Investing 101: Building Wealth for the Future

May 17, 2024Unlock the secrets to financial success with our Investing 101 guide – pave your way to a wealthier tomorrow now!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Financial planning is a crucial aspect of running a successful small business. It involves setting goals, creating a plan, and monitoring progress to ensure the business remains financially healthy. In this blog post, we will delve into the importance of financial planning for small businesses and provide tips on how to effectively manage finances for long-term success.

Understanding Financial Planning for Small Businesses

Financial planning for small businesses involves developing a strategy to manage the company’s finances efficiently. It includes budgeting, forecasting, and risk management to ensure the business remains viable and profitable.

Setting Financial Goals for Small Businesses

Setting clear and achievable financial goals is essential for small businesses. Goals provide direction and help measure progress towards financial success. When setting financial goals, it is important to make them specific, measurable, achievable, relevant, and time-bound (SMART).

Creating a Financial Plan for Small Businesses

Creating a comprehensive financial plan is key to the success of a small business. A financial plan outlines how the company will achieve its financial goals and includes strategies for managing cash flow, budgeting expenses, and forecasting revenue. It also considers factors like market conditions and potential risks that may impact the business’s financial stability.

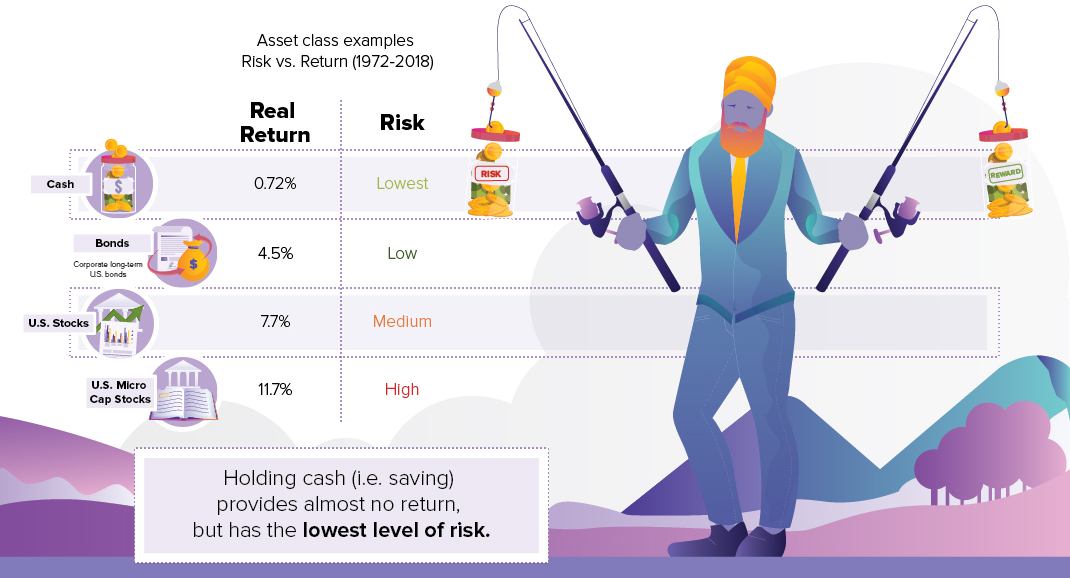

Image courtesy of wealth.visualcapitalist.com via Google Images

Monitoring and Adjusting Financial Plans for Small Businesses

Monitoring and evaluating the company’s financial performance against the set goals is crucial for the success of a small business. Regularly reviewing financial statements, cash flow reports, and budget variances can help identify areas where adjustments may be necessary. By making timely adjustments to the financial plan, small businesses can adapt to changing market conditions and ensure long-term sustainability.

Conclusion

Financial planning is a fundamental aspect of running a successful small business. By setting clear financial goals, creating a comprehensive financial plan, and monitoring progress regularly, small businesses can build a strong foundation for future growth and success. Effective financial planning not only helps businesses navigate challenges but also enables them to seize opportunities for expansion and innovation.