The Secret to Boosting Your Business’s Bottom Line

June 14, 2024Discover the hidden strategy that will skyrocket your business profits and transform your bottom line for lasting success today.

Image courtesy of Ivan Babydov via Pexels

Table of Contents

Proper financial management is the backbone of any successful business. From setting goals to monitoring cash flow, every aspect of managing your business finances plays a crucial role in determining the overall success of your venture. In this blog post, we will discuss the key strategies you can implement to successfully manage your business finances and ultimately boost your bottom line.

Set Financial Goals

Setting clear and achievable financial goals is the first step towards effective financial management for your business. These goals act as a roadmap, guiding your financial decisions and helping you stay on track. Whether your goal is to increase revenue, reduce expenses, or improve profit margins, having a clear target in mind can motivate you and your team to work towards a common objective.

Create a Budget

Creating a budget for your business is essential for managing your finances effectively. Start by projecting your expected revenue and expenses for the upcoming period. Be sure to account for any potential fluctuations or unforeseen expenses to ensure your budget is realistic and sustainable. Once your budget is in place, regularly monitor your actual financial performance against your budgeted figures and make adjustments as needed.

Monitor Cash Flow

Cash flow is the lifeblood of your business, and monitoring it regularly is crucial to ensure you have enough liquidity to cover your expenses. By keeping a close eye on your cash flow, you can identify any potential cash shortages and take proactive measures to address them. Strategies such as reducing expenses, improving collections, or negotiating better payment terms with suppliers can help improve your cash flow and strengthen your financial position.

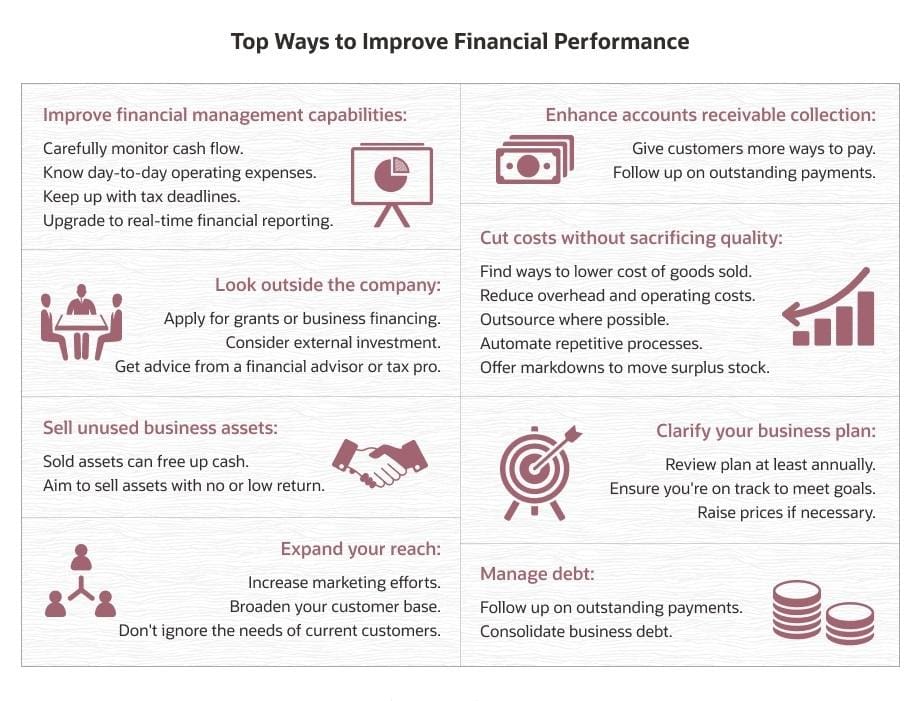

Image courtesy of www.netsuite.com via Google Images

Invest Wisely

Once you have surplus funds available, consider investing them back into your business or exploring other investment opportunities. Investing wisely can help you maximize your returns and grow your business over time. Evaluate investment opportunities carefully, considering factors such as potential returns, risk levels, and alignment with your overall business strategy. By making informed investment decisions, you can help secure the financial future of your business.

Seek Professional Advice

Consulting with financial professionals, such as accountants or financial advisors, can provide valuable insights and guidance to help you make informed financial decisions. These experts can offer expert advice on tax planning, financial reporting, and investment strategies tailored to your business’s specific needs. By leveraging their expertise, you can gain a deeper understanding of your business finances and access the resources necessary to drive financial success.

In conclusion, successful financial management is the key to boosting your business’s bottom line. By setting clear financial goals, creating a budget, monitoring cash flow, investing wisely, and seeking professional advice, you can take control of your business finances and set the stage for long-term growth and success. Implementing these strategies will not only help you navigate the complexities of financial management but also position your business for sustainable profitability and prosperity.