From Startup to Success Story: How to Make Your Business Boom

May 15, 2024Learn the key strategies and secrets to transforming your startup into a thriving success story in just a few simple steps.

Image courtesy of Pixabay via Pexels

Table of Contents

Managing your business finances effectively is crucial to the success and longevity of your company. By implementing sound financial practices, you can ensure that your business operates smoothly, remains profitable, and achieves long-term growth. In this guide, we will walk you through the essential steps to managing your business finances like a pro.

Create a Budget

One of the first steps in managing your business finances is to create a budget. A budget serves as a roadmap for your financial decisions, helping you plan and allocate resources effectively. Start by forecasting your income and expenses for the upcoming period. Consider all sources of revenue, including sales, investments, and loans, as well as potential expenses such as payroll, rent, utilities, and supplies.

Track Expenses

Tracking expenses is essential for maintaining financial health in your business. By monitoring your spending, you can identify areas where costs can be reduced and make informed decisions about resource allocation. Use accounting software or apps to streamline the process of tracking expenses. Categorize expenses, set spending limits, and regularly review your financial records to stay on top of your finances.

Monitor Cash Flow

Cash flow is the lifeblood of your business, so it’s crucial to monitor it closely. Keep track of incoming and outgoing cash to ensure that your business has enough liquidity to cover expenses and seize opportunities. Improve your cash flow by invoicing promptly, offering discounts for early payments, and negotiating better payment terms with vendors. By maintaining a positive cash flow, you can avoid cash shortages and keep your business running smoothly.

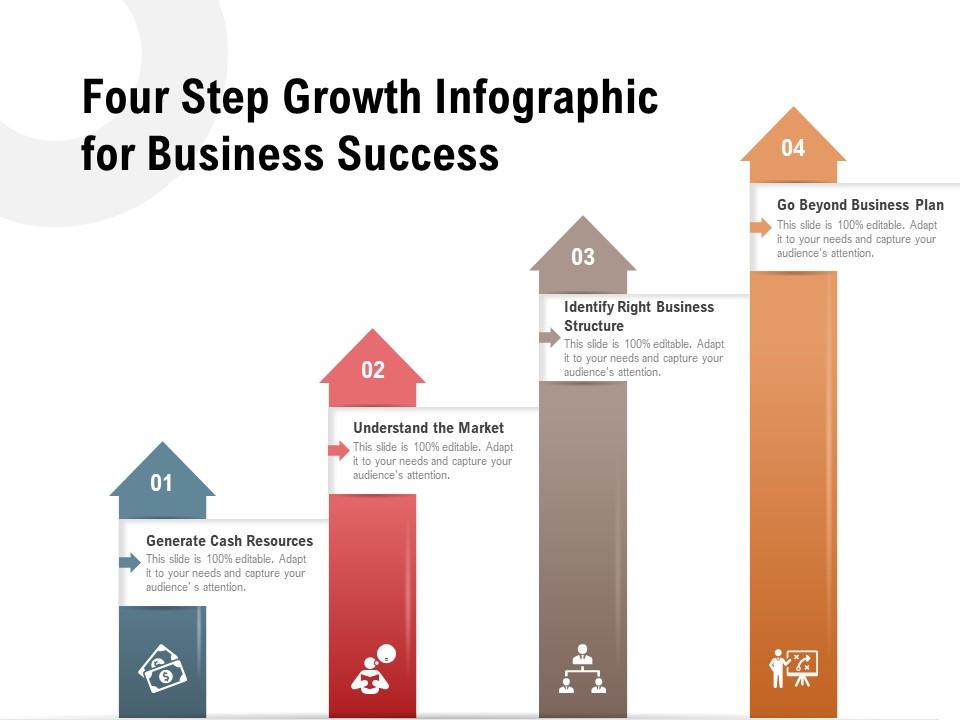

Image courtesy of www.slideteam.net via Google Images

Set Financial Goals

Setting financial goals is an effective way to drive your business forward and measure success. Define clear and attainable objectives, such as increasing revenue, reducing costs, or expanding your customer base. By setting specific goals, you can focus your efforts, track progress, and make informed decisions about resource allocation. Regularly review your financial goals and adjust them as needed to stay on track and achieve long-term success.

Review and Adjust Regularly

Financial management is an ongoing process that requires regular review and adjustment. Conduct financial reviews at regular intervals to assess the performance of your business, identify areas for improvement, and make necessary adjustments to your financial strategies. Analyze financial statements, track key performance indicators, and seek feedback from stakeholders to ensure that your business remains financially healthy and sustainable.

In conclusion, managing your business finances like a pro is essential for the success and growth of your company. By creating a budget, tracking expenses, monitoring cash flow, setting financial goals, and regularly reviewing and adjusting your financial strategies, you can ensure that your business operates smoothly, remains profitable, and achieves long-term success. Implement these essential steps in your business today and watch your company thrive from startup to success story.