Money Moves: How to Take Control of Your Finances

May 24, 2024Unlock the secrets to financial freedom and learn how to make strategic money moves that will transform your future.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing the finances of a business can be a daunting task, but it is crucial for its success. Effective financial management can lead to increased profitability, sustainability, and growth. In this blog post, we will explore how you can improve financial management in your business through strategic planning and smart decision-making.

Assessing Your Current Financial Situation

Before you can make any changes to your financial management practices, it is essential to assess your current financial situation. Start by reviewing your profit and loss statements, balance sheets, and cash flow statements. These documents will give you a clear picture of how your business is performing financially.

Identify areas where your business is spending too much or not generating enough revenue. Look for any patterns or trends that may be impacting your financial health. Understanding your current financial situation is the first step towards making improvements.

Setting Financial Goals

Once you have a clear understanding of your current financial situation, it is time to set financial goals for your business. These goals can be both short-term and long-term and should be specific, measurable, achievable, relevant, and time-bound (SMART).

Determine key performance indicators (KPIs) that will help you track your progress towards achieving these goals. KPIs can include metrics such as revenue growth, profitability, and cash flow. Setting financial goals will give you a roadmap to follow and help you stay focused on improving your financial management practices.

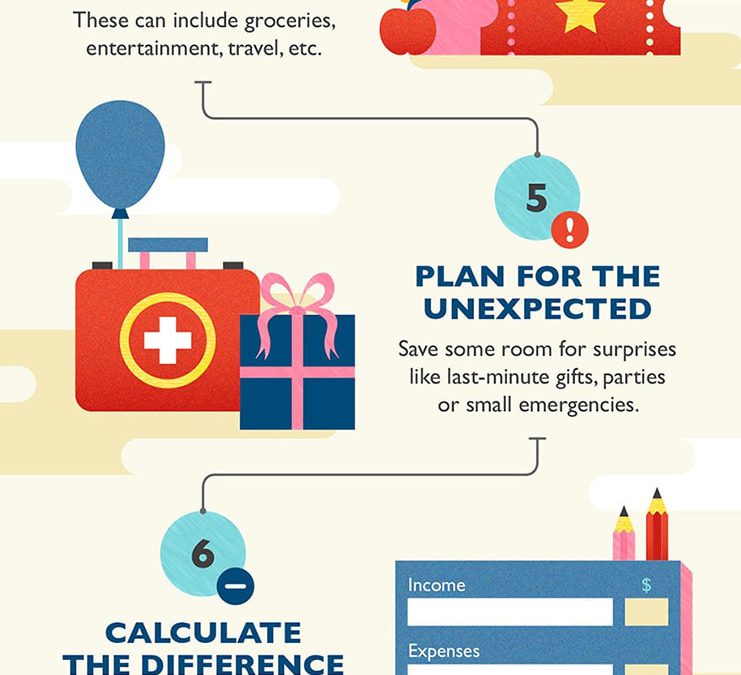

Creating a Budget

A budget is a critical tool for effective financial management. It allows you to plan and control your finances by outlining your expected revenue and expenses for a specific period. When creating a budget, consider all sources of income and expenses, including fixed costs, variable costs, and one-time expenses.

Image courtesy of www.businessinsider.com via Google Images

Allocate funds to different departments or projects based on their importance to the overall success of the business. Be sure to account for any unexpected expenses or emergencies that may arise. A well-thought-out budget will help you make informed financial decisions and avoid overspending.

Monitoring and Adjusting

Monitoring your financial performance against your budget is essential for staying on track towards your financial goals. Regularly review your financial statements and compare them to your budgeted numbers. Identify any discrepancies or areas where expenses are exceeding expectations.

If you notice any deviations from your budget, take prompt action to address them. This may involve cutting costs, increasing revenue, or reallocating funds. Adjust your budget as needed to ensure that you are meeting your financial goals and staying within your financial limits.

Seeking Professional Help

Managing the finances of a business can be complex, especially if you are not a financial expert. Consider hiring a financial advisor or accountant to provide expert advice on improving your financial management practices.

Image courtesy of www.quicken.com via Google Images

A financial advisor can help you develop a financial strategy that aligns with your business goals and objectives. They can also offer guidance on investment opportunities, tax planning, and risk management. Attending workshops or seminars on financial management can also help you enhance your knowledge and skills in this area.

Conclusion

Improving financial management in your business is essential for its success and sustainability. By assessing your current financial situation, setting financial goals, creating a budget, monitoring and adjusting, and seeking professional help, you can take control of your finances and make informed decisions that will lead to increased profitability and growth.

Start implementing these tips today and watch as your business thrives financially!