Money Matters: How to Take Control of Your Finances in 5 Simple Steps

May 30, 2024Discover the 5 secret steps to financial freedom that will change your life and help you take control of your money.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Small businesses often face challenges when it comes to managing their finances. From setting up financial systems to monitoring key metrics, there is a lot to consider. In this blog post, we will explore how small business owners can successfully manage their finances in five simple steps.

Setting Up Your Financial Systems

One of the first steps in taking control of your small business finances is to set up the right financial systems. This includes selecting the appropriate accounting software for your business needs. There are many options available, so be sure to choose one that aligns with your budget and accounting requirements.

Once you have chosen your accounting software, it’s important to implement a bookkeeping system to track your income and expenses accurately. This will help you stay organized and make informed financial decisions. Additionally, establishing a budget and cash flow projections can help you plan for future expenses and revenue.

Managing Cash Flow Effectively

Cash flow is crucial for the success of any small business. To improve your cash flow, consider strategies such as timely invoicing and collections. Sending out invoices promptly and following up on late payments can help you maintain a steady cash flow.

If you find yourself facing cash flow gaps, explore short-term financing options to bridge the gap. This could include lines of credit or business loans. Additionally, reducing expenses can also help improve your cash flow. Look for areas where you can cut costs without sacrificing the quality of your products or services.

Monitoring Key Financial Metrics

Monitoring key financial metrics is essential for understanding the financial health of your small business. Identify the key performance indicators (KPIs) that are most relevant to your business and track them regularly. This could include metrics such as revenue growth, profit margins, and customer acquisition costs.

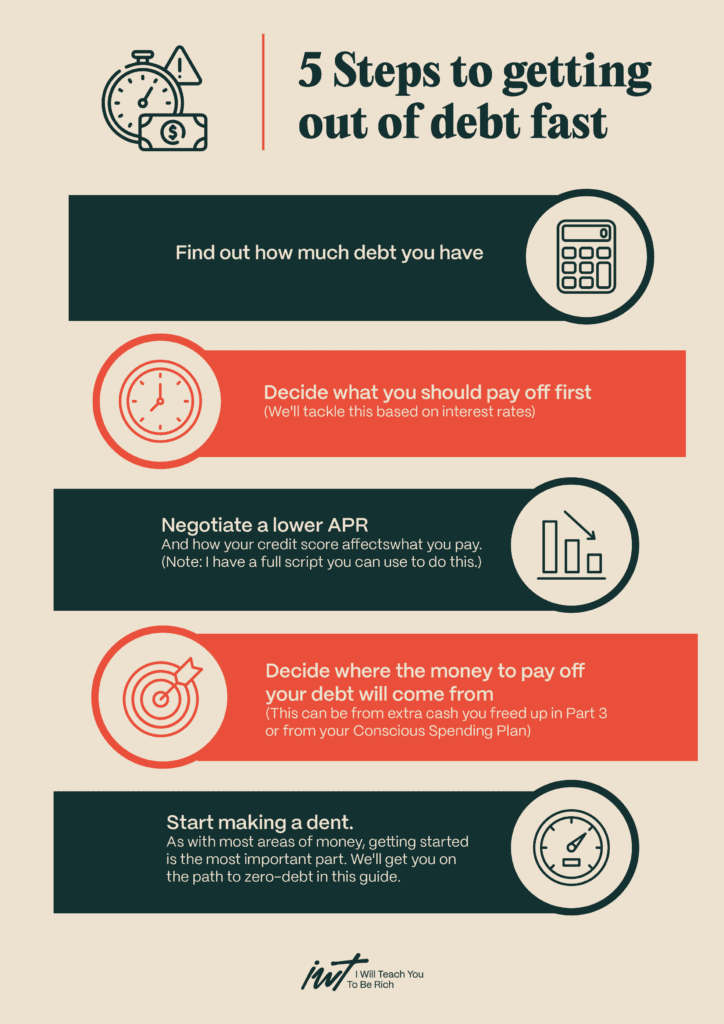

Image courtesy of www.iwillteachyoutoberich.com via Google Images

Setting financial goals and benchmarks can help you stay on track and measure your progress over time. Analyzing financial statements, such as your balance sheet and income statement, can provide valuable insights into your business’s financial performance. Use this information to make informed decisions and adjust your strategy as needed.

Tax Planning and Compliance

Small businesses have specific tax obligations that must be met to avoid penalties and fines. Understanding your tax liabilities and obligations is crucial for staying compliant. Consider working with a tax professional to ensure that you are meeting all of your tax requirements.

Strategies for tax planning can help you minimize your tax liabilities and take advantage of deductions that are available to small businesses. Be proactive in planning for your taxes throughout the year to avoid any surprises come tax season. Stay informed about changes to tax laws that could impact your business.

Seeking Professional Advice

Knowing when to seek the help of financial professionals is important for small business owners. Consider hiring an accountant or financial advisor to assist with complex financial tasks or provide guidance on financial decisions. Outsourcing financial tasks can free up your time to focus on other aspects of your business.

Image courtesy of www.clevergirlfinance.com via Google Images

There are many resources available to small business owners who are looking for support in managing their finances. Online courses, workshops, and seminars can provide valuable information and guidance. Networking with other business owners and financial professionals can also be a great way to learn from others’ experiences.

Conclusion

Managing your small business finances doesn’t have to be overwhelming. By following these five simple steps, you can take control of your finances and set your business up for long-term success. From setting up financial systems to monitoring key metrics, there are many ways to improve your financial management skills. Remember to seek professional advice when needed and stay informed about changes in tax laws and regulations. With the right tools and strategies, you can confidently manage your small business finances and achieve your financial goals.