The Road to Entrepreneurial Success: Lessons from Top Business Leaders

June 6, 2024Discover the secret sauce to entrepreneurial success as top business leaders share their invaluable lessons and strategies for growth.

Image courtesy of Valentin Antonucci via Pexels

Table of Contents

Running a successful business requires more than just a great product or service – it also involves effective financial management. By taking control of your business finances, you can ensure long-term sustainability and growth. In this blog post, we will guide you through the steps to manage your business finances effectively, following the outline below.

Assess Your Current Financial Situation

Before you can make any financial decisions for your business, it’s crucial to assess your current financial situation. Start by reviewing your financial statements, including the income statement, balance sheet, and cash flow statement. These documents will give you a clear picture of your business’s financial health over the past year.

Take the time to analyze your financial performance and identify any strengths and weaknesses. Are there areas where you’re consistently overspending? Are there opportunities to increase revenue? By understanding your current financial situation, you can make more informed decisions moving forward.

Set Financial Goals

Setting financial goals is essential for guiding your business’s financial decisions. Define specific, measurable, and attainable goals for your business, such as increasing revenue by a certain percentage or reducing expenses in a particular area. Determine a timeline for achieving each goal and prioritize them based on their importance to your business’s overall success.

By setting clear financial goals, you can keep your business on track and measure your progress over time. Whether your goal is to expand into new markets or increase profitability, having a roadmap will help you stay focused and motivated.

Create a Budget

A detailed budget is a fundamental tool for managing your business finances effectively. Start by listing all of your business’s income sources and expenses, including fixed costs like rent and utilities, as well as variable costs like marketing and supplies. Allocate funds to different areas of your business based on priority and ensure that your expenses align with your revenue.

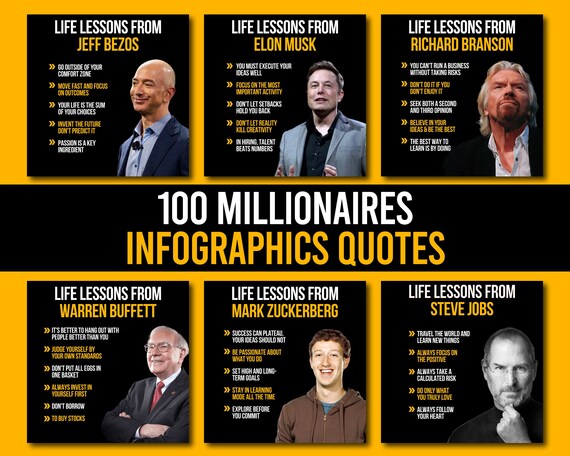

Image courtesy of www.etsy.com · In stock via Google Images

Monitor your budget regularly to track your financial performance and make adjustments as needed. If you notice that you’re consistently overspending in a certain area, look for ways to cut costs or increase revenue to stay within your budget. A well-planned budget will help you make informed financial decisions and avoid cash flow issues.

Monitor Cash Flow

Cash flow is the lifeblood of any business, so it’s essential to monitor it closely. Keep track of your cash flow on a regular basis to ensure that you have enough liquidity to cover your expenses. By forecasting your cash flow, you can identify potential issues before they become problematic and take steps to address them proactively.

If you’re experiencing cash flow challenges, consider implementing strategies to improve your cash flow, such as negotiating payment terms with suppliers or speeding up accounts receivable collections. By staying on top of your cash flow, you can avoid liquidity issues and keep your business running smoothly.

Seek Professional Advice

Managing your business finances can be complex, so don’t hesitate to seek professional advice. Consider working with a financial advisor or accountant who can provide guidance on financial management best practices. They can help you create a financial plan, analyze your financial statements, and make strategic decisions for your business.

Image courtesy of in.pinterest.com via Google Images

Additionally, don’t underestimate the value of seeking advice from other business owners or mentors. Networking with successful entrepreneurs can provide valuable insights and lessons learned that can help you navigate the challenges of managing business finances. Stay informed about financial best practices and industry trends to make informed decisions for your business.

Conclusion

In conclusion, effective financial management is crucial for the success of your business. By assessing your current financial situation, setting clear goals, creating a budget, monitoring cash flow, and seeking professional advice, you can take control of your business finances and drive long-term growth. Remember, managing your business finances is an ongoing process that requires attention and diligence. By following the steps outlined in this blog post, you can pave the way for financial success and sustainable business growth.