Maximizing Your Financial Potential: Tips for Success

June 17, 2024Uncover the secrets to unlocking your financial potential with these expert tips that are guaranteed to lead you to success.

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing your business finances effectively is crucial for the success and sustainability of your venture. By setting clear financial goals, creating a budget, implementing financial controls, managing cash flow, and seeking professional help when needed, you can ensure that your business thrives financially. In this blog post, we will dive into each of these key areas and provide you with practical tips on how to manage your business finances effectively.

Set Clear Financial Goals

Before you can effectively manage your business finances, you need to define your financial goals. Whether you aim to increase revenue, decrease expenses, or improve cash flow, setting clear and specific goals is essential for guiding your financial decisions and efforts. Break down your goals into achievable milestones and set a timeline for reaching each milestone. This will help you stay focused and motivated as you work towards financial success.

Create a Budget

Creating a budget is a fundamental step in managing your business finances effectively. Start by reviewing your current financial situation, including your revenue, expenses, and cash flow. Identify areas where you can cut costs or reallocate resources to align with your financial goals. Develop a detailed budget that outlines your projected income and expenses, and monitor it regularly to ensure you stay on track. Be prepared to make adjustments to your budget as needed to reflect changes in your business operations or financial circumstances.

Implement Financial Controls

Establishing financial controls is essential for safeguarding your business finances and ensuring accountability within your organization. Develop financial policies and procedures that outline how financial transactions should be handled, and implement checks and balances to prevent fraud or misuse of funds. Consider using accounting software or tools to track your expenses, revenue, and cash flow, and regularly review financial reports to analyze key metrics and identify areas for improvement.

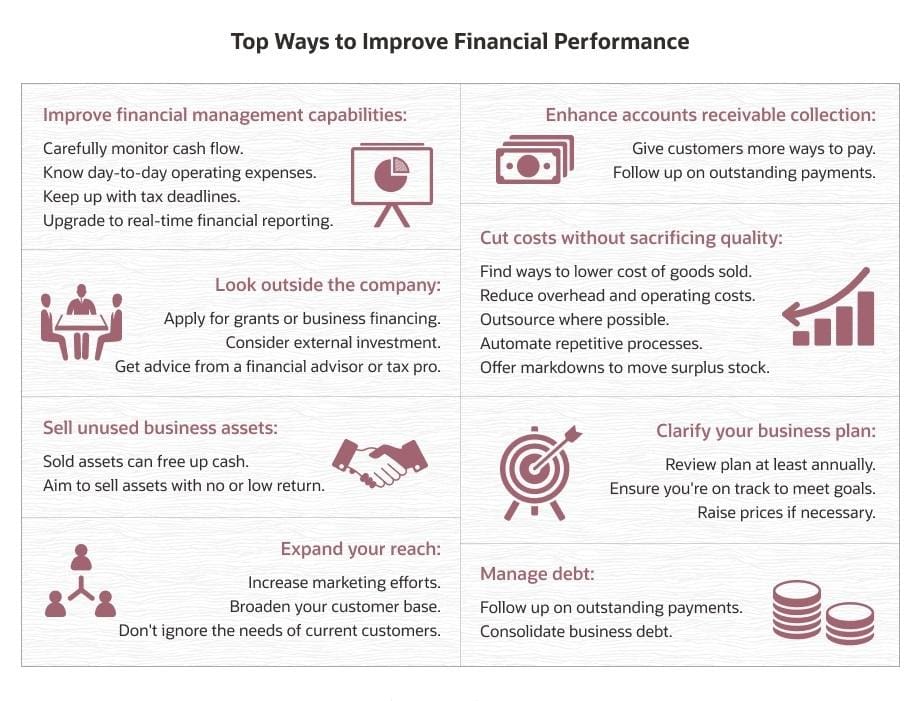

Image courtesy of via Google Images

Manage Cash Flow

Cash flow management is a critical aspect of effective financial management for any business. Monitor your cash flow regularly to ensure that you have enough liquidity to cover your expenses and obligations. Implement strategies to improve your cash flow, such as invoicing promptly, offering discounts for early payments, or negotiating favorable payment terms with suppliers. If cash flow fluctuations are a concern, consider establishing a line of credit or securing a working capital loan to help bridge any gaps.

Seek Professional Help When Needed

While you may have a good handle on managing your business finances, seeking professional help can provide you with valuable insights and expertise to optimize your financial management strategies. Consult with a financial advisor or accountant for advice on financial planning, tax implications, or investment opportunities. Consider outsourcing certain financial tasks, such as bookkeeping or tax preparation, to professionals who can handle these tasks efficiently and accurately. Additionally, attending workshops or seminars on financial management can help you enhance your knowledge and skills in this area.

In conclusion, managing your business finances effectively is essential for the long-term success and growth of your venture. By setting clear financial goals, creating a budget, implementing financial controls, managing cash flow, and seeking professional help when needed, you can position your business for financial stability and prosperity. Take action today to implement these tips and maximize your financial potential.