Money Moves: Mastering Personal Finance Like a Pro

June 2, 2024Discover the insider secrets to financial success and take control of your money with these expert tips and tricks!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Personal finance is a critical aspect of every individual’s life. Whether you are a seasoned business professional or just starting out in your career, mastering the art of personal finance is essential for achieving your financial goals. By implementing key strategies and making informed decisions, you can take control of your finances and pave the way to a secure financial future.

Setting Financial Goals

Setting clear and specific financial goals is the first step towards managing your finances effectively. When your goals are specific, measurable, achievable, relevant, and time-bound (SMART), you are more likely to stay focused and motivated to achieve them. Begin by identifying your short-term and long-term financial goals, whether it’s saving for a dream vacation, buying a home, or retiring comfortably.

Budgeting and Expense Tracking

Creating a budget is a cornerstone of sound financial management. A budget helps you track your income and expenses, identify areas where you can cut back, and allocate funds towards your financial goals. Start by listing all your sources of income and fixed expenses, then track your variable expenses such as groceries, dining out, and entertainment. Use budgeting apps or tools to streamline the process and stay on top of your finances.

Debt Management

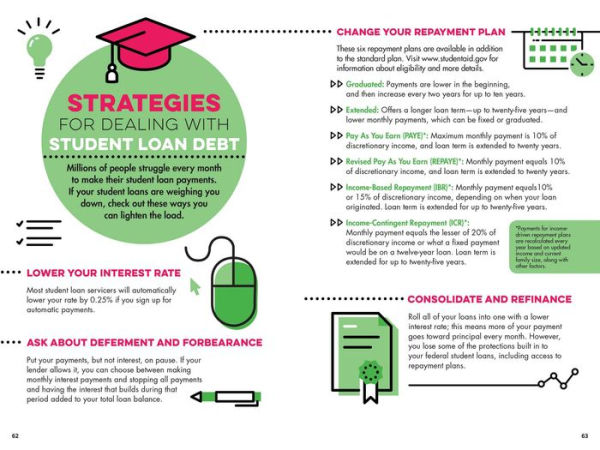

Managing and reducing debt is crucial for improving your financial health. Two popular strategies for tackling debt include the debt snowball and debt avalanche methods. With the debt snowball method, you pay off debts starting with the smallest balance first, while the debt avalanche method focuses on paying off debts with the highest interest rates. Additionally, consider negotiating lower interest rates and payment plans with creditors to make paying off debt more manageable.

Image courtesy of www.hamiltonplace.com via Google Images

Saving and Investing

Saving and investing are key components of building wealth and securing your financial future. Start by building an emergency fund to cover unexpected expenses and avoid going into debt. Save consistently for retirement by contributing to retirement accounts like 401(k) or IRA. When investing, consider your risk tolerance and investment goals to diversify your portfolio effectively. By saving and investing wisely, you can grow your wealth over time.

Financial Literacy and Education

Continuous learning and improving financial literacy are essential for making informed financial decisions. There are various resources available, such as books, podcasts, and online courses, that can help you enhance your financial knowledge and skills. Stay up to date on financial trends and developments to make sound investment decisions and navigate the complex world of personal finance with confidence.

In conclusion, mastering personal finance is a journey that requires commitment, discipline, and ongoing education. By setting clear financial goals, creating a budget, managing debt, saving and investing wisely, and improving your financial literacy, you can take control of your finances and work towards achieving your long-term financial objectives. Start implementing these strategies today and watch your financial future transform for the better.