Dollars and Sense: A Guide to Budgeting Like a Pro

June 8, 2024Unlock the secrets to mastering your finances with our expert guide on budgeting like a pro. Say goodbye to debt!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Proper financial management is the backbone of any successful business. Without a solid understanding of your company’s finances, it’s challenging to make informed decisions that will drive growth and sustainability. In this guide, we will explore how you can effectively manage your business finances to set yourself up for long-term success.

Analyze Your Current Financial Situation

Before you can begin to make improvements to your financial management practices, it’s essential to have a clear understanding of your current situation. Take the time to review your income, expenses, and cash flow to identify any areas of concern or potential improvement. This analysis will serve as a foundation for creating a plan to enhance your financial management.

Create a Budget and Financial Plan

One of the most critical steps in effective financial management is creating a comprehensive budget and financial plan. Start by outlining your expected income and expenses for the upcoming period. Set clear financial goals and objectives for your business, such as increasing profits, reducing costs, or expanding into new markets. Once you have established these goals, develop strategies to achieve them and track your progress regularly to ensure you stay on target.

Monitor and Manage Cash Flow

Cash flow is the lifeblood of any business, so it’s vital to monitor and manage it effectively. Keep a close eye on your incoming and outgoing payments to ensure you have enough cash on hand to meet your financial obligations. Implement strategies to improve your cash flow, such as negotiating better payment terms with vendors or offering discounts to customers who pay their invoices early. Consider using accounting software or financial tools to help you manage your cash flow more efficiently.

Image courtesy of www.linkedin.com via Google Images

Seek Professional Financial Advice

While you may have a good understanding of your business finances, seeking professional financial advice can provide valuable insights and guidance. Consider consulting with a financial advisor or accountant to help you make informed decisions about tax planning, investment opportunities, or financial forecasting. These experts can also help ensure your compliance with financial regulations and laws, giving you peace of mind that your finances are in good hands.

Continuously Review and Adjust Your Financial Management Practices

Financial management is not a one-time task; it requires ongoing attention and adjustment to remain effective. Regularly review your financial statements and reports to ensure their accuracy and identify areas for improvement. Be proactive in adjusting your financial management practices based on changing market conditions or business needs. Stay informed about financial trends and best practices in financial management to ensure you are equipped to make sound financial decisions.

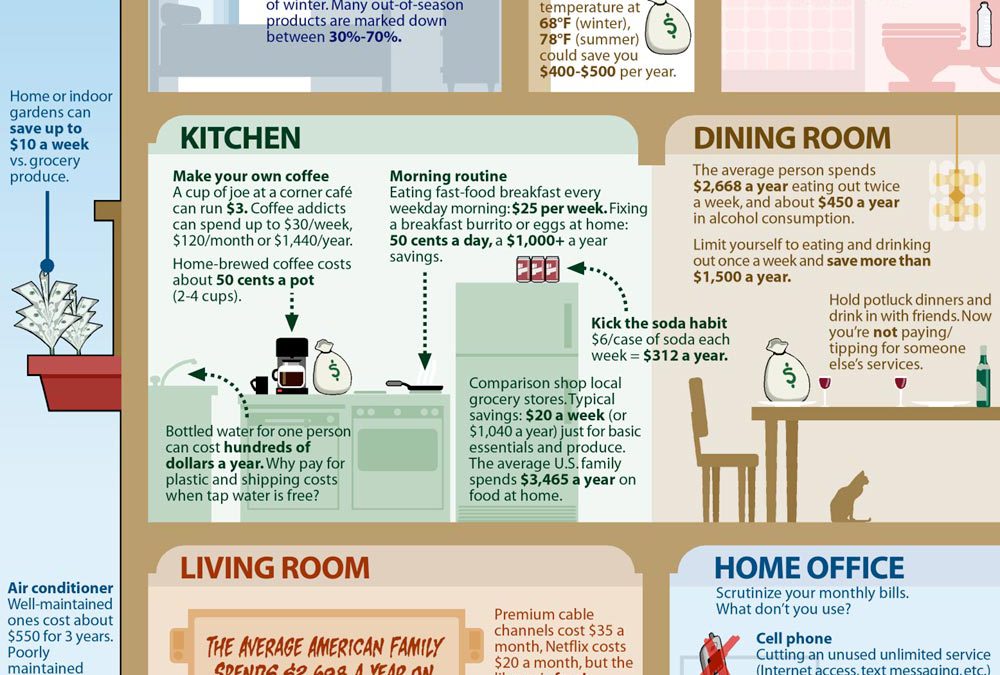

Image courtesy of www.quicken.com via Google Images

Conclusion

Effective financial management is essential for the success and sustainability of any business. By following the tips and strategies outlined in this guide, you can set yourself up for success and drive growth and profitability in your business. Remember to analyze your current financial situation, create a budget and financial plan, monitor and manage your cash flow, seek professional advice, and continuously review and adjust your financial management practices. By taking a proactive approach to managing your business finances, you can position your business for long-term success.