Smart Finance: Key Trends for 2025

May 6, 2024Uncover the top financial trends shaping 2025 and learn how to stay ahead in the ever-evolving world of finance.

Image courtesy of Arnesh Yadram via Pexels

Image courtesy of Arnesh Yadram via Pexels

Table of Contents

Introduction to Smart Finance

In this section, we will delve into the world of smart finance and explore the latest trends and innovations that are shaping the way we manage money. Whether you’re saving up for a new toy or a big business looking to make strategic financial decisions, understanding smart finance is key to achieving your goals.

What is Smart Finance?

Smart finance is all about making clever decisions with your money. It’s about being strategic and thoughtful in how you save, spend, and invest your hard-earned cash. Whether you’re a kid with a piggy bank or a business owner with a budget to manage, smart finance is about maximizing the value of every dollar you have.

Trendy Ways to Manage Money in 2025

Hey there, money-savvy friends! Let’s dive into some trendy ways to manage your money in 2025. First up, let’s talk about saving tips and tricks. Saving money is like building a treasure chest full of coins and gems!

Spending Wisely

Now, let’s chat about spending wisely. When you have saved up your money, it’s time to spend it wisely. Think of it like choosing the best toy in the toy store or the yummiest snack at the ice cream shop!

Strategies for Financial Fun

Setting goals is like creating a treasure map for your money adventures. Imagine saving up for that shiny new bike you’ve been eyeing! Each coin you tuck away brings you closer to your goal, making every penny count towards something exciting.

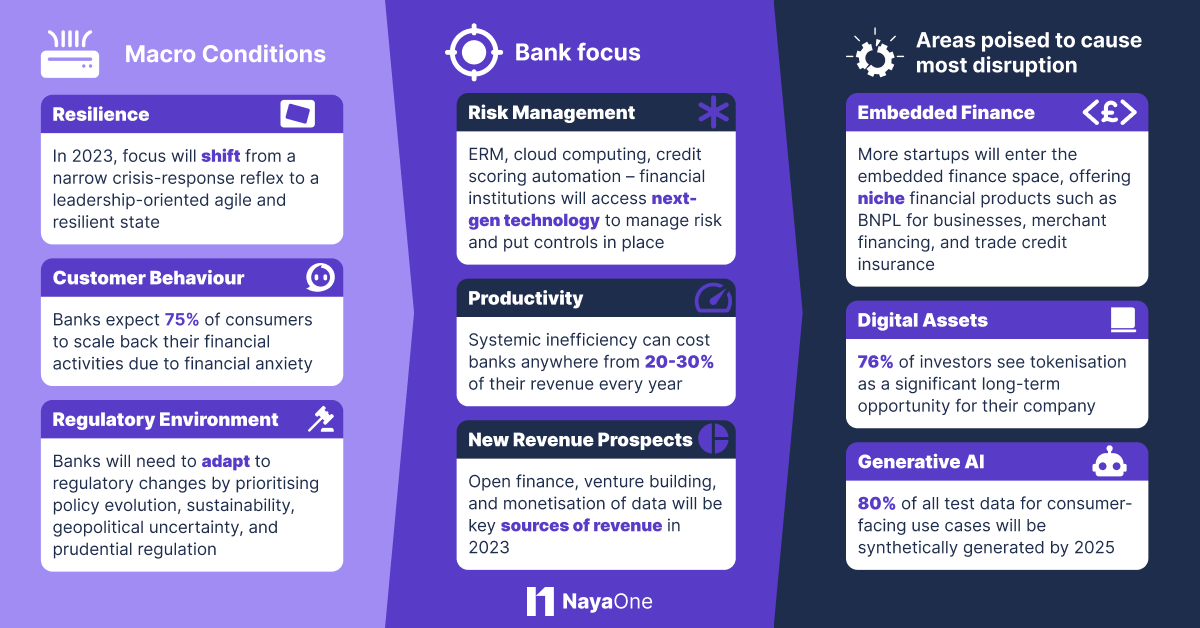

Image courtesy of nayaone.com via Google Images

Tracking Your Money

Being a money detective is all about keeping tabs on where your money goes. It’s like following a trail of clues to see if your coins are sneaking off to buy extra snacks or hiding in your piggy bank. By tracking your money, you can make sure it’s doing what you want it to do.

How Businesses Handle Their Dough

Just like you might have an allowance, businesses also have budgets. A budget is like a plan for how a business will use its money. It helps them decide how much they can spend on making toys, buying ingredients for candy, or paying their workers. By carefully planning their budgets, businesses can make sure they have enough money to keep running smoothly.

Investing in Fun

Businesses invest money to create new toys and games for you to enjoy. This means they use some of their money to come up with new ideas, design cool products, and make them available in stores. By investing in fun projects, businesses can keep growing and bringing you exciting new toys to play with. So, the next time you see a new toy on the shelves, remember that a business somewhere made an investment to make it happen!

Techy Money Matters

Have you ever wished your phone could help you manage your allowance? Well, guess what? There are apps designed just for that! These apps are like little money superheroes that keep track of how much you have, how much you’ve spent, and even help you set goals for saving. It’s like having a virtual piggy bank right in your pocket!

Virtual Pigs

Speaking of piggy banks, have you heard about digital piggy banks? They’re like the old-fashioned piggy banks but with a high-tech twist. Instead of dropping coins into a slot, you can use these digital piggy banks to save money online. You can set savings goals, track your progress, and even earn rewards for reaching your goals. It’s a fun way to learn about saving and managing your money in the digital age!

Looking Ahead: The Future of Finance for Kids

As we look ahead to the future, young savers like you have so much to be excited about! Imagine a world where saving and spending money is even more fun and high-tech than it is now. Technology is advancing rapidly, and with it, the way we handle money is constantly evolving.

One day, you might have a digital assistant that helps you manage your allowance, reminding you when it’s time to save and guiding you on how to spend wisely. Virtual reality could make learning about finances an immersive and exciting experience, turning financial education into a thrilling adventure.

Furthermore, as you grow up, new financial tools and resources will become available to help you navigate the world of money with ease. From virtual piggy banks that track your savings goals to interactive budgeting apps that make money management a breeze, the future of finance is full of possibilities.

So, as you continue on your financial journey, remember to stay curious and open to new ways of handling money. The future of finance for kids like you is bright, and with a little creativity and ingenuity, you’ll be well-prepared to make the most of it!

Conclusion: Becoming a Smart Finance Whiz

Throughout our journey into the world of smart finance, we’ve uncovered some exciting and essential information that can help you become a money master. By understanding the trends, strategies, and innovations in finance, you’re on your way to managing your money like a pro.

Key Takeaways

As we wrap up our discussion on smart finance, here are a few key takeaways to remember:

1. Saving is super important! Whether you use a traditional piggy bank or a modern savings account, putting money aside for the future is a smart move.

2. Be wise with your spending. Making smart choices about where and how you spend your money can help you reach your financial goals faster.

3. Setting goals is like creating a treasure map for your money. When you have a clear target in mind, saving and managing your finances becomes more exciting.

4. Tracking your money is like solving a mystery. By keeping a close eye on your expenses and income, you can better understand where your money is going and make informed decisions.

5. Businesses also have to manage their finances carefully. Learning about budgets and investments can give you a glimpse into how companies handle their dough.

By incorporating these tips and tricks into your financial habits, you’re well on your way to becoming a smart finance whiz. Remember, being savvy with your money doesn’t have to be boring – it can be fun, rewarding, and empowering!

Image courtesy of www.linkedin.com via

Image courtesy of www.linkedin.com via