From Small Start-Up to Big Success: Insider Tips for Entrepreneurs

June 30, 2024Discover the secrets behind transforming a small start-up into a thriving success with these exclusive insider tips for entrepreneurs.

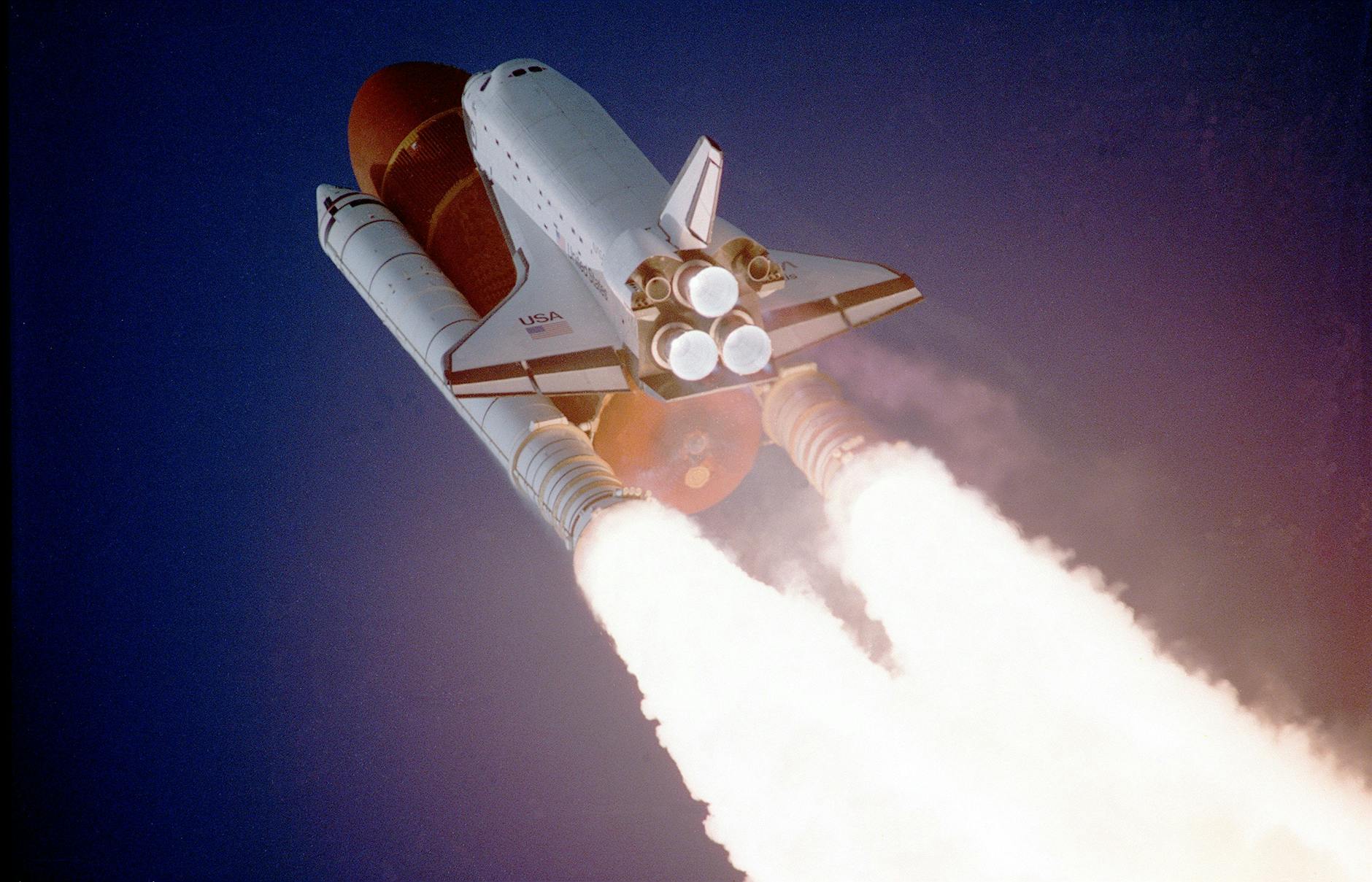

Image courtesy of Pixabay via Pexels

Table of Contents

Managing the finances of a business is a critical aspect of running a successful venture. Whether you are a seasoned entrepreneur or just starting out, mastering the art of financial management can make a significant difference in the growth and sustainability of your business. In this blog post, we will explore key strategies and tips on how to manage your business finances like a pro.

Set Up Your Financial Framework

Establishing a solid financial framework is the first step in effective financial management. Start by creating a budget that outlines your business’s income and expenses. Setting clear financial goals can help you stay focused and track your progress. Additionally, investing in accounting software can streamline your financial processes and provide valuable insights into your business’s financial health. Consider opening separate business bank accounts to keep personal and business finances separate, making it easier to track and manage your cash flow.

Monitor Cash Flow Regularly

Cash flow is the lifeblood of any business. Regularly monitoring your cash flow can help you identify potential cash shortages or surpluses and make informed decisions to maintain financial stability. Analyzing patterns in your cash flow can also help you anticipate future financial needs and plan accordingly. Implementing strategies to improve cash flow, such as securing payment terms with clients or cutting unnecessary expenses, can further enhance your business’s financial health.

Control Costs and Expenses

Controlling costs and expenses is essential for maximizing profitability and sustainability. Conduct regular reviews of your expenses to identify areas where costs can be minimized. Negotiating better deals with vendors and suppliers can help you save money on purchases and reduce your overall expenses. Implementing a spending policy and approval process can help curb unnecessary spending and ensure that resources are allocated efficiently.

Plan for Taxes and Legal Compliance

Staying compliant with tax regulations and legal requirements is crucial for avoiding penalties and maintaining the financial health of your business. Stay informed about tax laws that apply to your business and set aside funds for taxes to avoid cash flow interruptions. Creating a system for filing taxes accurately and on time can help you stay organized and avoid costly mistakes. Consult with a tax professional to ensure compliance and identify opportunities for tax savings.

Review and Adjust Your Financial Plan

Regularly reviewing your financial performance against your goals is essential for making informed decisions and adjusting your financial plan as needed. Seek feedback from key stakeholders and advisors to gain valuable insights into your financial strategies. Continuously educating yourself on financial management best practices can help you stay ahead of the curve and make proactive decisions to improve your business’s financial health.

Conclusion

Managing your business finances effectively is a key component of entrepreneurial success. By setting up a solid financial framework, monitoring your cash flow, controlling costs and expenses, planning for taxes and legal compliance, and reviewing and adjusting your financial plan, you can position your business for long-term growth and sustainability. Take control of your business finances today and pave the way for a successful future.