Innovate to Dominate: Strategies for Business Growth

May 25, 2024Learn how innovative strategies can propel your business to new heights, revolutionizing growth and dominating the competition like never before.

Image courtesy of Pixabay via Pexels

Table of Contents

Running a small business is no easy feat. From managing day-to-day operations to overseeing customer relations, small business owners wear many hats. One crucial aspect that often gets overlooked in the midst of the chaos is financial planning. Financial planning is the roadmap that guides a business towards its goals and helps ensure long-term success. In this blog post, we will explore the importance of financial planning for small businesses and discuss key strategies that can help drive growth and profitability.

Setting Financial Goals

Setting clear financial goals is the first step in effective financial planning for small businesses. Whether it’s increasing revenue, reducing expenses, or expanding market share, having well-defined goals provides direction and focus. Short-term goals help keep the business on track in the day-to-day operations, while long-term goals provide a vision for the future. Aligning financial goals with overall business objectives ensures that every financial decision made contributes to the company’s growth and success.

Budgeting and Forecasting

Budgeting is a critical component of financial planning as it helps in the efficient allocation of resources. By creating a budget, small businesses can track their income and expenses, identify areas of overspending or underutilization, and make informed decisions on where to invest or cut costs. Furthermore, forecasting future financial needs and expenses allows businesses to anticipate cash flow fluctuations and plan accordingly. By staying proactive in budgeting and forecasting, small businesses can avoid financial surprises and ensure financial stability.

Managing Cash Flow

Cash flow management is essential for the survival and growth of a small business. Monitoring cash flow on a regular basis helps business owners understand their liquidity position and make informed decisions regarding expenditures and investments. Implementing strategies to improve cash flow, such as offering discounts for early payments or renegotiating payment terms with suppliers, can help maintain a healthy cash flow cycle. By staying on top of cash flow, small businesses can avoid cash crunches and ensure they have the funds needed to operate and grow.

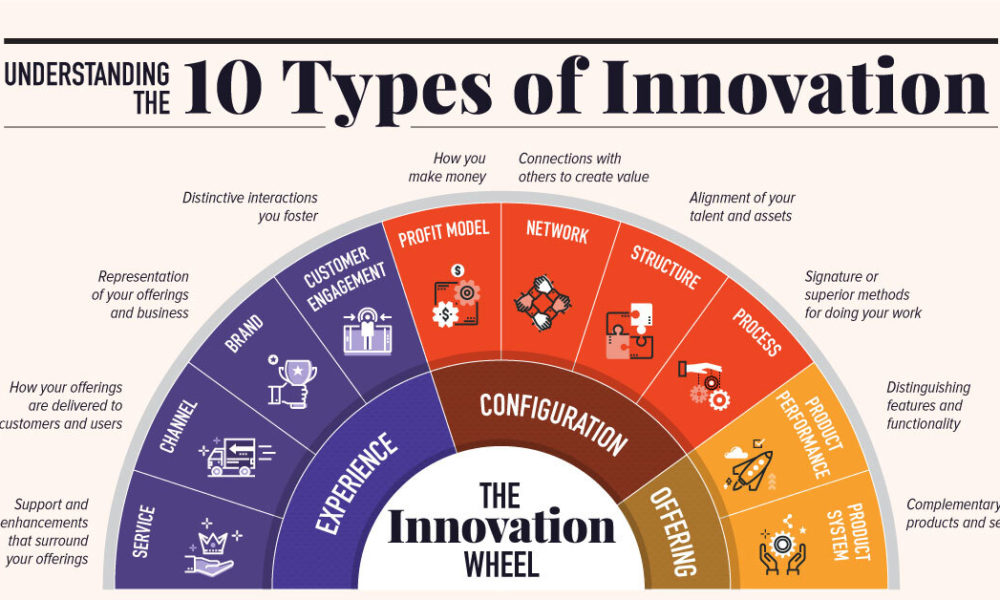

Image courtesy of www.visualcapitalist.com via Google Images

Risk Management

Every business faces risks, and small businesses are no exception. Identifying potential risks, whether it’s economic downturns, natural disasters, or industry-specific challenges, is crucial in financial planning. Developing a risk management plan that outlines strategies to mitigate these risks can help small businesses navigate uncertainties and protect their financial well-being. Investing in insurance coverage and creating contingency plans for worst-case scenarios are essential components of effective risk management for small businesses.

Seeking Professional Help

While small business owners often pride themselves on wearing multiple hats, there comes a time when seeking professional help is necessary. Financial advisors can provide invaluable guidance on financial planning, investment strategies, and risk management. Knowing when to outsource financial tasks to experts can save time, money, and headaches in the long run. By leveraging the expertise of professionals, small business owners can focus on what they do best – growing their business.

In conclusion, financial planning is a critical aspect of running a successful small business. By setting clear financial goals, budgeting effectively, managing cash flow, mitigating risks, and seeking professional help when needed, small business owners can position their businesses for growth and profitability. Prioritizing financial planning efforts can help small businesses weather challenges, seize opportunities, and achieve long-term success.