How to Create a Finance Plan

May 7, 2024Unlock the secret to financial success with these 10 essential steps for creating a foolproof finance plan that works wonders!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Introduction to Financial Planning

Finance planning is like having a superhero for your money. It helps you make smart choices about how to use your money wisely. Just like how superheroes have a plan to save the day, financial planning is your plan to save and grow your money.

What is Financial Planning?

Financial planning is all about making a plan for how to use your money. It’s like creating a roadmap to help you reach your goals. By setting financial goals and making a plan to achieve them, you can make sure your money is working hard for you.

Why We Need a Finance Plan

Having a finance plan is super important because it helps you stay on track with your money. Think of it like having a map for a treasure hunt – it guides you to where you want to go. With a finance plan, you can make sure you have enough money for the things you need and want.

Understanding Your Money

Income is like the fuel that keeps your money engine running. It’s all the ways you get money, like when you do chores for your parents, receive birthday cash from relatives, or even earn a little allowance. Just like in a video game, the more income you have, the more power you have to make smart choices with your money.

Expenses: Where Does the Money Go?

Expenses are like the villains in your money adventure – they’re the things that take your money away. These can be things like buying snacks, getting a new toy, or even paying for a fun day out with friends. By keeping track of your expenses, you can see where your money is going and make sure you’re using it wisely.

Creating Your Super Budget

Learn to make a super budget that helps you control your money like a video game controller.

Image courtesy of venngage.com via Google Images

Listing Your Expenses

We’ll make a list of things you spend money on, sort of like a shopping list, but for everything. It’s important to know where your money is going so you can see what you’re spending the most on.

Planning Your Savings

We’ll figure out how you can save money, like putting some coins in your piggy bank. Saving money is like collecting treasures in a game – the more you save, the more you’ll have for later. It’s a great way to reach your goals faster!

Savings and Goals

Let’s talk about why saving is a big deal and how it can help you reach cool goals, like buying a new bike or game.

Setting Super Goals

We’ll think about what you really want to save for and how to make it happen. Maybe you want to save up for a new video game, a special toy, or even a fun day out with your friends. By setting clear goals, you can stay motivated to save your money instead of spending it right away.

Growing Your Savings

Discover how to make your saved money grow, like watering a plant to help it get bigger. You can put your money in a special account that earns you more money over time, just like magic! This way, your savings can grow faster and help you reach your goals even sooner.

Investment Strategy for Kids

Investment strategy is like a game plan for making your money grow over time. It’s a way to plant seeds of money now, so they can turn into big trees of cash later on.

Image courtesy of venngage.com via Google Images

What is Investing?

Investing is a way to use your money to buy things that can make even more money for you in the future. It’s like having a magic pet that grows and multiplies your coins while you sleep.

Investing for the Future

For kids, investing can be as simple as starting a small business, like a lemonade stand, to earn extra money. Or you can ask grown-ups to help you buy shares of a company you like, so you can grow your money like a garden.

Being Smart with Money

When it comes to using your money wisely, you want to be like a smart detective solving a case. Think carefully before you spend your money. Is buying that new toy really worth it, or could you save your money for something even better later on? Make sure to prioritize what’s important to you and spend your money on things that bring you joy.

Avoiding Money Mistakes

Just like in a game, you want to avoid traps that can make you lose points. When it comes to money, there are some common mistakes you’ll want to steer clear of. For example, always make sure to save some of your money for a rainy day instead of spending it all at once. It’s also important to be cautious about sharing your personal information or giving money to people you don’t know well. By avoiding these money mistakes, you can keep your finances safe and secure.

Reviewing and Improving Your Plan

Now that you’ve created your finance plan and set some awesome goals, it’s time to check how well you’re doing. Just like in a video game, you want to see if you’re getting closer to completing a level or reaching a big boss. Take a look at your goals and see if you’re making progress. Maybe you wanted to save up for a new toy or bike – are you getting closer to that goal? If you are, give yourself a pat on the back for all your hard work!

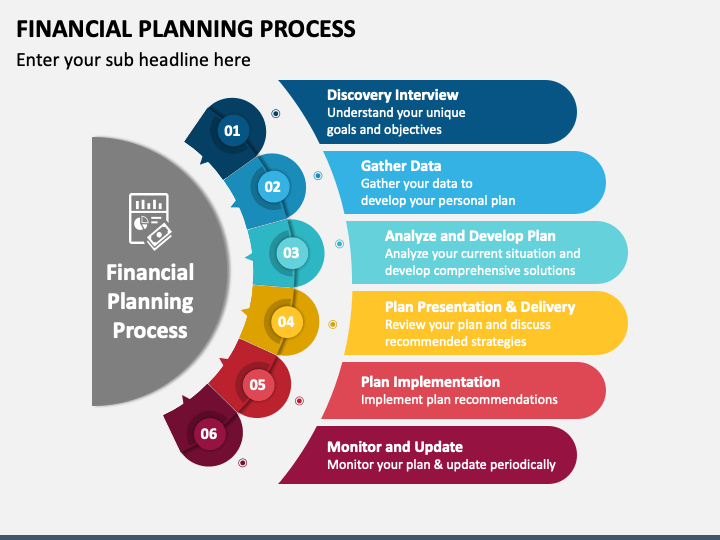

Image courtesy of www.sketchbubble.com via Google Images

Making Your Plan Better

Even superheroes need to upgrade their gear to defeat tougher villains, right? The same goes for your finance plan. It’s important to review your plan regularly and see if there are any areas where you can make improvements. Maybe you’ve noticed that you’re spending too much money on snacks and not saving as much as you’d like. You can tweak your plan by cutting back on snacks and putting that extra money into your savings. By making small adjustments like this, you can level up your money skills and get closer to your goals faster.

Conclusion: Becoming a Finance Superhero

As we come to the end of our journey into the world of finance planning, it’s time to unleash your inner finance superhero! By mastering the art of financial planning, budgeting, and investment strategy, you have equipped yourself with the tools to take control of your money like a true champion.

Embracing Financial Planning

Financial planning is like your trusty sidekick, guiding you towards your goals and dreams. Just like a superhero needs a plan to defeat the bad guys, you need a finance plan to conquer your financial challenges and achieve success.

Making Budgeting Your Superpower

Your super budget is your secret weapon in the battle for financial freedom. By listing your expenses and planning your savings like a fearless warrior, you can stay ahead of the game and ensure your money works for you, not against you.

Harnessing the Power of Investment Strategy

Investment strategy is your key to unlocking the potential of your money. Just like planting seeds that grow into mighty trees, investing wisely can help your savings grow and flourish over time, setting you up for a prosperous future.

So, don your cape, grab your finance plan, and soar into the world of financial superheroism. With the knowledge and skills you’ve gained, you are well on your way to becoming a finance superhero, ready to conquer any financial challenge that comes your way. Remember, with great financial power comes great financial responsibility!