Innovative Marketing Strategies for Small Businesses on a Budget

June 13, 2024Discover how small businesses can compete with larger competitors by using cost-effective and inventive marketing strategies for maximum impact.

Image courtesy of RDNE Stock project via Pexels

Table of Contents

Managing finances effectively is crucial for the success and sustainability of any business. By establishing clear financial goals, creating a budget, monitoring cash flow, managing debt wisely, seeking professional advice, and staying informed about best practices, small business owners can take control of their finances and set their business up for growth and success.

Set Financial Goals

Setting financial goals is the first step towards managing your business finances successfully. Whether your goal is to increase revenue, reduce expenses, or improve cash flow, it’s important to clearly define and prioritize these goals. This will help you create a roadmap for your financial future and make informed decisions about where to allocate resources.

Create a Budget

A comprehensive budget is essential for managing your business finances effectively. Start by projecting your revenue and expenses for the upcoming year. Allocate funds to different areas of your business, such as marketing, operations, and employee salaries. Be sure to regularly review and update your budget as needed to ensure it aligns with your financial goals.

Monitor Cash Flow

Monitoring cash flow is key to ensuring that your business has enough funds to cover expenses. Keep track of your cash inflows and outflows on a regular basis. Identify any cash flow gaps or bottlenecks that may impact your business operations. Implement strategies, such as invoicing promptly and managing inventory effectively, to improve cash flow and keep your business running smoothly.

Image courtesy of www.wordstream.com via Google Images

Manage Debt Wisely

Debt can be a valuable tool for growing your business, but it’s important to manage it wisely. Evaluate your current debt obligations and prioritize repayment based on interest rates and terms. Explore options for refinancing or restructuring debt to reduce interest costs and improve cash flow. Avoid taking on unnecessary debt and strive to maintain a healthy debt-to-equity ratio for your business.

Seek Professional Advice

Consulting with a financial advisor or accountant can provide valuable insight into managing your business finances. These professionals can help you develop a financial strategy, navigate complex financial situations, and make informed decisions about your business. Additionally, utilizing financial management tools and software can streamline the budgeting and monitoring process, making it easier to track your finances and stay on top of your financial goals.

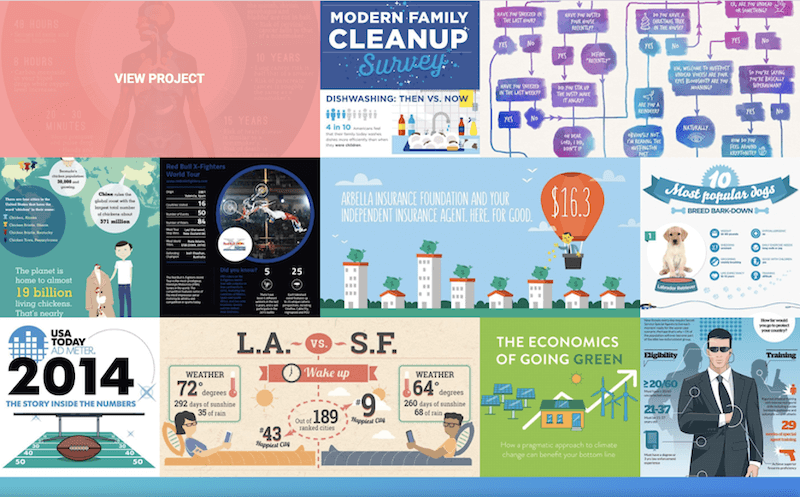

Image courtesy of venngage.com via Google Images

Conclusion

Effective financial management is essential for the success of any business, big or small. By setting clear financial goals, creating a budget, monitoring cash flow, managing debt wisely, seeking professional advice, and staying informed about best practices, small business owners can take control of their finances and set their business up for growth and success. Remember, managing your business finances is an ongoing process and requires regular attention and adaptation to ensure financial stability and growth.