Dollars and Sense: Understanding the Basics of Personal Finance

May 25, 2024Unlock the secrets to financial success with our guide to mastering personal finance and securing your financial future today!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing finances is a crucial aspect of running a successful business. Without proper financial management, a business can quickly run into cash flow problems, struggle to cover expenses, and ultimately fail. In this blog post, we will discuss some essential tips on how to effectively manage your business finances.

Keep track of your expenses

Creating a budget for your business is the first step in managing your finances effectively. A budget helps you plan and allocate your resources in a way that ensures you can cover all your expenses while still making a profit. Be sure to record all transactions and categorize them properly to get a clear picture of where your money is going.

Utilizing accounting software can streamline the process of tracking your expenses and make it easier to generate financial reports. These tools can also help you identify any areas where you might be overspending or where you can cut costs.

Monitor your cash flow

Regularly checking your cash flow statement is essential for understanding the financial health of your business. Your cash flow statement shows how money is moving in and out of your business over a specific period. By analyzing this statement, you can identify any patterns or trends that may be impacting your cash flow.

If you notice that more money is going out of your business than coming in, it may be time to take action. This could involve reducing expenses, increasing sales, or finding ways to improve your collection of accounts receivable.

Control your costs

Analyzing your expenses and finding ways to cut costs is key to managing your business finances effectively. Start by examining your expenses and identifying areas where you may be overspending. Look for opportunities to negotiate with suppliers for better rates or consider outsourcing certain tasks to save on overhead costs.

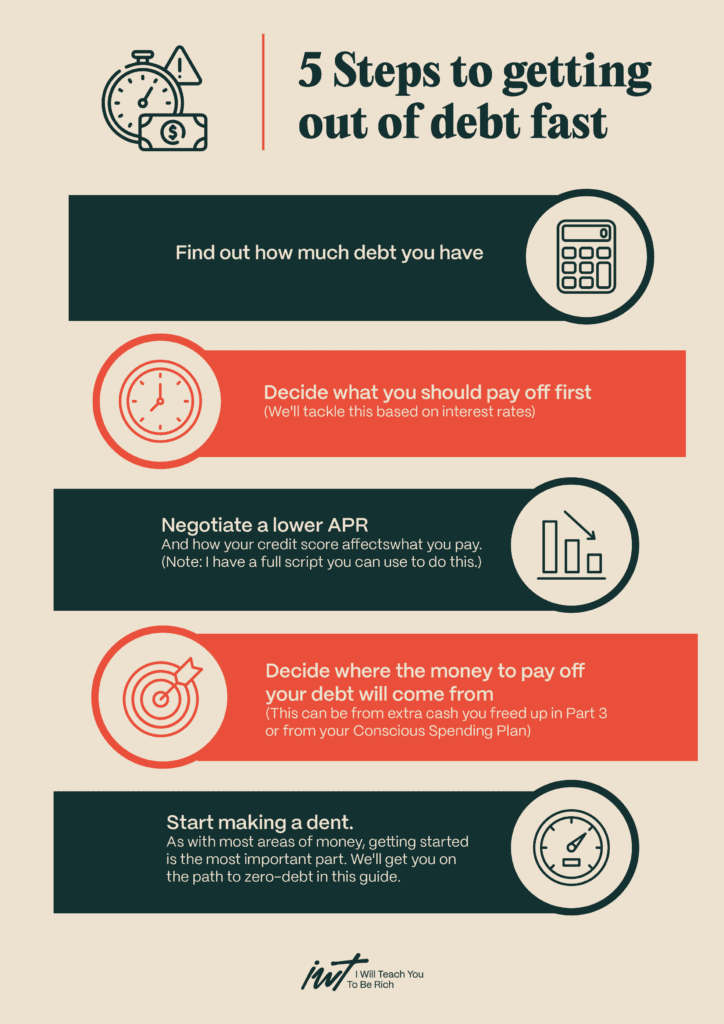

Image courtesy of www.iwillteachyoutoberich.com via Google Images

Implementing cost-saving measures can help improve your bottom line and increase your profitability. By regularly reviewing your expenses and looking for ways to cut costs, you can ensure that your business remains financially healthy.

Set financial goals

Setting financial goals for your business is important for staying on track and measuring your progress. Establish both short-term and long-term goals that are specific, measurable, achievable, relevant, and time-bound. Break down these goals into manageable steps that you can work towards on a daily, weekly, or monthly basis.

Regularly monitoring your progress towards your financial goals allows you to make adjustments as needed and stay focused on your objectives. This can help you stay motivated and ensure that you are making progress towards building a financially successful business.

Seek professional help if needed

If you are struggling to manage your business finances on your own, consider seeking professional help. Hiring a financial advisor can provide you with expert guidance on how to improve your financial management practices and make informed decisions about your business finances.

Working with an accountant can also be beneficial, especially when it comes to preparing your taxes and financial statements. An accountant can ensure that your financial records are accurate and up-to-date, helping you avoid costly mistakes and penalties.

Attending workshops or seminars on financial management can also be a great way to improve your financial literacy and learn new strategies for managing your business finances effectively. By investing in your financial education, you can set yourself up for long-term success and ensure the financial health of your business.

Managing your business finances effectively is essential for the success and longevity of your business. By keeping track of your expenses, monitoring your cash flow, controlling your costs, setting financial goals, and seeking professional help when needed, you can ensure that your business remains financially healthy and sustainable.