The Secret to Building a Financially Secure Future

June 11, 2024Uncover the hidden key to financial freedom and security in our latest blog post. Don’t miss out on this invaluable advice!

Image courtesy of Mathias Reding via Pexels

Table of Contents

Running a successful business requires more than just having a great product or service. It also involves mastering your finances to ensure long-term stability and growth. As a business owner, understanding essential financial management practices is crucial for achieving your goals and securing your company’s future. In this blog post, we will explore some key tips and strategies to help you master your finances and build a financially secure future for your business.

Setting Financial Goals

Setting clear and attainable financial goals is the first step to mastering your business finances. By defining specific objectives, you can create a roadmap for your financial success and monitor your progress along the way. When setting financial goals, it’s essential to follow the SMART criteria – making sure they are Specific, Measurable, Achievable, Relevant, and Time-bound. This approach will help you stay focused and motivated as you work towards achieving your financial milestones.

Budgeting Basics

Creating a realistic budget is fundamental to effective financial management. A budget allows you to plan and track your business expenses and income, providing a clear picture of your financial health. To develop a successful budget, start by listing all your expenses and income sources. Be sure to include both fixed costs, such as rent and utilities, and variable expenses like marketing and supplies. Regularly review and adjust your budget as needed to ensure you stay on track with your financial goals.

Managing Cash Flow

Cash flow management is essential for the sustainability of your business. Maintaining a healthy cash flow ensures that you have enough funds to cover your expenses and invest in growth opportunities. To improve your cash flow, consider offering discounts for early payments from customers, negotiating favorable payment terms with suppliers, and implementing efficient invoicing processes. Tracking your cash flow regularly will help you identify any potential issues and take proactive steps to address them.

Image courtesy of www.clevergirlfinance.com via Google Images

Business Financing Options

When it comes to financing your business, there are several options to consider. From traditional bank loans to lines of credit and business credit cards, each financing option has its pros and cons. Before choosing a financing solution, carefully evaluate your business needs, financial situation, and repayment capabilities. Compare interest rates, terms, and fees to ensure you select the option that best aligns with your goals and objectives. Seeking advice from financial experts can also help you make informed decisions about your business financing.

Long-Term Financial Planning

Long-term financial planning is crucial for the sustained growth and success of your business. Setting aside funds for retirement and reinvesting profits back into your company are essential components of long-term financial planning. By creating a solid financial strategy that accounts for your future goals and aspirations, you can ensure that your business remains financially secure over the long run. Consider consulting with financial advisors to develop a comprehensive financial plan tailored to your business needs and objectives.

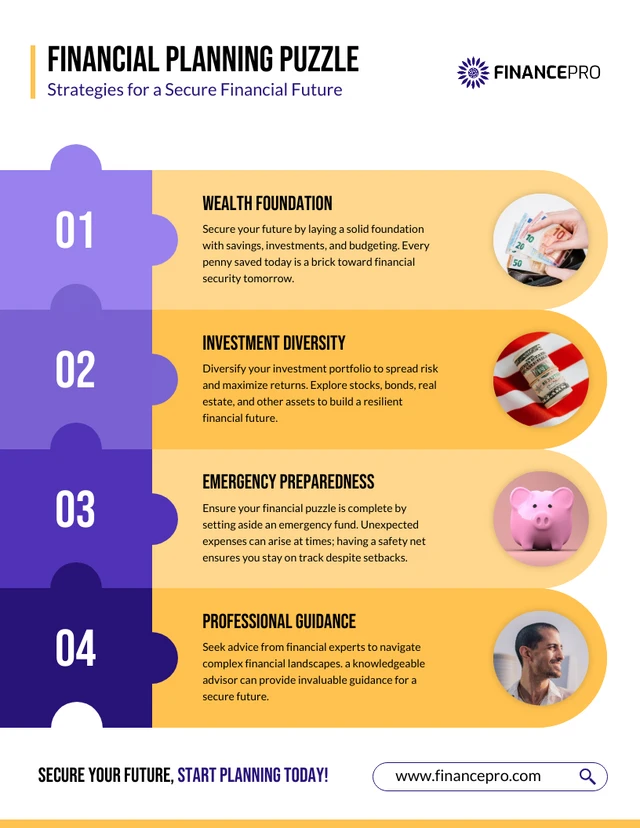

Image courtesy of venngage.com via Google Images

Conclusion

Mastering your business finances is a key aspect of building a financially secure future for your company. By setting clear financial goals, creating a realistic budget, managing cash flow effectively, exploring different financing options, and engaging in long-term financial planning, you can position your business for long-term success. Remember, financial management is an ongoing process that requires dedication, discipline, and strategic decision-making. By prioritizing your business finances and seeking professional advice when needed, you can pave the way for a prosperous and financially secure future for your business.