Navigating the Stock Market: A Beginner’s Guide to Investing

June 2, 2024Uncover the secrets to mastering the stock market with this beginner’s guide to investing. Take control of your financial future!

Image courtesy of Valentin Antonucci via Pexels

Table of Contents

Investing in the stock market can be a daunting prospect for beginners. With so many options and complexities to navigate, it’s easy to feel overwhelmed. However, with the right knowledge and approach, anyone can start building a successful investment portfolio. In this guide, we will walk you through the basics of investing in the stock market and provide tips on how to get started.

Understanding Your Investment Goals

Before diving into the world of investing, it’s essential to understand your investment goals. Are you looking to save for retirement, grow your wealth, or achieve a specific financial milestone? By identifying your goals, you can tailor your investment strategy to meet your objectives.

Assessing Your Risk Tolerance

Another crucial consideration when investing in the stock market is your risk tolerance. How comfortable are you with the idea of potentially losing money? Generally, higher risk investments offer the potential for higher returns, but they also come with greater volatility. It’s important to align your risk tolerance with your investment strategy to ensure you can weather market fluctuations.

Researching Investment Options

With a clear understanding of your investment goals and risk tolerance, it’s time to research investment options. The stock market offers a wide range of investment opportunities, from individual stocks to exchange-traded funds (ETFs) and mutual funds. Take the time to explore different investment vehicles and understand their potential risks and rewards.

Image courtesy of www.easypeasyfinance.com via Google Images

Building a Diversified Portfolio

Diversification is a key strategy for managing risk in the stock market. By spreading your investments across different asset classes and industries, you can reduce the impact of a downturn in any single investment. Building a diversified portfolio can help you achieve more consistent returns over time.

Setting Up an Investment Account

Once you’ve done your research and identified your investment strategy, it’s time to set up an investment account. There are several types of accounts to choose from, including individual brokerage accounts, retirement accounts like IRAs and 401(k)s, and education savings accounts like 529 plans. Selecting the right account will depend on your investment goals and tax considerations.

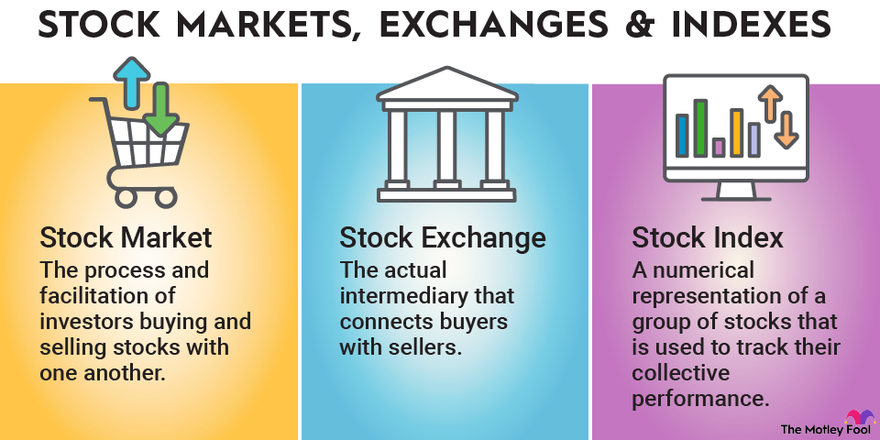

Image courtesy of www.fool.com via Google Images

Monitoring Your Investments

After you’ve made your initial investments, it’s important to monitor your portfolio regularly. Keep an eye on market trends, news that may impact your investments, and your portfolio performance. By staying informed, you can make informed decisions about when to buy, sell, or hold onto your investments.

Rebalancing Your Portfolio

Over time, your investment portfolio may drift away from your desired asset allocation due to market fluctuations. Periodically rebalancing your portfolio can help realign your investments with your target allocations. Rebalancing involves selling overperforming assets and buying underperforming assets to maintain your desired mix of investments.

Image courtesy of www.fool.com via Google Images

Seeking Professional Advice

If you’re feeling overwhelmed by the complexities of investing in the stock market, don’t hesitate to seek professional advice. Financial advisors can help you develop a personalized investment strategy based on your goals and risk tolerance. They can also provide guidance on building a diversified portfolio and managing market volatility.

Final Thoughts

Investing in the stock market can be a rewarding way to grow your wealth over time. By understanding your investment goals, assessing your risk tolerance, and building a diversified portfolio, you can set yourself up for success in the stock market. Remember to stay informed, monitor your investments regularly, and seek professional advice when needed. With the right approach, anyone can become a successful investor in the stock market.