The Secret to Growing Your Business: A Step-by-Step Guide

May 18, 2024Uncover the hidden strategies that will skyrocket your business to success with this comprehensive step-by-step guide. Don’t miss out!

Image courtesy of Madison Inouye via Pexels

Table of Contents

As an entrepreneur or business owner, one of the key factors in achieving success is managing your finances effectively. Understanding how to navigate the world of personal finance can make a significant impact on the growth and sustainability of your business. In this blog post, we will provide a comprehensive guide on strategies for success in personal finance, tailored specifically for business owners.

Budgeting Techniques

Creating a budget is the cornerstone of financial management for any business. By establishing a budget, you can track your expenses, monitor cash flow, and ensure that you are meeting your financial goals. One effective budgeting technique is zero-based budgeting, where every dollar is allocated towards a specific expense or savings goal. Another popular method is the envelope system, where you allocate cash into different envelopes for specific expenses, helping you stay within your budget limits.

Tracking your expenses is crucial in budgeting. By keeping a record of all your expenditures, you can identify areas where you may be overspending and make necessary adjustments to stay on track. It’s important to regularly review and update your budget to reflect any changes in your business or financial situation.

Building an Emergency Fund

Having an emergency fund is essential for financial stability, both personally and in your business. An emergency fund serves as a safety net in case of unexpected expenses or emergencies, such as a sudden drop in revenue or major repairs needed for your business. Aim to save at least three to six months’ worth of expenses in your emergency fund to provide a buffer during challenging times.

To build an emergency fund, start by setting aside a portion of your income each month specifically for this purpose. Consider automating this process by setting up automatic transfers from your business account to a separate savings account designated for emergencies. By prioritizing your emergency fund, you can ensure that you are prepared for any unforeseen circumstances that may arise.

Managing Debt

Debt can be a double-edged sword for businesses. While it can provide necessary funding for growth and expansion, excessive debt can become a burden and hinder your financial progress. It’s important to understand the different types of debt, such as loans, credit card debt, and lines of credit, and their implications on your business’s financial health.

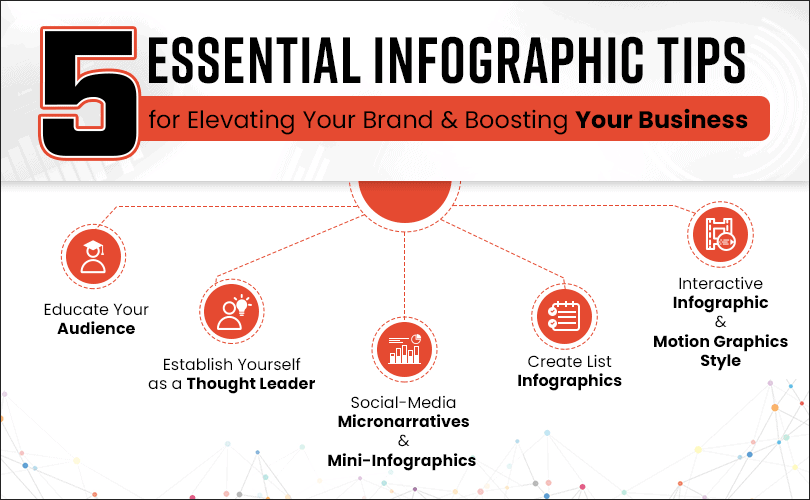

Image courtesy of www.cibirix.com via Google Images

When it comes to paying off debt, consider using strategies such as the snowball method or the avalanche method. The snowball method involves paying off debts from smallest to largest, while the avalanche method focuses on paying off debts with the highest interest rates first. Choose the method that aligns best with your financial goals and capabilities.

Investing for the Future

Investing is a key component of financial planning for business owners. By investing in assets that generate returns over time, you can build wealth and secure your financial future. Consider diversifying your investment portfolio with a mix of stocks, bonds, and mutual funds to spread risk and maximize returns.

Before investing, assess your risk tolerance and financial goals to determine the most suitable investment options for your business. Consult with a financial advisor if needed to develop a personalized investment strategy that aligns with your long-term objectives. Remember that investing is a long-term commitment that requires patience and discipline.

Planning for Retirement

Retirement planning is often overlooked by business owners who are focused on growing their businesses. However, planning for retirement is crucial for your long-term financial security. Start by estimating your retirement expenses and determining how much you need to save to maintain your desired lifestyle post-retirement.

Image courtesy of www.pinterest.com via Google Images

Explore retirement savings options such as 401(k) plans and Individual Retirement Accounts (IRAs) to build a nest egg for your retirement years. Take advantage of employer-sponsored retirement plans if available, as they often provide matching contributions that can boost your savings significantly. By starting early and consistently saving for retirement, you can ensure a comfortable and secure future for yourself.

Conclusion

Managing your personal finances as a business owner is a fundamental aspect of achieving success and sustainability in your business. By implementing budgeting techniques, building an emergency fund, managing debt effectively, investing for the future, and planning for retirement, you can set yourself up for financial success both in the short and long term.

Remember that financial literacy and planning are ongoing processes that require dedication and discipline. By following the strategies outlined in this guide and seeking guidance from financial professionals when needed, you can navigate the complexities of personal finance with confidence and achieve your business goals.

Take the first step towards financial empowerment today and watch your business thrive!