Navigating the Stock Market Rollercoaster: Tips for Successful Investing

June 4, 2024Uncover the secrets to riding the stock market rollercoaster with confidence and skill. Your guide to successful investing awaits!

Image courtesy of Sarowar Hussain via Pexels

Table of Contents

Managing finances effectively is crucial for individuals and businesses alike. Whether you’re looking to save for a big purchase, create a retirement fund, or grow your business, having a solid financial plan in place is essential. In this comprehensive guide, we will walk you through the fundamentals of financial management and provide you with practical tips to help you achieve your financial goals.

Setting Financial Goals

Before diving into the specifics of financial planning, it’s important to establish clear and achievable financial goals. These goals can be short-term, such as saving for a vacation, medium-term, like buying a new car, or long-term, such as building a retirement fund. By defining your goals, you can create a roadmap that will guide your financial decisions and keep you on track.

Budgeting Basics

Creating a budget is the foundation of good financial management. A budget helps you understand where your money is going, identify areas where you can cut back on expenses, and prioritize your spending. To create a budget, start by listing your income sources and then track your expenses for a month to get a clear picture of your financial habits. From there, you can allocate funds to different categories, such as housing, transportation, groceries, and entertainment, and make adjustments as needed.

Managing Debt

Debt is a common financial burden that many individuals and businesses face. Whether it’s credit card debt, student loans, or a mortgage, managing debt effectively is key to achieving financial stability. To tackle your debt, start by making a list of all your debts, including the amount owed and interest rates. Prioritize paying off high-interest debt first while making minimum payments on other debts. Consider debt consolidation or refinancing options to lower interest rates and make repayment more manageable.

Image courtesy of www.visualcapitalist.com via Google Images

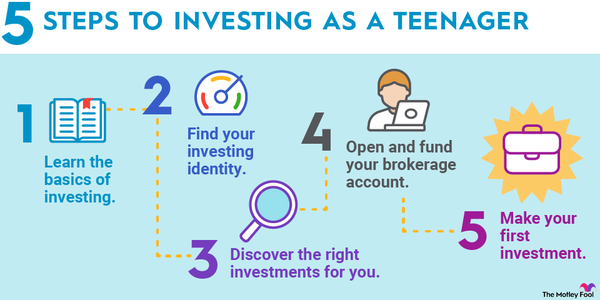

Investing for the Future

Investing is a powerful tool for building wealth and achieving long-term financial goals. There are various investment options available, including stocks, bonds, real estate, and mutual funds. Before diving into the world of investing, it’s essential to understand your risk tolerance, investment timeline, and financial goals. Consider working with a financial advisor to develop an investment strategy that aligns with your objectives and helps you grow your wealth over time.

Financial Wellness

Financial wellness goes beyond just managing money—it encompasses your overall financial health and well-being. In addition to creating a budget and investing wisely, financial wellness includes building an emergency fund, planning for retirement, and protecting your assets with insurance. By taking a holistic approach to financial management, you can create a stable financial foundation that will support you throughout your life.

Image courtesy of www.fool.com via Google Images

Conclusion

In conclusion, understanding and managing your finances is a crucial skill that can have a profound impact on your life and future. By setting clear financial goals, creating a budget, managing debt effectively, investing wisely, and prioritizing financial wellness, you can take control of your financial future and work towards achieving your dreams. Remember, financial management is a journey, so be patient with yourself and seek professional advice when needed to ensure you’re making the best decisions for your financial well-being.