From Startup to Success: How to Navigate the Business World Like a Pro

May 23, 2024Unlock the secrets of navigating the business world from startup to success with insider tips and expert strategies revealed now!

Image courtesy of Valentin Antonucci via Pexels

Table of Contents

When it comes to running a successful business, financial management plays a crucial role. As a business owner, it is essential to have a solid understanding of finance in order to make informed decisions that can lead to sustainable growth and profitability. In this blog post, we will explore some essential tips for business owners to navigate the world of finance effectively.

Setting Financial Goals

Setting clear financial goals is the first step towards ensuring the success of your business. By establishing realistic and achievable targets, you can create a roadmap to guide your financial decisions and track your progress over time. It is important to set both short-term and long-term goals that align with your overall business objectives.

Budgeting and Forecasting

Creating a comprehensive budget is essential for managing your business finances effectively. A budget helps you allocate resources efficiently, prioritize expenses, and identify areas where cost-saving measures can be implemented. By developing accurate financial forecasts, you can anticipate future income and expenses, allowing you to make informed decisions about the financial health of your business.

Managing Cash Flow

Maintaining healthy cash flow is vital for the sustainability of your business. Efficient cash flow management involves ensuring that you have enough cash on hand to cover expenses and invest in growth opportunities. By implementing strategies to improve cash flow, such as streamlining invoicing and payment collection processes, you can prevent cash flow problems that may hinder your business operations.

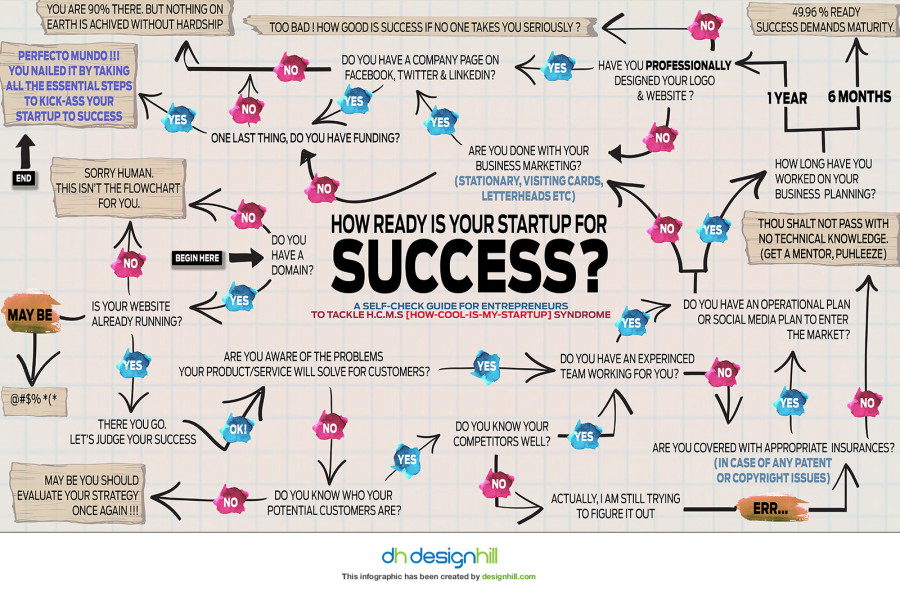

Image courtesy of www.business2community.com via Google Images

Investment and Financing Options

As a business owner, you may need to explore various investment and financing options to support your growth objectives. Understanding the differences between debt and equity financing can help you make informed decisions about how to raise capital for your business. It is important to evaluate the risk and return of investment opportunities carefully to ensure that they align with your financial goals.

Tax Planning and Compliance

Proper tax planning and compliance are essential for maintaining financial stability and minimizing tax liabilities. By taking advantage of common tax deductions and credits available to business owners, you can optimize your tax strategy and reduce your tax burden. Working with tax professionals can help ensure that you are compliant with tax regulations and take advantage of any tax-saving opportunities.

Image courtesy of www.simpleslides.co via Google Images

Conclusion

In conclusion, financial management is a critical aspect of running a successful business. By setting clear financial goals, creating budgets and forecasts, managing cash flow effectively, exploring investment and financing options, and prioritizing tax planning and compliance, business owners can navigate the world of finance with confidence. Remember, seeking professional assistance when needed can help you make informed financial decisions that lead to long-term success for your business.