Maximizing Your Money: Expert Tips for Financial Success

May 28, 2024Unlock the secrets to financial success with expert tips on maximizing your money and securing a prosperous future ahead.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Understanding the ins and outs of finance is essential for any business owner or entrepreneur looking to achieve success in their ventures. From setting financial goals to managing cash flow effectively, mastering the fundamentals of finance can make a significant difference in the profitability and sustainability of your business. In this blog post, we will explore expert tips for navigating the world of finance and maximizing your money for long-term success.

Importance of Financial Literacy

Financial literacy is the foundation of sound financial decision-making in business. It involves understanding key financial concepts and being able to apply them to your business operations. Without a solid grasp of financial literacy, business owners may struggle with managing their finances effectively, leading to potential cash flow problems and missed opportunities for growth.

Many business owners face challenges related to financial literacy, such as not knowing how to create and stick to a budget, mismanaging cash flow, or failing to make informed investment decisions. By enhancing your financial literacy, you can avoid these common pitfalls and set your business up for success.

Setting Financial Goals

One of the first steps towards financial success in business is setting clear and measurable financial goals. These goals provide a roadmap for your business and help you stay focused on your objectives. When setting financial goals, it’s essential to make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Start by defining your financial objectives, whether it’s increasing revenue, reducing expenses, or improving profit margins. Break down these goals into smaller, actionable steps that you can track and measure over time. By setting SMART financial goals, you can create a clear path towards financial success for your business.

Budgeting and Cash Flow Management

Effective budgeting and cash flow management are essential components of financial success in business. A budget serves as a financial roadmap for your business, outlining your expected revenues and expenses over a specific period. By creating a budget, you can track your financial performance, identify areas for improvement, and make informed decisions about resource allocation.

Image courtesy of www.linkedin.com via Google Images

Cash flow management is equally important, as it ensures that your business has enough cash on hand to cover expenses and take advantage of growth opportunities. Monitoring your cash flow regularly, identifying cash flow bottlenecks, and implementing strategies to improve cash flow are crucial steps in managing your business’s financial health.

Investing Wisely

Investing in your business’s growth is a key strategy for maximizing your money and achieving long-term success. Whether it’s investing in marketing initiatives, technology upgrades, or talent development, strategic investments can drive business growth and profitability. When considering investment opportunities, it’s essential to weigh the potential risks and rewards and align your investments with your business goals.

Additionally, diversifying your investment portfolio can help mitigate risk and maximize returns over time. By investing wisely in your business’s future, you can position yourself for sustainable growth and profitability in the long run.

Financial Planning for the Future

Creating a comprehensive financial plan is critical for the long-term success of your business. A financial plan outlines your business’s financial goals, strategies for achieving them, and contingency plans for unforeseen circumstances. By developing a financial plan, you can gain clarity on your business’s financial position, identify areas for improvement, and make informed decisions about resource allocation.

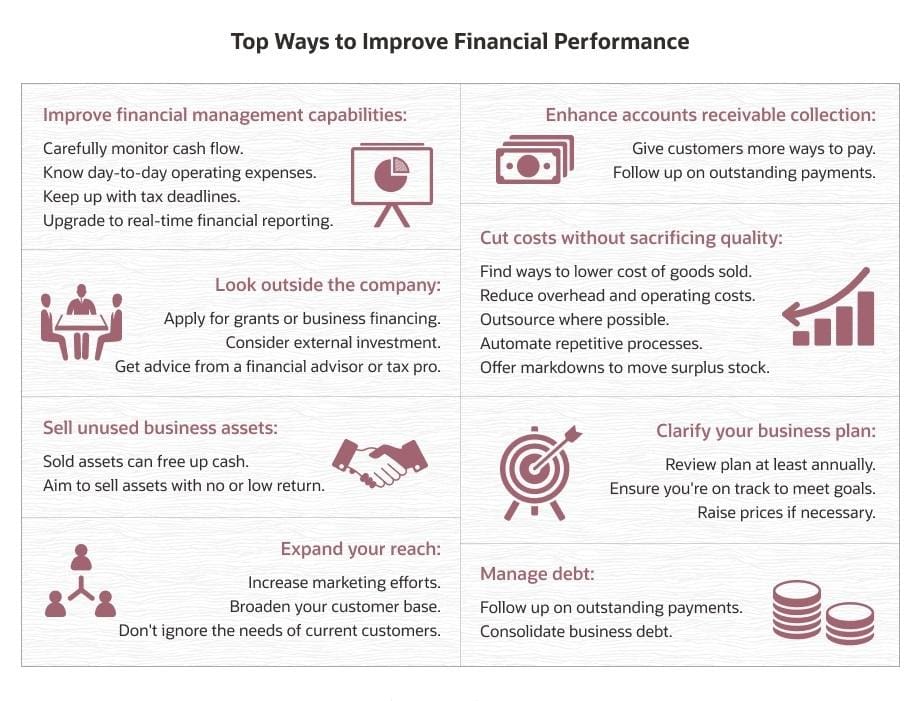

Image courtesy of www.netsuite.com via Google Images

Regularly reviewing and updating your financial plan is essential to adapt to changing market conditions, business needs, and financial goals. By integrating financial planning into your business strategy, you can enhance your financial resilience and set a solid foundation for future growth and success.

Conclusion

Mastering the fundamentals of finance is crucial for achieving financial success in business. By enhancing your financial literacy, setting SMART financial goals, managing cash flow effectively, and investing wisely, you can maximize your money and position your business for sustainable growth and profitability. Remember, financial success is a journey, not a destination – continue to educate yourself, seek expert advice, and adapt your financial strategies to navigate the ever-changing landscape of business finance.