The Top 10 Business Trends to Watch Out for in 2021

June 15, 2024Discover the 10 upcoming business trends shaping the future of commerce in 2021. Stay ahead of the curve with insights.

Image courtesy of Arnesh Yadram via Pexels

Table of Contents

Financial decisions play a critical role in the success or failure of a business. Every choice made regarding budgeting, investments, financing, and financial reporting can have a significant impact on the overall health and growth of a company. In this blog, we will explore the importance of making informed financial decisions and how they can shape the future of a business.

Strategic Budgeting

Creating a budget is a fundamental aspect of financial management for any business. It serves as a roadmap for allocating resources and helps in controlling expenses. Operating budgets outline the day-to-day expenses of a business, while capital budgets focus on long-term investments in assets. Cash budgets, on the other hand, track the cash flow of a business to ensure liquidity. Effectively allocating funds in a budget is crucial for maximizing profitability and achieving financial goals.

Investment Decisions

When it comes to making investment decisions for a business, careful evaluation is necessary. Understanding the risks and potential returns associated with different investment options is essential. Whether it’s investing in new technologies, expanding into new markets, or acquiring other businesses, strategic investment decisions can drive growth and profitability. Developing a clear investment strategy and conducting thorough research can help in making informed choices.

Financing Options

Businesses have various options for financing their operations, including equity financing, debt financing, and grants. Each financing option comes with its own set of advantages and disadvantages. Equity financing involves selling ownership stakes in the company, while debt financing entails borrowing funds that need to be repaid with interest. Grants are non-repayable funds provided by governments or organizations. Choosing the right financing option depends on factors such as the business’s financial situation, growth plans, and risk tolerance.

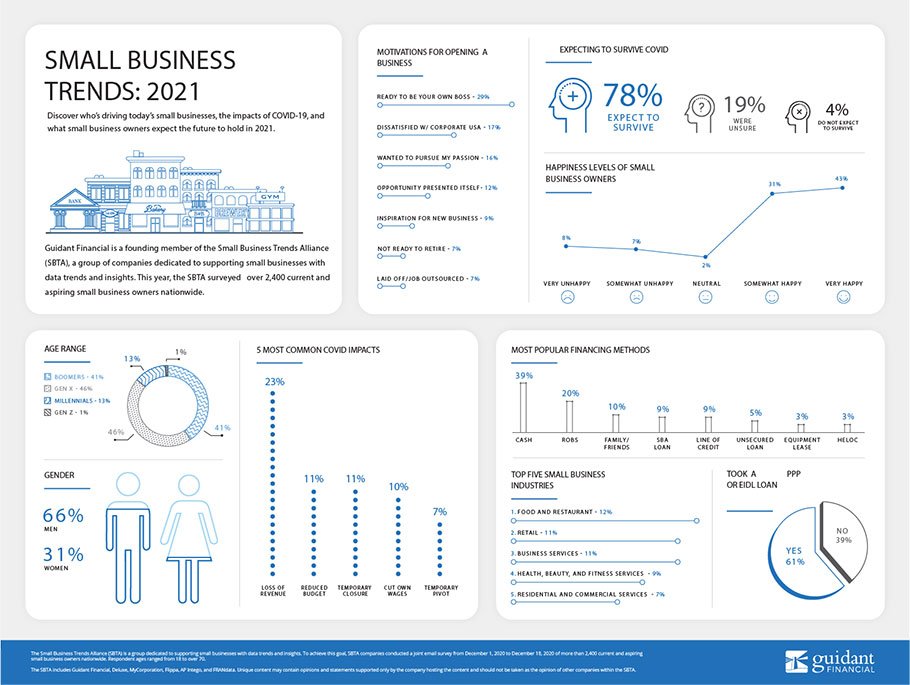

Image courtesy of www.guidantfinancial.com via Google Images

Financial Reporting and Analysis

Accurate financial reporting is crucial for businesses to track their performance and make informed decisions. Key financial statements such as the balance sheet, income statement, and cash flow statement provide valuable insights into a company’s financial health. Analyzing financial data helps in identifying trends, forecasting future performance, and making strategic adjustments to achieve financial objectives.

Monitoring and Adjusting Financial Strategies

Monitoring financial performance on a regular basis is essential for identifying strengths and weaknesses in a business’s financial strategies. Key performance indicators (KPIs) such as revenue growth, profit margins, and cash flow ratios help in evaluating the effectiveness of financial decisions. By tracking KPIs and analyzing financial metrics, businesses can make timely adjustments to their strategies to optimize performance and ensure long-term success.

Conclusion

In conclusion, financial decisions have a profound impact on the success of a business. From strategic budgeting and investment decisions to financing options and financial reporting, every aspect of financial management plays a crucial role in shaping the future of a company. By prioritizing financial literacy, making informed decisions, and continuously monitoring and adjusting financial strategies, businesses can position themselves for sustainable growth and long-term success.