Money Matters: The Ultimate Guide to Financial Success

May 19, 2024Unlock the secrets to financial success with our comprehensive guide on money matters that will change your life forever.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing your business finances effectively is crucial for the success and sustainability of your company. By implementing a solid financial management system, you can ensure that your business stays on track financially, even during challenging times. In this guide, we will walk you through the steps to manage your business finances like a pro.

Assess Your Current Financial Situation

Before you can effectively manage your business finances, it’s important to assess your current financial situation. Take the time to review your income, expenses, and any outstanding debts. Analyze your cash flow to understand where your money is coming from and where it’s going. By understanding your current financial position, you can make informed decisions about how to move forward.

Create a Budget

One of the key steps in managing your business finances is creating a budget. A budget will help you track your income and expenses and plan for the future. Start by listing out all of your fixed costs, such as rent, utilities, and insurance. Then, identify your variable expenses, like marketing and supplies. Finally, set aside a portion of your income for savings and investments. By creating a budget, you can ensure that you are not overspending and that you have enough funds to cover your expenses.

Monitor and Track Your Finances

Once you have created a budget, it’s important to monitor and track your finances. This will help you stay on top of your financial situation and make any necessary adjustments. Regularly review your financial statements, such as profit and loss reports and balance sheets. Keep track of your accounts receivable and accounts payable. Consider using financial software or tools to help you stay organized. By monitoring your finances, you can identify trends or issues early on and take action to address them.

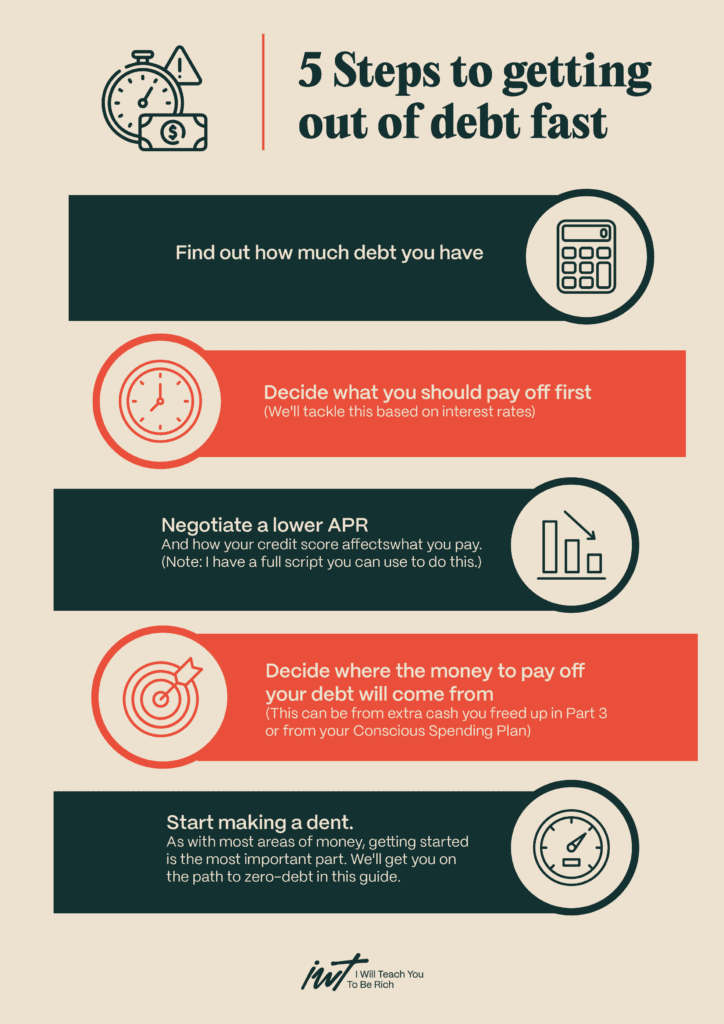

Image courtesy of www.iwillteachyoutoberich.com via Google Images

Plan for the Future

It’s important to set financial goals for your business and create a plan to achieve them. Whether your goal is to increase revenue, reduce debt, or save for the future, having a clear plan in place will help you stay on track. Consider working with a financial advisor or accountant to help you develop a financial plan and set realistic goals. By planning for the future, you can ensure that your business is financially secure and prepared for any challenges that may arise.

Stay Organized and Stay Consistent

Organization is key when it comes to managing your business finances. Keep all financial documentation organized and easily accessible. This will help you quickly find information when you need it and make informed decisions based on your financial data. Make sure to consistently update your budget and monitor your financial performance. This will help you stay on top of your finances and make any necessary adjustments as needed.

Managing your business finances can seem daunting, but with the right strategies in place, you can ensure that your business remains financially stable and successful. By assessing your current financial situation, creating a budget, monitoring and tracking your finances, planning for the future, and staying organized and consistent, you can take control of your business finances and achieve financial success.