Money Moves: How to Grow Your Wealth and Security

June 11, 2024Unlock the secrets to growing your wealth and achieving financial security with these expert money moves and strategies today.

Image courtesy of Ivan Babydov via Pexels

Table of Contents

Running a small business comes with its own set of challenges and responsibilities. One crucial aspect that every small business owner should have a good grasp of is finance. Having a solid understanding of finance is essential for making informed decisions, managing cash flow effectively, and ensuring the financial health of your business. In this blog post, we will delve into the basics of finance for small business owners and provide insights on key financial concepts that can help you steer your business towards success.

Importance of Financial Literacy for Small Business Owners

Financial literacy is the cornerstone of sound business management. For small business owners, having a good grasp of finance can mean the difference between success and failure. Understanding financial concepts allows you to make informed decisions, create realistic budgets, and plan for the future of your business. Financial literacy also enables you to communicate effectively with investors, lenders, and other stakeholders, showcasing your competence and commitment to the financial success of your business.

Basic Financial Concepts for Small Business Owners

Effective cash flow management is vital for the survival and growth of a small business. Cash flow refers to the movement of money in and out of your business, including revenue, expenses, and investments. To manage cash flow effectively, small business owners should keep a close eye on their income and expenses, plan for seasonal fluctuations, and explore ways to improve cash flow, such as negotiating better payment terms with suppliers and monitoring inventory levels.

Budgeting

Creating a budget is an essential tool for small business owners to track and control their finances. A budget helps you allocate resources effectively, set financial goals, and monitor your progress towards achieving them. To develop a budget for your small business, start by estimating your income and expenses, identifying areas where you can cut costs or increase revenue, and revisiting your budget regularly to make adjustments as needed.

Financial Statements and Analysis

An income statement, also known as a profit and loss statement, provides a snapshot of your business’s financial performance over a specific period. It shows your revenue, expenses, and net income or loss. By analyzing your income statement, you can assess your business’s profitability, identify areas where costs can be reduced, and make strategic decisions to improve your bottom line.

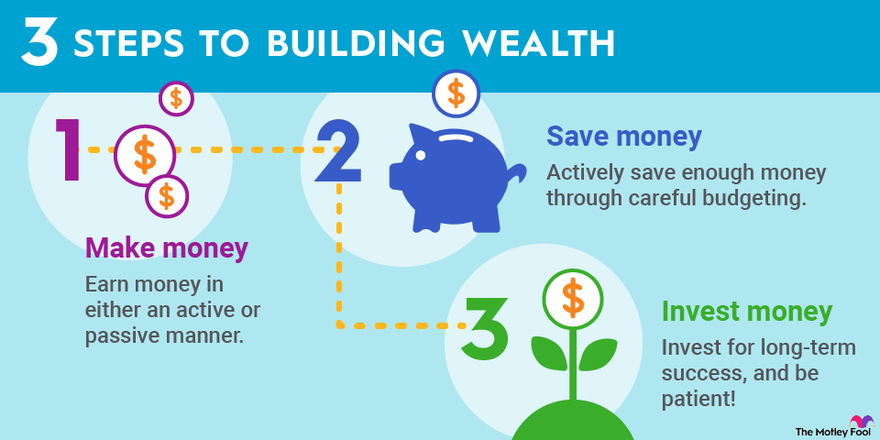

Image courtesy of www.fool.com via Google Images

Balance Sheet

A balance sheet is a financial statement that shows your business’s assets, liabilities, and equity at a specific point in time. It provides a comprehensive view of your business’s financial position and helps you understand its solvency and liquidity. By analyzing your balance sheet, you can assess your business’s financial health, track changes in your assets and liabilities, and make informed decisions about investments, financing, and growth strategies.

Funding Options for Small Businesses

Small businesses often require external funding to support their growth and expansion. There are several funding options available to small business owners, including loans from financial institutions, equity investments from investors, and grants from government agencies or private organizations. Each funding option has its own pros and cons, and the choice of funding source will depend on your business’s financial needs, growth objectives, and risk tolerance. It’s essential to carefully evaluate the terms and conditions of each funding option and choose the one that best aligns with your business goals.

Conclusion

Finance is a critical aspect of running a successful small business. By understanding key financial concepts, such as cash flow management, budgeting, and financial statement analysis, small business owners can make informed decisions, manage their finances effectively, and ensure the long-term financial health of their business. By exploring different funding options and seeking expert advice when needed, small business owners can secure the resources they need to support their growth and achieve their business goals. Investing time and effort into improving your financial literacy can pay off in the form of increased profitability, sustainability, and success for your small business.