From Startup to Success: How These Entrepreneurs Made It Big

June 17, 2024Discover the secret strategies and challenges faced by successful entrepreneurs as they transformed their startups into thriving businesses.

Image courtesy of Engin Akyurt via Pexels

Table of Contents

Financial decisions play a crucial role in determining the success of a business. From budgeting and investment strategies to managing debt and cash flow, smart financial management can make or break a company’s growth and profitability. In this blog post, we will explore the impacts of financial decisions on business success and provide insights into how entrepreneurs can navigate the complexities of finance to achieve their goals.

The Role of Budgeting in Business

Budgeting is the cornerstone of financial management in any business. By creating a budget, companies can set clear financial goals, allocate resources effectively, and monitor their performance against targets. A well-designed budget provides a roadmap for decision-making and helps business owners make informed choices about how to invest their resources.

One of the key benefits of budgeting is that it forces businesses to prioritize their spending and focus on activities that drive value. By identifying areas of unnecessary expenditure and reallocating resources to more productive uses, companies can improve their bottom line and achieve sustainable growth.

Investment Strategies for Long-Term Growth

Investing wisely is essential for businesses looking to achieve long-term success. Whether it’s investing in new equipment, expanding into new markets, or acquiring another company, strategic investments can drive growth and create value for shareholders.

Diversification is a key principle of investment strategy, as it helps businesses spread risk and maximize returns. By investing in a mix of assets with different risk profiles, companies can protect themselves against market fluctuations and ensure a more stable financial future.

The Impact of Debt on Business Operations

Debt can be a double-edged sword for businesses. On one hand, it can provide the capital needed to grow and expand operations. On the other hand, excessive debt can burden companies with high interest payments and limit their ability to invest in future opportunities.

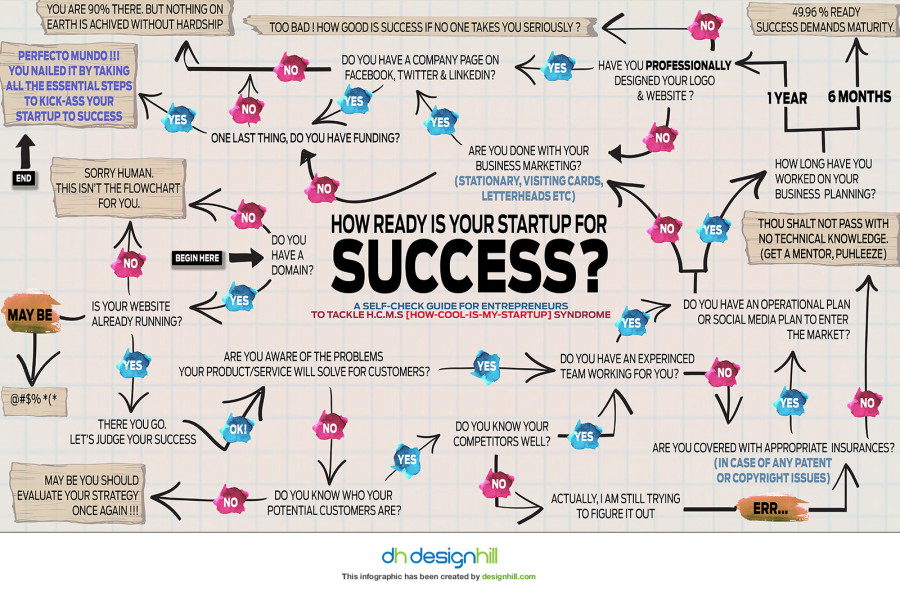

Image courtesy of www.business2community.com via Google Images

Managing debt effectively is crucial for maintaining a healthy financial position. By keeping debt levels in check, businesses can reduce their financial risk and free up resources for other strategic initiatives. Developing a debt repayment plan and renegotiating terms with creditors can help businesses navigate challenging financial situations and avoid long-term consequences.

Importance of Cash Flow Management

Cash flow is the lifeblood of any business. Without a steady stream of cash coming in, companies can struggle to meet their financial obligations and fund day-to-day operations. Effective cash flow management involves monitoring inflows and outflows, forecasting future cash needs, and implementing strategies to ensure liquidity.

Improving cash flow can help businesses weather economic downturns, seize new opportunities, and invest in growth initiatives. By implementing measures such as tightening credit terms, reducing inventory levels, and accelerating receivables, companies can enhance their cash flow position and strengthen their financial resilience.

Strategic Financial Decision-Making

Strategic financial decision-making is the foundation of successful businesses. By considering factors such as risk appetite, return on investment, and market conditions, companies can make informed choices that align with their long-term objectives.

Image courtesy of www.plugandplaytechcenter.com via Google Images

Examples of successful companies that have made strategic financial decisions abound. From strategic acquisitions and partnerships to innovative financing arrangements and cost-saving initiatives, these businesses have demonstrated the power of smart financial management in driving growth and profitability.

Conclusion

In conclusion, the impacts of financial decisions on business success are profound. By prioritizing budgeting, investing strategically, managing debt effectively, optimizing cash flow, and making informed financial decisions, entrepreneurs can navigate the complexities of finance and achieve their goals. By learning from the experiences of successful entrepreneurs and implementing best practices in financial management, businesses can position themselves for long-term success and sustainable growth.