Investing 101: A Beginner’s Guide to Financial Success

June 7, 2024Wondering how to start investing? Unlock the secrets to financial success with our beginner’s guide to investing 101! Dive in now.

Image courtesy of maitree rimthong via Pexels

Table of Contents

When it comes to managing your business finances, having a solid plan in place is crucial. In this blog post, we will discuss key strategies and tips for successfully managing your business finances. From establishing a financial plan to monitoring income and expenses, we will cover all aspects of financial management to help you achieve financial success.

Establishing a Financial Plan

Setting clear goals and objectives is the first step in establishing a sound financial plan for your business. Whether you aim to increase revenue, reduce expenses, or grow your business, having specific financial targets will guide your decision-making process. Creating a budget is also essential to ensure you are allocating your resources effectively and efficiently. By planning for both short-term and long-term financial needs, you can set your business up for success in the long run.

Monitoring Income and Expenses

Tracking all sources of income and recording expenses accurately are key components of effective financial management. By categorizing expenses, you can identify areas where costs can be reduced or optimized. Implementing systems for better financial organization, such as using accounting software or hiring a professional bookkeeper, can streamline the process and provide you with valuable insights into your business finances.

Managing Cash Flow

Understanding the cash flow cycle is essential for maintaining financial stability in your business. By monitoring your cash flow regularly, you can identify potential cash flow issues and take proactive steps to address them. Strategies for improving cash flow include controlling costs, managing accounts receivable, and optimizing inventory levels. Liquidity management is also crucial to ensure your business has enough cash on hand to meet its financial obligations.

Image courtesy of wealth.visualcapitalist.com via Google Images

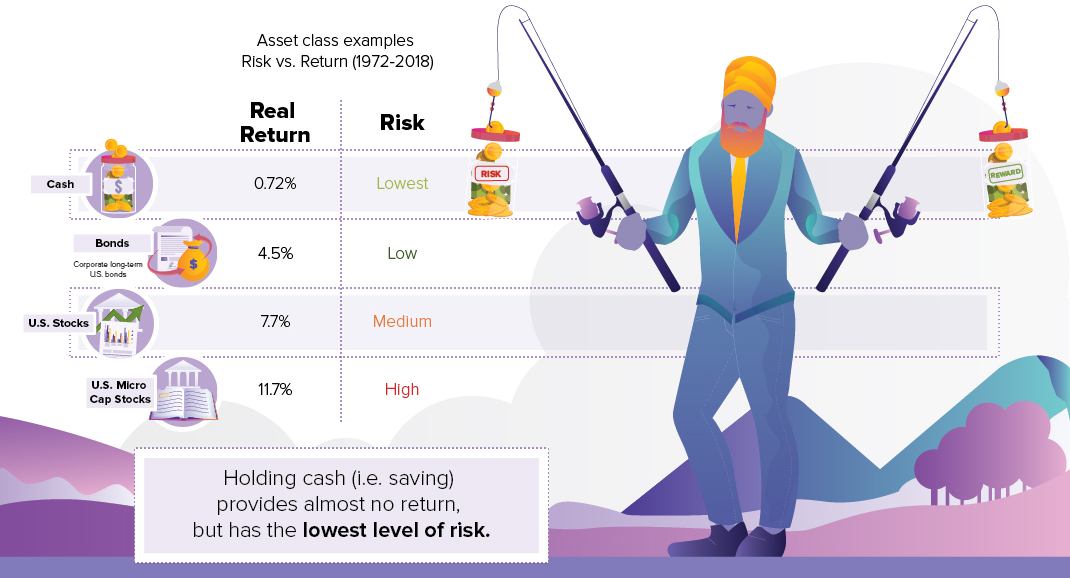

Investing Wisely

Investing wisely is another important aspect of financial management. Identifying investment opportunities that align with your business goals and risk tolerance is key to building wealth over time. Diversifying your investment portfolio can help mitigate risk and protect your assets in volatile market conditions. Seeking professional financial advice when making investment decisions can provide you with valuable insights and guidance to make informed choices.

Staying Informed and Adapting

Regularly reviewing financial reports and performance indicators is essential for staying informed about your business’s financial health. By analyzing trends and patterns in your financial data, you can identify areas for improvement and make data-driven decisions. Being proactive in adjusting your financial strategies as needed will help you adapt to changing market conditions and ensure your business remains financially viable. Staying informed about industry trends and economic conditions will also help you make strategic financial decisions that align with your business goals.

By following these key strategies and tips for managing your business finances, you can set your business up for financial success. From establishing a solid financial plan to monitoring income and expenses, effective financial management is essential for achieving long-term profitability and sustainability in your business.