Get Rich Quick: The Ultimate Guide to Building Wealth

June 2, 2024Discover the secrets to building wealth and achieving financial independence faster than you ever thought possible. Don’t miss out!

Image courtesy of Pixabay via Pexels

Table of Contents

Introduction: As a business owner, ensuring your financial preparedness is crucial for the long-term success of your venture. In this blog post, we will explore the key steps you can take to achieve financial stability and set your business up for growth and prosperity.

Assess Your Current Financial Situation

Before you can begin planning for the future, it’s essential to have a clear understanding of your current financial position. Start by reviewing your financial statements, including the balance sheet, income statement, and cash flow statement. These documents will give you a snapshot of your business’s financial health and help you identify any areas that may need improvement.

Next, take a look at key financial ratios such as profit margin, current ratio, and debt-to-equity ratio. Analyzing these ratios will give you insights into your business’s profitability, liquidity, and financial leverage. Look for trends over time and compare your ratios to industry benchmarks to see how your business stacks up against competitors.

Create a Budget and Financial Forecast

Once you have a clear picture of your current financial situation, it’s time to create a budget and financial forecast for your business. A budget will outline your expected revenue and expenses for the upcoming period, while a financial forecast will project your financial performance based on historical data and future assumptions.

Use your financial statements and key metrics to inform your budget and forecast. Set realistic goals for revenue growth and expense management, and be sure to monitor your progress regularly to identify any deviations from your plan.

Establish Financial Controls and Processes

To ensure the accuracy and integrity of your financial data, it’s essential to establish robust financial controls and processes. Implementing controls such as segregation of duties, approval processes, and regular audits can help prevent fraud and errors in your financial reporting.

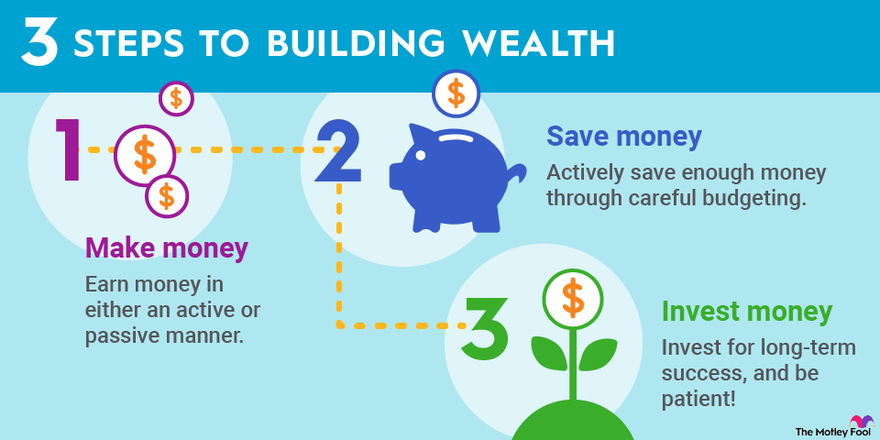

Image courtesy of www.fool.com via Google Images

Develop standardized processes for tasks such as expense tracking, invoicing, and financial reporting. By following consistent procedures, you can improve efficiency and accuracy in your financial management. Consider using accounting software to streamline these processes and gain real-time insights into your business’s financial performance.

Build an Emergency Fund and Plan for Unexpected Expenses

One key aspect of financial preparedness is building an emergency fund to handle unexpected expenses. Set aside a percentage of your revenue each month to build up a cash reserve that can be used in case of emergencies. Having an emergency fund can provide a cushion during challenging times and help your business weather unforeseen expenses.

In addition to an emergency fund, it’s essential to have a plan in place for handling unexpected expenses. Consider the types of risks your business may face, such as equipment breakdowns, legal disputes, or economic downturns, and establish protocols for managing these risks. You may also want to explore insurance options to mitigate certain risks and protect your business assets.

Seek Professional Financial Advice

Finally, don’t hesitate to seek out professional financial advice to guide your business’s financial strategy. Consulting with a financial advisor or CPA can provide you with personalized insights and recommendations tailored to your specific business needs.

Image courtesy of www.clevergirlfinance.com via Google Images

Attend workshops, seminars, and networking events to stay informed about financial best practices and connect with other business owners who can share their insights and experiences. By continuously learning and seeking advice from experts, you can position your business for long-term financial success.

Conclusion

In conclusion, financial preparedness is a critical component of building a successful business. By assessing your current financial situation, creating a budget and financial forecast, establishing financial controls and processes, building an emergency fund, and seeking professional financial advice, you can set your business up for growth and prosperity.

Implementing these key steps will help you navigate the challenges of running a business and make informed decisions that support your financial goals. By taking a proactive approach to financial management, you can position your business for long-term success and achieve your vision for the future.