Innovate or Evaporate: The Importance of Pivoting in Business

May 21, 2024Discover the key to survival in the ever-changing business world: how pivoting can be the secret to your company’s success.

Image courtesy of Anthony 🙂 via Pexels

Table of Contents

In today’s fast-paced business environment, the ability to adapt and pivot is crucial for the success and survival of any company. With constantly changing market trends, customer preferences, and economic conditions, businesses that fail to innovate and evolve are at risk of falling behind their competitors. In this blog post, we will explore the importance of pivoting in business and provide actionable tips for how to successfully navigate changes and challenges.

Set Clear Financial Goals

Setting clear financial goals is the first step in effectively managing your business finances. Without a clear roadmap for where you want your business to go financially, it can be challenging to make informed decisions and track progress. Start by determining both short-term and long-term financial goals for your business. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Consider factors such as revenue targets, expense management, profitability margins, and cash flow projections. By breaking down your goals into specific targets, you can create a clear path for achieving financial success.

Create a Budget

A budget is a crucial tool for managing your business finances effectively. It allows you to track all sources of income and expenses, allocate funds to different categories, and stay on top of your financial health. Start by listing all sources of income, including sales, investments, and grants, and tracking all expenses, such as payroll, rent, utilities, and marketing.

Allocate funds to different categories based on your business’s needs and priorities. Regularly review and update your budget to reflect changes in your business, such as new hires, increased sales, or unexpected expenses. By keeping a close eye on your budget, you can ensure that you are staying on track financially.

Monitor Cash Flow

Cash flow management is essential for the day-to-day operations of your business. By monitoring your incoming and outgoing cash flow, you can identify any gaps or issues that may arise and take timely action to address them. Tools and software can help streamline the cash flow management process and provide real-time insights into your business’s financial health.

Image courtesy of www.linkedin.com via Google Images

Keep track of your accounts receivable and accounts payable, and ensure that you have enough cash on hand to cover your expenses. By monitoring your cash flow regularly, you can anticipate any potential cash flow issues and take proactive steps to mitigate them.

Manage Debt Wisely

Debt can be a useful tool for financing business growth, but it is essential to manage it wisely. Keep track of your business debts, including loan balances, interest rates, and repayment terms. Develop a plan to pay off debts while maintaining a healthy cash flow to ensure that your business remains financially stable.

Consider options such as refinancing or negotiating with creditors to reduce your debt burden and lower your interest payments. By managing your debt wisely, you can free up cash flow for other business needs and reduce financial stress.

Invest for Growth

Investing for growth is a key strategy for expanding your business and seizing new opportunities. Allocate a portion of your profits towards investments that will help grow your business, such as expanding product lines, launching marketing campaigns, or hiring new talent. Conduct thorough research and consider different investment options based on your business’s needs and goals.

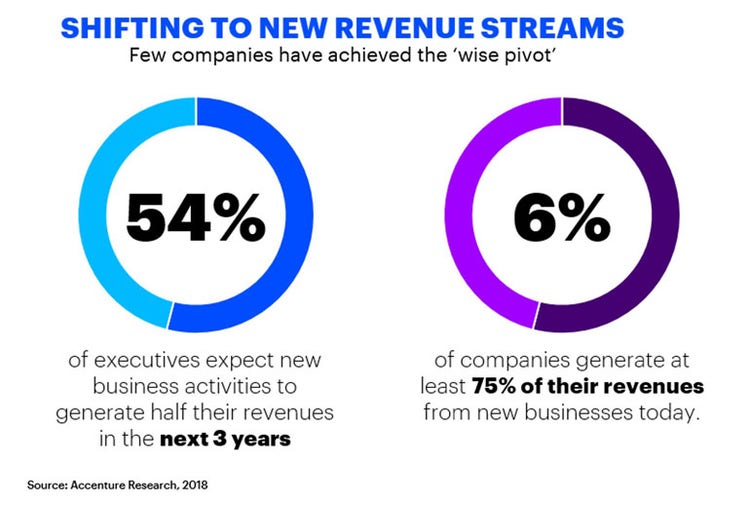

Image courtesy of newsroom.accenture.com via Google Images

Regularly review the performance of your investments and make adjustments as needed to ensure that they are contributing to your business’s growth. By investing for growth, you can stay ahead of the competition and position your business for long-term success.

Conclusion

In conclusion, managing your business finances effectively is crucial for the success and sustainability of your company. By setting clear financial goals, creating a budget, monitoring cash flow, managing debt wisely, and investing for growth, you can navigate changes and challenges with confidence. Prioritize financial management in your business operations and seek professional help if needed to ensure that your business remains financially healthy and resilient.