Dollars and Sense: Navigating the World of Finance with Confidence

May 21, 2024Unlock the secrets to financial success and confidence in our comprehensive guide to mastering the world of finance.

Image courtesy of Valentin Antonucci via Pexels

Table of Contents

As a small business owner, you wear many hats, and one of the most important ones is that of a financial manager. Effectively managing your business finances is crucial for sustainable growth and long-term success. In this guide, we will walk you through the steps to manage your small business finances like a pro.

Track Income and Expenses

Tracking your small business’s income and expenses is the foundation of good financial management. It allows you to have a clear picture of your financial health and make informed decisions. Start by keeping detailed records of all transactions, including sales, expenses, and any other financial activities.

Consider using accounting software or apps to streamline this process. These tools can help you categorize transactions, generate financial reports, and track your cash flow more effectively.

Create a Budget

Creating a budget is essential for managing your small business finances. A budget helps you set financial goals, allocate resources effectively, and plan for future expenses. Start by listing all your expenses, including fixed costs like rent and utilities, variable costs like inventory and supplies, and any other operational expenses.

Next, estimate your monthly income and compare it to your expenses. This will help you identify areas where you can cut costs or reallocate resources. Review and adjust your budget regularly based on your financial performance to ensure you stay on track.

Monitor Cash Flow

Cash flow is the lifeblood of any small business. It refers to the movement of money in and out of your business and is essential for day-to-day operations. Monitoring your cash flow allows you to identify any cash shortages or surpluses and take proactive measures to manage them.

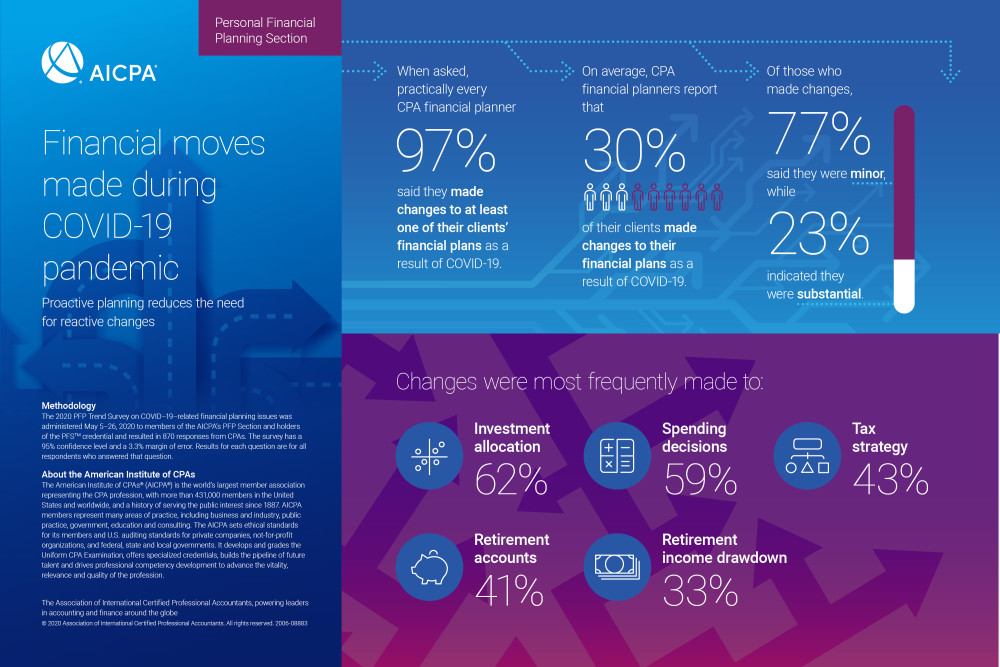

Image courtesy of www.aicpa-cima.com via Google Images

To improve your cash flow, consider strategies such as negotiating better payment terms with vendors, incentivizing early payments from customers, or reducing unnecessary expenses. Managing your accounts receivable and accounts payable effectively can also help optimize your cash flow.

Plan for Taxes

Taxes are a significant financial obligation for small businesses. To avoid any surprises come tax season, it’s essential to plan and set aside funds for taxes throughout the year. Familiarize yourself with the tax requirements for small businesses in your jurisdiction and keep accurate records of your income and expenses.

Consider working with a qualified tax professional who can provide guidance on tax planning, deductions, and compliance. They can help you maximize your tax savings and ensure you meet all your tax obligations on time.

Seek Professional Help

Managing your small business finances can be overwhelming, especially as your business grows. Seeking professional help from an accountant or financial advisor can provide you with invaluable expertise and support. An accountant can help you with bookkeeping, financial reporting, and tax preparation, while a financial advisor can offer strategic advice on business finances and investments.

Outsourcing financial tasks to experts allows you to focus on growing your business and ensures that your finances are in capable hands. Consider hiring professionals who specialize in small business finances and have experience working with businesses similar to yours.

By following these steps and incorporating sound financial practices into your small business operations, you can manage your finances like a pro and set your business up for long-term success.