, seize opportunities for growth, and emerge stronger on the other side.

Common Challenges in Financial Planning

Despite its benefits, financial planning can pose challenges for businesses. Common obstacles include inaccurate data, insufficient resources, and lack of expertise. To overcome these challenges, businesses can leverage technology, seek professional advice, and regularly review and adjust their financial plans.

Identifying potential obstacles in financial planning is the first step towards finding solutions. By acknowledging challenges and seeking support when needed, businesses can improve their financial planning processes and set themselves up for success.

Conclusion

Effective financial planning is a cornerstone of business success. By incorporating budgeting, cash flow management, forecasting, and investment planning into their business operations, companies can optimize their financial performance, mitigate risks, and achieve their long-term goals. In today’s competitive business landscape, businesses that prioritize financial planning are better equipped to navigate uncertainties, seize opportunities, and thrive in the long run.

Remember, financial planning is not a one-time activity but an ongoing process that requires regular review and adjustment. By staying proactive, informed, and adaptive, businesses can position themselves for success in 2021 and beyond.