From Start-Up to Success: How to Build a Thriving Business from Scratch

May 23, 2024Discover the key strategies and insider tips to transform your start-up into a thriving business with proven success.

Image courtesy of JESHOOTS.com via Pexels

Table of Contents

In today’s competitive business landscape, starting a new venture can be a daunting task. However, with the right strategies and mindset, it is possible to build a successful business from scratch. In this blog post, we will guide you through the essential steps you need to take to turn your start-up into a thriving enterprise.

Setting Financial Goals

One of the first steps in building a successful business is setting clear financial goals. These goals will serve as a roadmap for your business and help you track your progress towards achieving financial stability. When setting financial goals, it is important to be specific, measurable, achievable, relevant, and time-bound (SMART).

Budgeting Basics

Budgeting is a fundamental aspect of financial management for any business. It involves planning and tracking your income and expenses to ensure that you are operating within your means. To create a budget, start by listing all your sources of income and expenses. This will give you a clear picture of your financial situation and help you identify areas where you can cut costs or increase revenue.

Building an Emergency Fund

Building an emergency fund is essential for protecting your business from unexpected expenses or financial setbacks. An emergency fund should ideally cover three to six months’ worth of operating expenses. To build an emergency fund, set aside a portion of your income each month and keep it in a separate account that is easily accessible in case of emergencies.

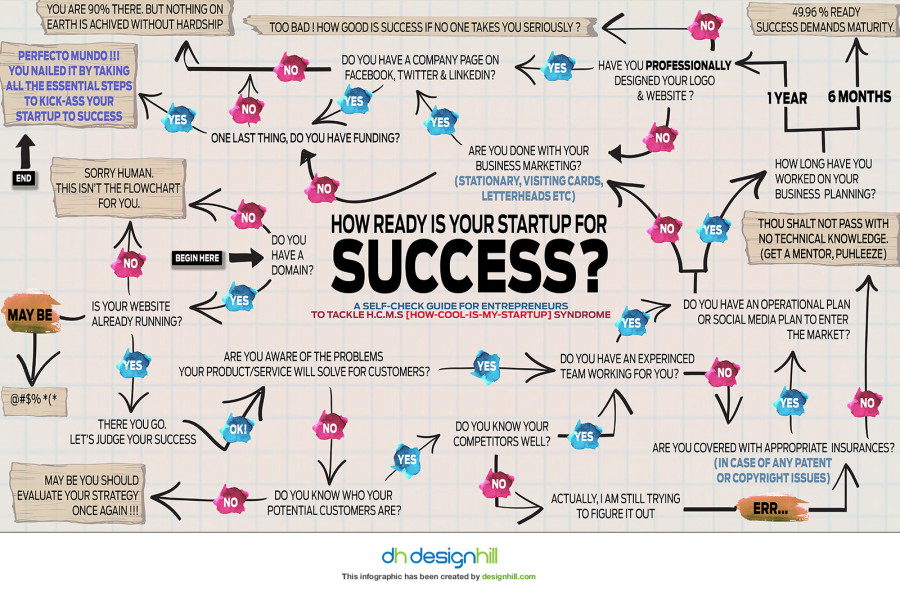

Image courtesy of www.business2community.com via Google Images

Investing for the Future

Investing is a key aspect of building wealth and achieving long-term financial stability. There are various investment options available, such as stocks, bonds, mutual funds, and real estate. Before investing, it is important to do thorough research and seek advice from financial professionals to ensure that you are making informed decisions that align with your financial goals.

Financial Planning for the Long Term

Long-term financial planning is crucial for securing your business’s future and ensuring that you are prepared for retirement. This includes saving for retirement, estate planning, and creating a comprehensive financial plan that aligns with your business goals. Working with a financial advisor can help you navigate complex financial decisions and ensure that you are on track to achieve financial stability in the long run.

In conclusion, building a thriving business from scratch requires careful financial planning and management. By setting clear financial goals, creating a budget, building an emergency fund, investing for the future, and planning for the long term, you can lay the foundation for a successful and sustainable business. Remember, financial stability is a journey, not a destination, so stay committed to your financial goals and continuously assess and adjust your strategies to ensure the success of your business.