How to Double Your Revenue in Just One Year: A Guide for Small Business Owners

June 8, 2024Discover the top secrets and strategies for small business owners to skyrocket their revenue and double profits in one year.

Image courtesy of Pixabay via Pexels

Table of Contents

Finance is the lifeblood of any business. Whether you are a small start-up or a large corporation, having a solid grasp of business finance is essential for long-term success. In this blog post, we will delve into the fundamentals of business finance, covering everything from types of financing to financial statements and ratios.

What is Business Finance?

Business finance refers to the management of money and financial resources within a business. It involves making decisions about how to raise capital, invest in assets, and manage cash flow to ensure the financial health of the business. Effective financial management is crucial for achieving business goals and sustaining growth.

Types of Business Finance

There are two main types of business finance: debt financing and equity financing. Debt financing involves borrowing money from lenders, such as banks or financial institutions, which must be repaid with interest. Equity financing, on the other hand, involves selling shares of ownership in the company to investors in exchange for capital.

Businesses also have the option to choose between short-term and long-term financing. Short-term financing typically involves loans or lines of credit that are repaid within a year, while long-term financing involves borrowing money for larger investments over a longer period, often through bonds or long-term loans.

Financial Statements

Financial statements are crucial tools for understanding a company’s financial performance. The three main types of financial statements are the income statement, balance sheet, and cash flow statement. The income statement shows a company’s revenues and expenses over a specific period, the balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a certain point in time, and the cash flow statement tracks the flow of cash in and out of the business.

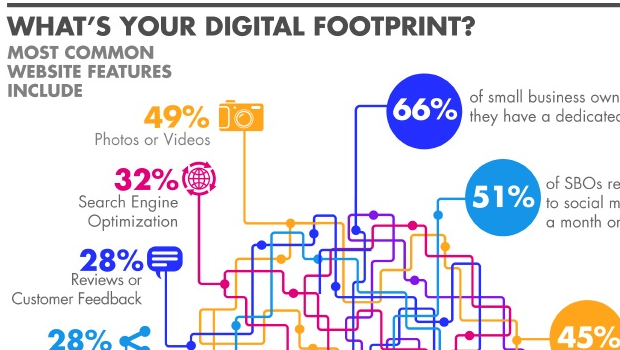

Image courtesy of verticalresponse.com via Google Images

Analyzing financial statements allows businesses to assess their profitability, liquidity, and overall financial health. By comparing trends and ratios within the financial statements, business owners and managers can make informed decisions to improve the company’s financial position.

Financial Ratios

Financial ratios are key metrics used to evaluate a company’s financial performance. Common financial ratios include liquidity ratios (such as the current ratio and quick ratio), solvency ratios (debt-to-equity ratio), profitability ratios (such as return on assets and return on equity), and efficiency ratios (like inventory turnover and accounts receivable turnover).

Calculating and interpreting these ratios can provide valuable insights into a company’s financial strength and operational efficiency. For example, a high liquidity ratio indicates that a company has enough current assets to cover its short-term liabilities, while a low profitability ratio may signal inefficiencies in the company’s operations.

Financial Planning and Budgeting

Financial planning and budgeting are essential components of effective financial management. A financial plan outlines a company’s financial goals and strategies for achieving them, while a budget sets specific targets for revenue and expenses over a certain period.

Image courtesy of www.act.com via Google Images

Creating a financial plan and budget helps businesses allocate resources efficiently, track progress towards financial goals, and identify areas for improvement. By regularly monitoring actual financial performance against the budget, business owners can make adjustments to ensure the financial health and sustainability of the company.

Conclusion

Understanding business finance is crucial for the success of any business. By mastering the basics of business finance, small business owners can make informed decisions to manage their finances effectively, achieve their business goals, and drive growth. Continuously learning and applying financial principles will help businesses thrive in today’s competitive marketplace.