Budgeting 101: How to Take Control of Your Finances

June 9, 2024Discover the simple strategies to finally take control of your finances and achieve financial freedom once and for all!

Image courtesy of maitree rimthong via Pexels

Table of Contents

Managing the finances of a business is a critical aspect of running a successful operation. Without proper financial planning and oversight, a business can quickly find itself in dire straits. In this blog post, we will explore the importance of effective financial management for businesses and provide a step-by-step guide on how to successfully manage your business finances.

Assess Your Current Financial Situation

Before you can make any meaningful changes to your financial management strategy, it is essential to have a clear understanding of your current financial situation. This involves reviewing your current income and expenses, analyzing your financial statements, and evaluating your cash flow.

By taking the time to assess your current financial situation, you can identify areas of strength and weakness in your finances and make informed decisions about how to move forward.

Create a Budget and Financial Goals

One of the most important steps in effectively managing your business finances is creating a budget and setting financial goals. Your financial goals should be specific, measurable, attainable, relevant, and time-bound (SMART).

Developing a detailed budget that aligns with your goals is crucial for tracking your progress and making adjustments as needed. Regularly monitoring your budget will help you stay on track and make informed decisions about your business finances.

Track and Monitor Expenses

Tracking and monitoring your expenses is essential for maintaining control over your finances. Implementing a system to track all business expenses, whether through accounting software or manual record-keeping, will help you identify areas where you can cut costs and improve your bottom line.

Image courtesy of www.clevergirlfinance.com via Google Images

Regularly reviewing your expenses will also help you identify any discrepancies or errors in your financial records, allowing you to address them before they become larger issues.

Save for Taxes and Emergency Funds

Setting aside funds for taxes and emergency situations is a crucial part of financial management for businesses. By saving a portion of your income for taxes and unexpected expenses, you can avoid financial stress and ensure that your business remains financially stable.

Understanding your tax obligations and deadlines is essential for avoiding penalties and fines. Building a financial cushion for unexpected expenses will provide peace of mind and protect your business from unforeseen financial challenges.

Seek Professional Help When Needed

While it is possible to manage your business finances on your own, there may be times when seeking professional help is necessary. Consulting with a financial advisor or accountant can provide valuable insights and guidance on how to improve your financial management strategy.

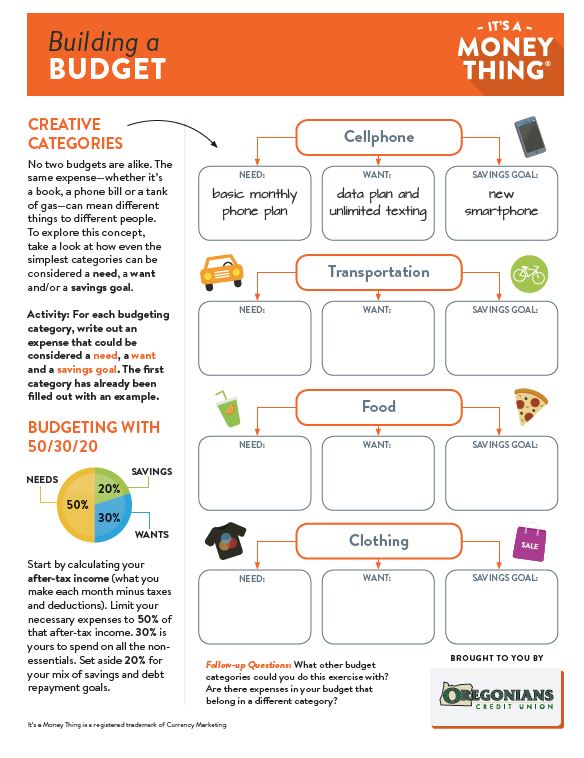

Image courtesy of www.oregonianscu.com via Google Images

Utilizing online resources and tools for financial management can also help streamline your processes and make it easier to track and monitor your finances. Knowing when to delegate financial tasks to others in your team is essential for maintaining efficiency and accuracy in your financial management.

Conclusion

Effective financial management is crucial for the success of any business. By following the steps outlined in this blog post, you can take control of your finances and set your business up for long-term success. Remember to regularly assess your financial situation, create a budget and set financial goals, track and monitor your expenses, save for taxes and emergency funds, and seek professional help when needed. With a solid financial management strategy in place, you can confidently navigate the financial aspects of your business and achieve your goals.