Investing 101: A Beginner’s Guide to Financial Freedom

May 23, 2024Unlock the secrets to financial freedom with this beginner’s guide to investing – start building wealth today and secure your future.

Image courtesy of Valentin Antonucci via Pexels

Table of Contents

When it comes to achieving financial freedom, investing is a crucial tool that can help you grow your wealth over time. For many beginners, the world of investing can seem daunting and complex. However, by understanding the basics of investing and developing a solid investment strategy, you can set yourself on the path to financial success. In this blog post, we will explore the fundamental principles of investing and provide you with a beginner’s guide to building a strong investment portfolio.

Setting Financial Goals

Before you start investing, it’s important to establish clear financial goals. By defining your objectives, whether it’s saving for retirement, buying a home, or funding your children’s education, you can tailor your investment strategy to meet these specific needs. Make sure your goals are realistic, measurable, and time-bound to track your progress effectively.

Budgeting and Cash Flow Management

Effective budgeting and cash flow management are essential components of successful investing. Creating a budget allows you to track your income and expenses, identify areas where you can cut costs, and allocate funds towards your investment goals. Managing your cash flow efficiently ensures that you have enough liquidity to meet your financial obligations and take advantage of investment opportunities.

Investing and Growth Strategies

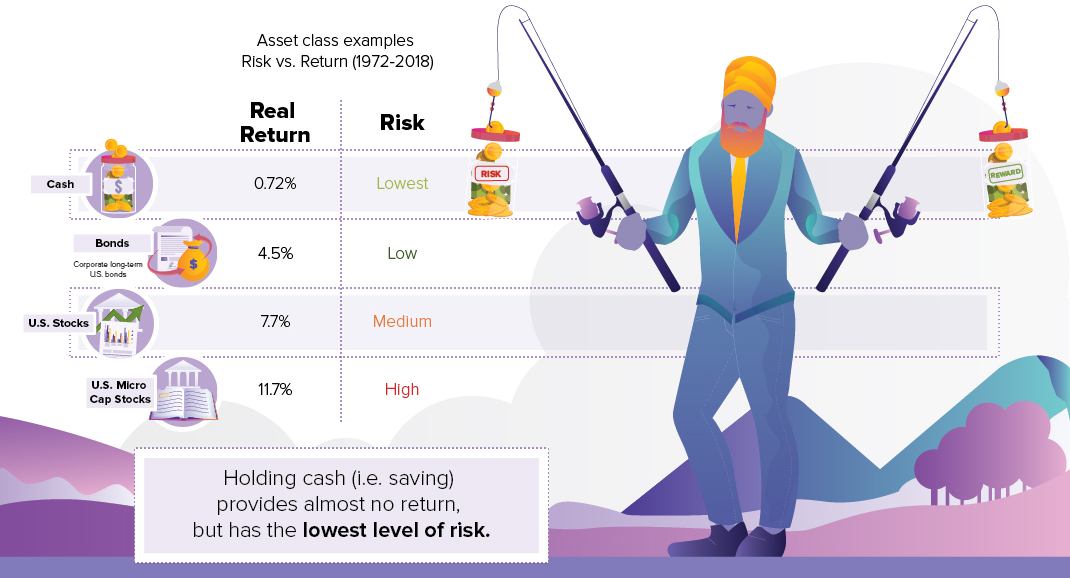

When it comes to investing, there are various strategies you can employ to grow your wealth. Whether you choose to invest in stocks, bonds, real estate, or other asset classes, it’s important to diversify your portfolio to reduce risk. Consider your risk tolerance, investment timeline, and financial goals when developing your investment strategy. Take a long-term view and avoid making rash investment decisions based on short-term market fluctuations.

Image courtesy of wealth.visualcapitalist.com via Google Images

Risk Management and Contingency Planning

Investing always involves a certain degree of risk, and it’s crucial to assess and manage these risks effectively. Diversifying your investment portfolio across different asset classes can help mitigate risk and protect your investments from market volatility. Additionally, having a contingency plan in place can provide you with a safety net in case of unexpected financial setbacks. Consider factors such as insurance coverage, emergency funds, and alternative income sources to safeguard your financial well-being.

Seeking Professional Financial Advice

While investing can be a rewarding endeavor, it’s essential to seek professional financial advice to ensure that you are making informed decisions. A financial advisor can help you develop a customized investment strategy based on your unique financial situation, risk tolerance, and goals. They can provide you with valuable insights, market expertise, and ongoing guidance to help you navigate the complexities of the investment landscape.

In conclusion, investing is a powerful tool that can help you achieve financial freedom and build wealth over time. By setting clear financial goals, budgeting effectively, developing a sound investment strategy, managing risks, and seeking professional advice, you can set yourself up for long-term financial success. Remember that investing is a journey, and it’s essential to stay disciplined, patient, and informed as you work towards your financial goals. With the right mindset and strategy, you can pave the way towards a brighter financial future.