The Ultimate Guide to Business Growth Strategies

June 11, 2024Unlock the secrets to sustainable business growth with proven strategies that will take your company to the next level.

Image courtesy of Mike Bird via Pexels

Table of Contents

Running a successful business requires more than just offering great products or services. One of the key factors in achieving long-term success is effectively managing your business finances. In this guide, we will explore the best practices for managing your business finances to ensure sustainable growth and profitability.

Setting Up Your Financial System

Before you can effectively manage your business finances, you need to have a solid financial system in place. This starts with choosing the right accounting software that suits your business needs. Look for software that offers features such as expense tracking, invoicing, and financial reporting. Once you have selected your accounting software, it’s essential to create a chart of accounts that accurately reflects your business’s financial transactions. This will help you organize your finances and provide a clear overview of your income and expenses.

Setting a budget and financial goals is another crucial step in establishing your financial system. A budget will help you plan and allocate your resources effectively, while financial goals will provide you with a roadmap for achieving long-term success.

Tracking Income and Expenses

Tracking all income and expenses is essential for understanding the financial health of your business. There are various methods for tracking finances, including using spreadsheets, accounting software, or hiring a bookkeeper. Implementing systems for expense tracking, such as categorizing expenses and regularly reviewing financial statements, will help you make informed financial decisions.

Understanding Cash Flow

While profit is essential for business success, managing cash flow is equally important. Cash flow refers to the movement of money in and out of your business. It’s crucial to differentiate between cash flow and profit, as a business can be profitable but still experience cash flow issues. To improve cash flow, consider strategies such as negotiating better payment terms with suppliers, incentivizing early payments from customers, or securing a line of credit.

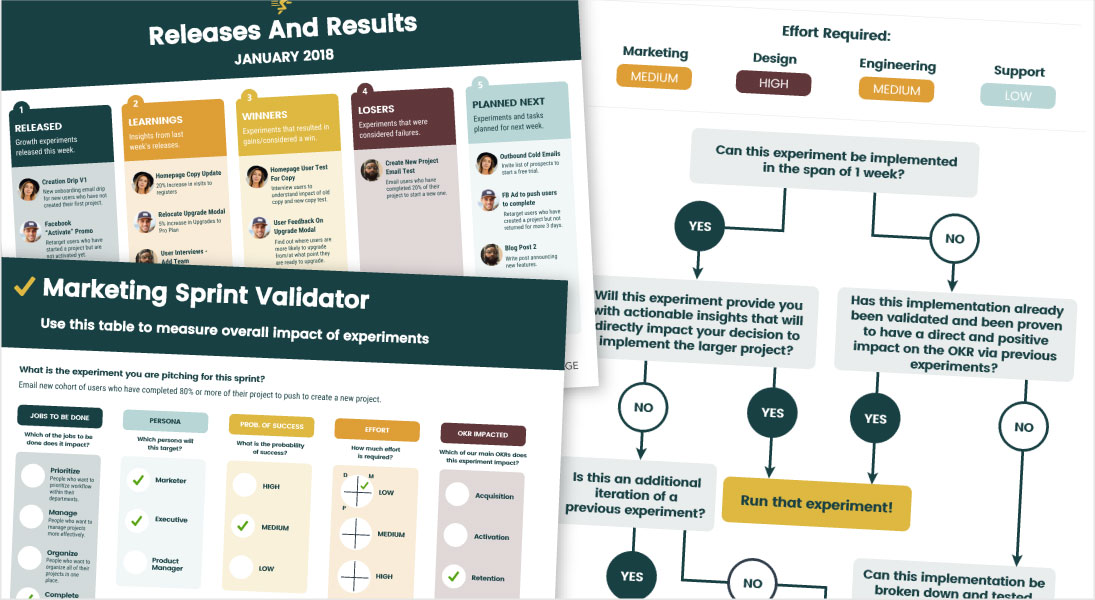

Image courtesy of venngage.com via Google Images

Managing Debt and Investments

Debt can be a valuable tool for growing your business, but it’s essential to manage it effectively. Make sure to understand the terms of any loans or lines of credit you have and create a plan to repay them on time. Investing profits back into the business can help fuel growth, but it’s essential to weigh the risks and benefits of different investment options. Consider seeking advice from a financial professional to make informed investment decisions.

Seeking Professional Advice

Managing business finances can be complex, especially as your business grows. Knowing when to seek professional advice is crucial in ensuring your financial success. Consider hiring a professional accountant or financial advisor to help you navigate complex financial decisions. Look for someone who has experience working with businesses similar to yours and can provide valuable insights and recommendations.

Image courtesy of www.wordstream.com via Google Images

Conclusion

Effectively managing your business finances is essential for sustainable growth and long-term success. By setting up a solid financial system, tracking income and expenses, understanding cash flow, managing debt and investments, and seeking professional advice when needed, you can ensure that your business remains financially healthy. Remember to regularly review and adjust your financial strategies to adapt to changing market conditions and ensure continued success.