Investing 101: How to Make Your Money Work for You

June 9, 2024Find out the secrets to making your money work for you with this comprehensive guide to investing 101. Don’t miss out!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing personal finances can seem like a daunting task, especially with the constant changes in the economy. However, taking control of your financial future is crucial for long-term success. In this ultimate guide, we will explore the key strategies and principles to help you master personal finance in 2021.

Setting Financial Goals

Setting clear, achievable financial goals is the first step towards financial freedom. When setting your goals, make sure they are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). Whether your goal is to save for a down payment on a house, pay off debt, or build a retirement fund, having a clear goal in mind will guide your financial decisions and keep you motivated.

Budgeting and Saving

Creating a realistic budget is essential for managing your finances effectively. Start by tracking your expenses and income to get a clear picture of where your money is going. Identify areas where you can cut expenses and redirect that money towards savings. Building a sustainable savings plan will not only help you achieve your financial goals but also provide a safety net for unexpected expenses.

Investing Basics

Understanding the basics of investing is key to growing your wealth over time. There are various investment options available, including stocks, bonds, mutual funds, and real estate. Diversifying your investment portfolio is crucial to manage risk and maximize returns. Consider your risk tolerance and investment goals when choosing the right investment strategy for you.

Image courtesy of www.fool.com via Google Images

Managing Debt

Debt can be a significant barrier to achieving financial freedom. It’s essential to prioritize debt repayment and develop a plan to reduce and manage your debt effectively. Consider strategies such as consolidating high-interest debt, negotiating with creditors for lower interest rates, and making extra payments towards your debt to accelerate the repayment process.

Building Wealth

Building wealth requires a long-term commitment to smart financial decisions. Saving for retirement, investing in growth opportunities, and maximizing tax advantages are all key strategies for building wealth over time. Additionally, protecting your wealth through insurance and estate planning is crucial to ensure your assets are secure for future generations.

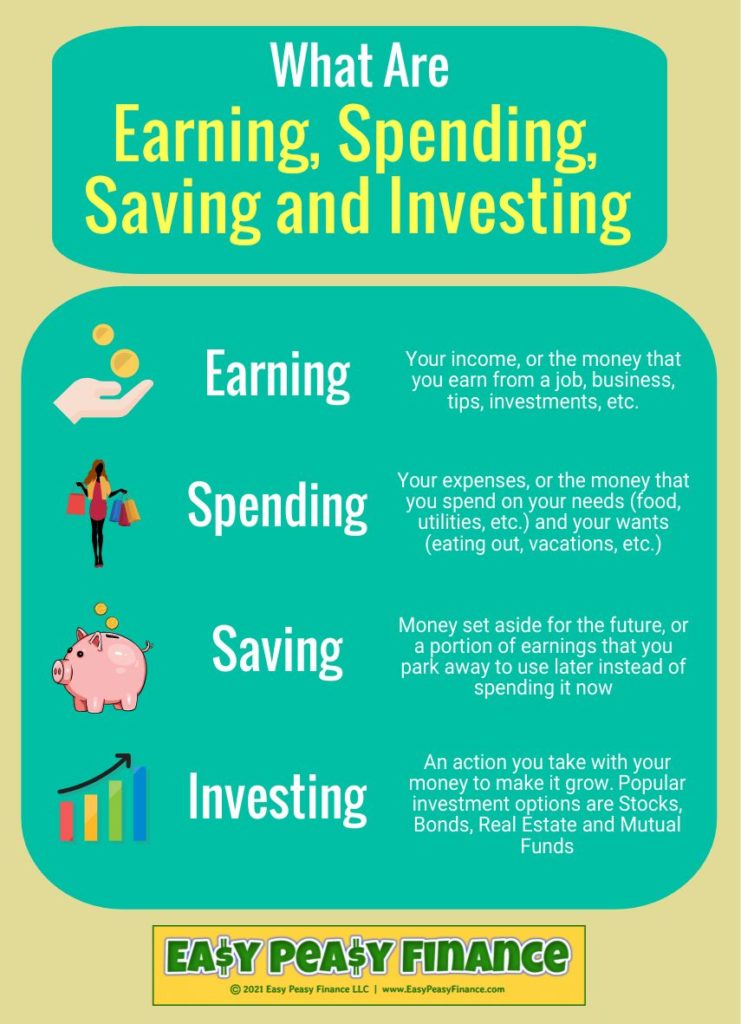

Image courtesy of www.easypeasyfinance.com via Google Images

Conclusion

Mastering personal finance is a journey that requires dedication and ongoing learning. By setting clear financial goals, creating a budget, investing wisely, managing debt, and building wealth strategically, you can take control of your financial future and achieve long-term financial success. Remember, financial planning is a continuous process, so stay committed to your goals and adapt to changing circumstances to secure a prosperous future.