From Startup to Success: The Ultimate Guide to Building a Thriving Business

May 24, 2024Unlock the secrets to transforming your startup into a thriving business with this ultimate guide filled with expert advice.

Image courtesy of jose luis Umana via Pexels

Table of Contents

As a small business owner, you know that financial planning is essential to the success and growth of your company. Whether you’re just starting out or looking to take your business to the next level, having a solid financial strategy in place can make all the difference. In this comprehensive guide, we will explore the key components of financial planning for small businesses and provide you with the tools and resources you need to set your business up for long-term success.

Setting Financial Goals

One of the first steps in financial planning for your small business is setting clear and achievable financial goals. These goals will serve as a roadmap for your business and help you stay focused on what you want to accomplish. Start by defining both short-term and long-term goals for your business. Short-term goals may include increasing revenue or launching a new product, while long-term goals could be expanding into new markets or achieving a certain level of profitability.

Budgeting and Cash Flow Management

Effective budgeting and cash flow management are crucial for the financial health of your small business. Establishing a budget will help you track your expenses, manage your cash flow, and make informed financial decisions. Be sure to regularly monitor your budget and adjust it as needed to stay on track. Additionally, managing your cash flow effectively is essential for ensuring that you have enough funds to cover your expenses and invest in the growth of your business.

Accounting and Bookkeeping Basics

Understanding basic accounting principles and maintaining accurate bookkeeping records are essential for the financial success of your small business. By keeping track of your revenue, expenses, and profits, you will have a clear picture of your financial performance and be better equipped to make strategic decisions. Consider using accounting software or hiring a professional accountant to help you manage your finances and ensure compliance with tax regulations.

Image courtesy of www.linkedin.com via Google Images

Investment and Growth Strategies

Exploring different investment options and growth strategies can help you take your small business to the next level. Whether you’re looking to expand your product line, enter new markets, or increase your market share, it’s important to have a solid plan in place. Consider investing in marketing, technology, or talent to drive growth and increase your revenue. Creating a sustainable growth plan will help you achieve your financial goals and build a thriving business.

Risk Management and Contingency Planning

Identifying potential risks and uncertainties in your business and creating contingency plans is essential for protecting your small business. From economic downturns to natural disasters, there are various risks that can impact your business operations. By developing risk management strategies and contingency plans, you can mitigate potential threats and ensure the long-term viability of your business. Additionally, having insurance coverage in place can provide added protection and peace of mind.

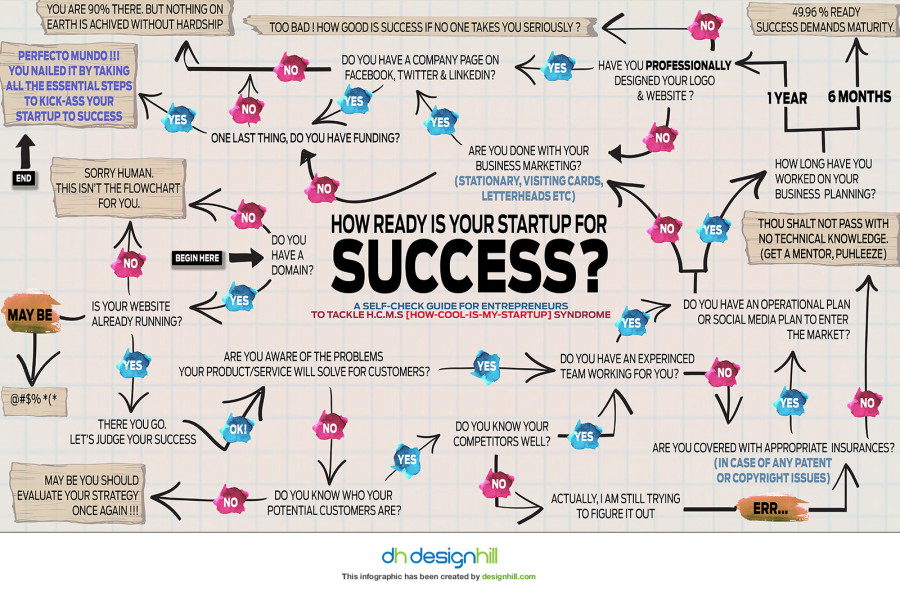

Image courtesy of www.business2community.com via Google Images

Conclusion

Financial planning is a critical component of building a successful small business. By setting clear goals, managing your budget and cash flow effectively, maintaining accurate accounting records, exploring investment and growth strategies, and implementing risk management and contingency planning, you can set your business up for long-term success. Remember, financial planning is an ongoing process that requires dedication and attention to detail. By prioritizing your finances and making informed decisions, you can build a thriving business that stands the test of time.