Money Moves: Easy Strategies to Save and Invest for a Brighter Future

May 30, 2024Discover simple yet effective ways to secure your financial future with these easy-to-implement money-saving and investment strategies. Start now!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing the finances of your business is crucial to its success. By taking control of your financial health, you can make informed decisions that will help your business grow and thrive. In this blog post, we will discuss easy strategies to improve your business’s financial health, from assessing your current situation to seeking professional advice.

Assess Your Current Financial Situation

Before you can start making improvements to your business’s financial health, it’s essential to assess your current situation. Take some time to review your financial statements and reports, including your income statement, balance sheet, and cash flow statement. This will give you a clear picture of where your business stands financially.

Identify areas of strength and weakness in your cash flow, revenue, and expenses. Are there any trends or patterns that you notice? Understanding your current financial situation is the first step in making positive changes for your business.

Set Financial Goals

Once you have a good understanding of your current financial situation, it’s time to set some financial goals for your business. Determine both short-term and long-term goals that align with your overall business objectives. Make sure your goals are SMART – specific, measurable, attainable, relevant, and time-bound.

Setting financial goals will give you a roadmap to follow as you work towards improving your business’s financial health. Whether you’re aiming to increase revenue, reduce expenses, or improve cash flow, having clear goals in place will keep you focused and motivated.

Create a Budget

Developing a budget is a crucial step in managing your business’s finances effectively. A budget helps you allocate funds for key expenses such as salaries, marketing, and operations, while also ensuring that you’re not overspending in any areas.

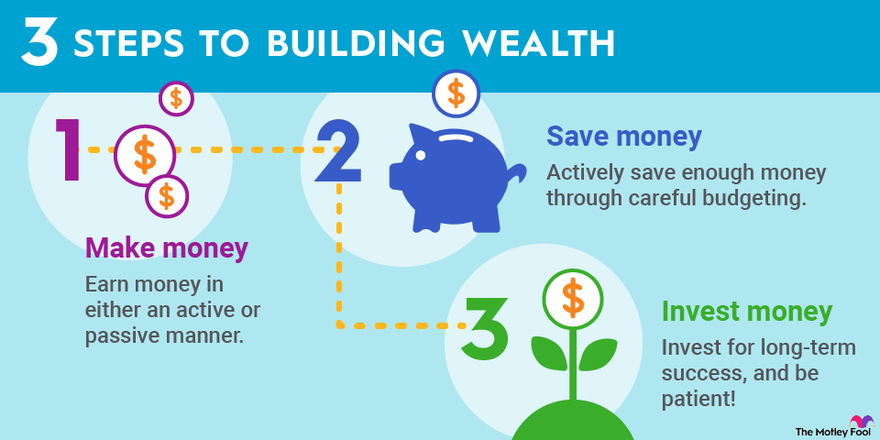

Image courtesy of www.fool.com via Google Images

When creating a budget, be sure to consider both your fixed and variable expenses. Fixed expenses, such as rent and utilities, remain constant each month, while variable expenses, like inventory or advertising, can fluctuate. By accurately forecasting your expenses and revenue, you can create a budget that aligns with your financial goals.

Monitor and Track Your Finances Regularly

Tracking your finances regularly is essential for staying informed about your business’s financial health. Consider using accounting software to track your income and expenses in real-time. This will allow you to generate financial reports and metrics that provide insights into how your business is performing.

Reviewing your financial reports on a regular basis will help you identify any areas that may need attention. Are you overspending in certain areas? Are there opportunities to increase revenue? By monitoring and tracking your finances regularly, you can make informed decisions that will positively impact your business’s financial health.

Cut Costs and Increase Revenue

One way to improve your business’s financial health is to cut costs where possible. Take a close look at your expenses and identify areas where you can reduce spending without sacrificing quality. This could involve renegotiating contracts with suppliers, finding more cost-effective solutions, or eliminating unnecessary expenses.

Image courtesy of www.creditkarma.com via Google Images

Additionally, explore ways to increase revenue for your business. This could involve implementing new sales strategies, adjusting pricing, or diversifying your income streams. By finding ways to increase revenue while also cutting costs, you can improve your business’s profitability and overall financial health.

Seek Professional Advice

Finally, don’t hesitate to seek professional advice when it comes to managing your business’s finances. Consider consulting with a financial advisor or accountant who can provide expert guidance based on your specific situation. They can offer valuable insights and recommendations to help you make informed decisions that will benefit your business.

Additionally, consider attending workshops or webinars on financial management to further improve your financial acumen. Learning from experts in the field can provide you with valuable knowledge and resources to enhance your business’s financial health.

By taking control of your business’s finances and implementing these easy strategies, you can improve your business’s financial health and set it on a path to success. Remember to assess your current financial situation, set clear goals, create a budget, monitor and track your finances regularly, cut costs, increase revenue, and seek professional advice. With a solid financial foundation in place, your business will be well-positioned for a brighter future.