The Ultimate Guide to Budgeting like a Boss

May 22, 2024Learn the secrets to mastering your finances with the ultimate guide to budgeting like a boss – your wallet will thank you!

Image courtesy of maitree rimthong via Pexels

Table of Contents

As a small business owner, managing your finances effectively is crucial for the success and sustainability of your business. Setting clear financial goals, keeping track of expenses, and investing in growth are all key components of financial management. In this guide, we will provide you with the top financial tips to help you budget like a boss and ensure the financial health of your small business.

Setting Financial Goals

Setting clear financial goals is the first step towards successful financial management. Whether your goal is to increase revenue, reduce expenses, or improve cash flow, having a clear objective in mind will help guide your financial decisions and actions. Start by defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals for your business.

Budgeting and Expense Tracking

Creating a realistic budget is essential for small business owners to ensure that expenses are managed effectively and revenue is maximized. Start by identifying all sources of income and categorizing your expenses. Use tools and apps to track your expenses in real-time and stay on top of your budget. Regularly review and adjust your budget to reflect changes in your business.

Managing Cash Flow

Cash flow is the lifeblood of any business, especially small businesses. Managing your cash flow effectively involves monitoring your incoming and outgoing cash, identifying potential cash flow issues, and implementing strategies to improve cash flow. Ensure that you have a buffer of cash reserves to cover unexpected expenses and maintain a positive cash flow balance.

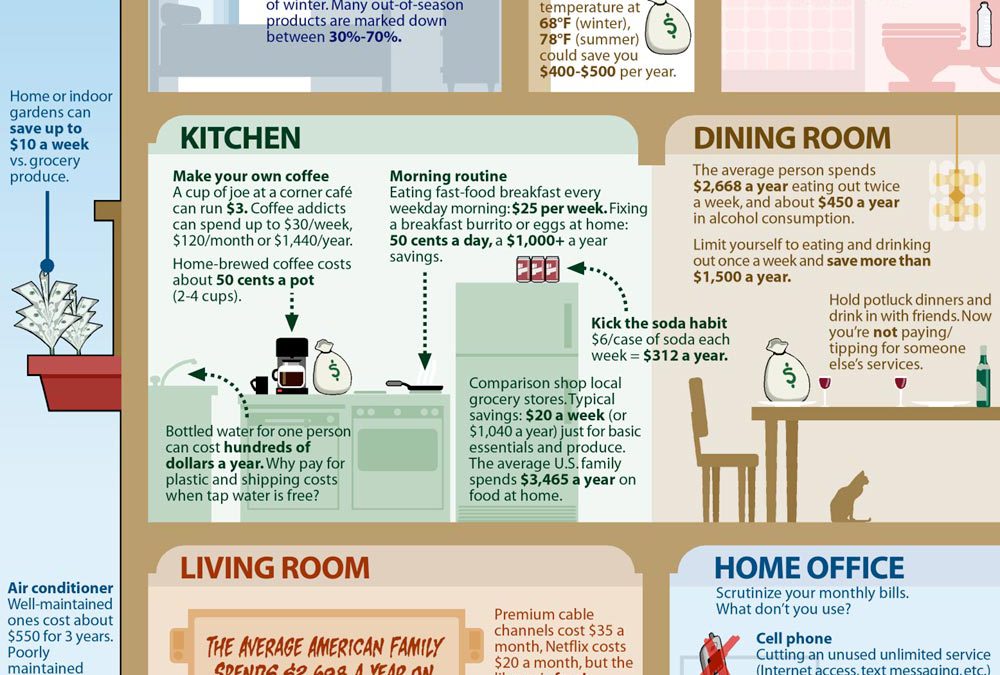

Image courtesy of www.quicken.com via Google Images

Investing in Growth

Investing in the growth of your business is essential for long-term success. Whether it’s investing in marketing, technology, or hiring new employees, smart investments can help your business expand and thrive. Prioritize investments that align with your business goals and have a clear return on investment (ROI) potential.

Seeking Professional Help

While managing your finances on your own can be challenging, seeking professional help from a financial advisor or accountant can provide valuable insights and expertise. A financial professional can help you navigate complex financial decisions, optimize your financial strategies, and ensure compliance with regulations. Consider hiring a financial professional to support your financial management efforts.

In conclusion, budgeting like a boss is essential for small business owners to achieve financial success and sustainability. By setting clear financial goals, tracking expenses, managing cash flow, investing in growth, and seeking professional help, you can take control of your finances and set your business up for long-term growth. Prioritize your financial management efforts and watch your small business thrive.