Budgeting Basics: How to Take Control of Your Finances and Live Within Your Means

June 5, 2024Discover the secrets to mastering your money and achieving financial freedom with these essential budgeting tips and tricks today!

Image courtesy of maitree rimthong via Pexels

Table of Contents

As an individual or a business, understanding and analyzing the impact of current economic trends on finance is crucial for making informed decisions. The economy is constantly changing, and these fluctuations can have a significant influence on business operations, investment decisions, and overall financial well-being. In this blog post, we will delve into the relationship between economic trends and business finance, exploring key indicators, strategies for mitigating risks, and real-life case studies of successful financial management.

Overview of Current Economic Trends

When looking at economic trends, there are several key indicators that businesses should pay attention to. Gross Domestic Product (GDP) growth, inflation rates, and unemployment rates are some of the main factors that can impact financial markets and business operations. For example, high GDP growth typically indicates a strong economy, which can lead to increased consumer spending and business investment. On the other hand, high inflation rates can erode purchasing power and affect production costs for businesses. Similarly, fluctuations in unemployment rates can impact consumer confidence and overall economic performance.

Impact on Business Finance

One of the ways in which economic trends can directly affect business finance is through interest rates. Fluctuating interest rates can have a significant impact on borrowing costs for businesses, influencing decisions on whether to take out loans or issue bonds. For example, low interest rates can make borrowing cheaper and more attractive, leading to increased investment in capital projects. Conversely, high interest rates can deter businesses from taking on debt, potentially slowing down economic growth.

Currency exchange rates are another important factor that can impact business finance, especially for companies engaged in international trade. Fluctuations in exchange rates can affect the cost of imported goods and the competitiveness of exports, leading to changes in revenue and profit margins. Businesses that operate across borders need to closely monitor currency movements and implement strategies to manage currency risk, such as hedging techniques.

Strategies for Mitigating Risks

There are several strategies that businesses can use to mitigate financial risks arising from economic trends. Hedging is a common technique used to manage currency risk by offsetting potential losses from adverse exchange rate movements. For example, a company that expects to receive payments in a foreign currency in the future can enter into a forward contract to lock in a favorable exchange rate.

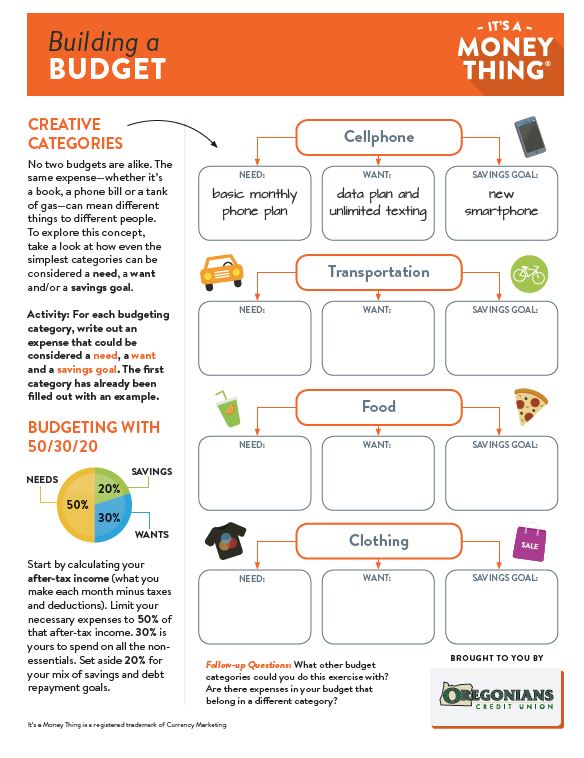

Image courtesy of www.oregonianscu.com via Google Images

Financial tools such as derivatives and insurance can also be used to protect against market fluctuations. Derivatives, such as options and futures contracts, can help businesses hedge against commodity price volatility or interest rate risk. Insurance products, such as property and casualty insurance, can provide protection against unforeseen events that could impact financial stability.

Case Studies

Examining real-life case studies can provide valuable insights into how businesses have successfully navigated economic challenges by implementing sound financial strategies. For example, during the 2008 financial crisis, companies that had a diversified portfolio of investments and a conservative approach to debt management were able to weather the storm better than those that took on excessive risk.

Lessons learned from past economic downturns can help businesses better prepare for future uncertainties. By staying informed about economic trends, monitoring key indicators, and implementing risk management strategies, businesses can position themselves to adapt to changing market conditions and thrive in a dynamic economic environment.

Conclusion

Understanding the impact of current economic trends on business finance is essential for making informed financial decisions and managing risks effectively. By analyzing key indicators, implementing strategies to mitigate risks, and learning from real-life case studies, businesses can take proactive steps to navigate economic challenges and ensure long-term financial stability. It is important for businesses to stay vigilant, stay informed, and be prepared to adjust their financial strategies in response to changing economic conditions.