The Power of Networking: How Building Connections Can Boost Your Business

June 14, 2024Unlock the secrets of successful networking and watch your business thrive with our expert tips on building valuable connections today.

Image courtesy of Ann H via Pexels

Table of Contents

When it comes to running a successful business, understanding the basics of finance is essential. From financial planning to managing cash flow, businesses need to have a solid grasp of these concepts to make informed decisions and ensure their long-term success. In this blog post, we will explore the fundamentals of business finance and how they play a crucial role in the overall operations of a company.

Importance of Financial Planning

Financial planning is the foundation of a successful business strategy. It involves setting goals, creating a budget, and making informed decisions based on financial data. Without a solid financial plan in place, businesses may struggle to allocate resources effectively and may risk running into financial difficulties.

One of the key aspects of financial planning is budgeting. By creating a budget, businesses can set financial targets and monitor their progress towards achieving them. Budgeting also helps businesses identify areas where they may be overspending or where they can cut costs to improve their bottom line.

Sources of Funding

Businesses need capital to operate and grow, and there are various sources of funding available to them. These sources include loans from financial institutions, investments from venture capitalists or angel investors, and grants from government agencies or non-profit organizations.

Each source of funding has its pros and cons. For example, while loans may provide businesses with quick access to capital, they also come with interest payments that can add to the overall cost of borrowing. On the other hand, investments from venture capitalists can provide businesses with not only funding but also valuable expertise and connections in the industry.

Managing Cash Flow

Cash flow is the lifeblood of a business, and managing it effectively is crucial to the success of a company. Cash flow refers to the movement of money in and out of a business and is essential for covering expenses, paying employees, and investing in growth opportunities.

Image courtesy of www.kinesisinc.com via Google Images

Businesses can manage their cash flow by closely monitoring their income and expenses, forecasting future cash flow, and implementing strategies to improve cash flow, such as reducing expenses or increasing sales. By keeping a close eye on their cash flow, businesses can avoid cash shortages and make informed decisions about their financial health.

Financial Statements

Financial statements are essential tools for businesses to track their financial performance and communicate their financial position to stakeholders. The three main types of financial statements are the income statement, balance sheet, and cash flow statement.

The income statement shows a business’s revenue and expenses over a specific period, providing insight into its profitability. The balance sheet provides a snapshot of a business’s assets, liabilities, and equity at a particular point in time, giving stakeholders an overview of its financial health. The cash flow statement details a business’s cash inflows and outflows, helping to assess its liquidity and ability to meet financial obligations.

Financial Ratios

Financial ratios are tools that businesses can use to analyze their financial performance and compare it to industry benchmarks. By calculating ratios based on data from their financial statements, businesses can gain valuable insights into their liquidity, profitability, and efficiency.

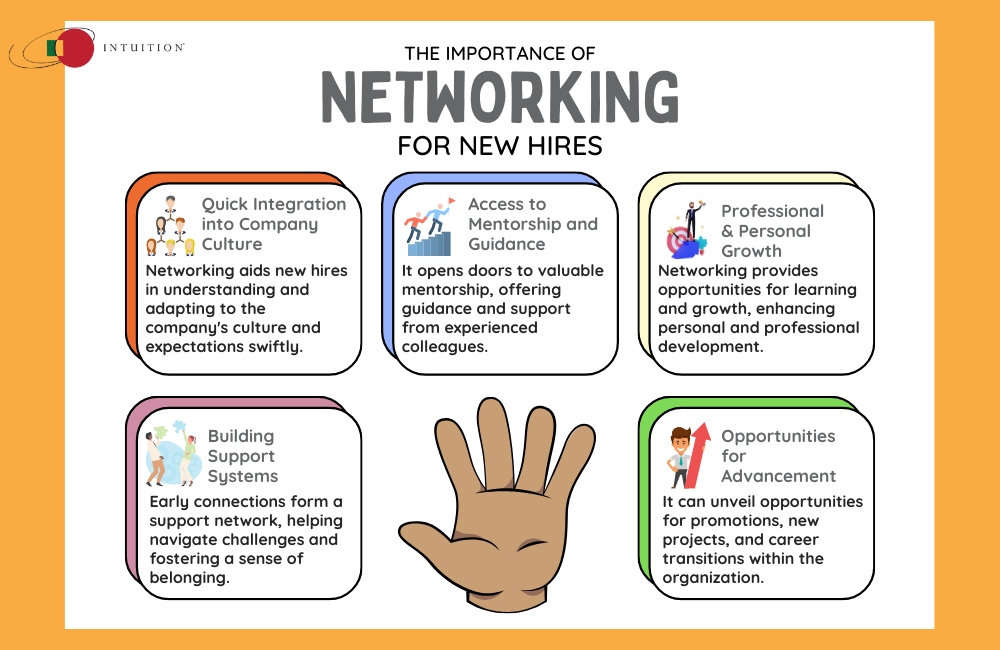

Image courtesy of www.intuition.com via Google Images

Some common financial ratios include the debt-to-equity ratio, which measures a company’s leverage, the return on investment ratio, which assesses the profitability of investments, and the current ratio, which evaluates a company’s ability to cover its short-term liabilities. By understanding and interpreting these ratios, businesses can make informed decisions about their financial strategies and performance.

Conclusion

In conclusion, understanding the basics of business finance is essential for the success of any company. Financial planning, sources of funding, cash flow management, financial statements, and financial ratios all play a crucial role in helping businesses make informed decisions and achieve their goals. By staying informed about these concepts and seeking professional advice when needed, businesses can ensure their long-term success and growth.