Breaking Barriers: Innovating in a Competitive Market

June 2, 2024Discover how one company defied the odds and revolutionized their industry with groundbreaking innovation in a cutthroat market.

Image courtesy of Mikael Blomkvist via Pexels

Table of Contents

Managing finances is a crucial aspect of running a successful business. Without effective financial management, a business can quickly find itself in trouble. In this blog post, we will discuss key steps that business owners can take to manage their finances effectively and ensure the financial health of their business.

Create a Budget

Creating a budget is the first step in managing your business finances effectively. Start by determining all your income sources, including revenue from sales, investments, and any other sources of income. Next, list all your expenses, both fixed costs like rent and salaries, and variable costs like supplies and utilities. Allocate funds for savings and emergency funds to ensure you have a financial buffer in case of unexpected expenses.

Track Expenses

Tracking expenses is essential for understanding where your money is going and identifying areas where costs can be reduced. Keep thorough records of all business expenditures, including receipts and invoices. Consider using accounting software or applications to help streamline the process and make it easier to track expenses. Regularly review and analyze your expenses to identify any unnecessary spending and find ways to cut costs.

Monitor Cash Flow

Managing cash flow is critical for the financial stability of your business. Keep track of incoming and outgoing cash flow to ensure you have enough funds to cover expenses and grow your business. Consider implementing a cash flow management system to help you monitor your cash flow more effectively and identify any potential cash flow issues before they become a problem.

Image courtesy of www.linkedin.com via Google Images

Set Financial Goals

Setting financial goals is essential for guiding your business towards success. Establish both short-term and long-term financial goals for your business, such as increasing revenue, reducing expenses, or expanding your operations. Make sure your financial goals are realistic and actionable so that you can track your progress and make adjustments as needed. Regularly review your progress towards achieving your financial goals to stay on track and make any necessary changes to your financial strategies.

Seek Professional Help

Consider hiring a financial advisor or accountant to help you manage your business finances. Financial professionals can provide valuable expertise and guidance on developing financial strategies and plans for your business. They can help you make informed financial decisions and ensure the financial health of your business. Take advantage of their advice and services to improve your financial management practices and set your business up for long-term success.

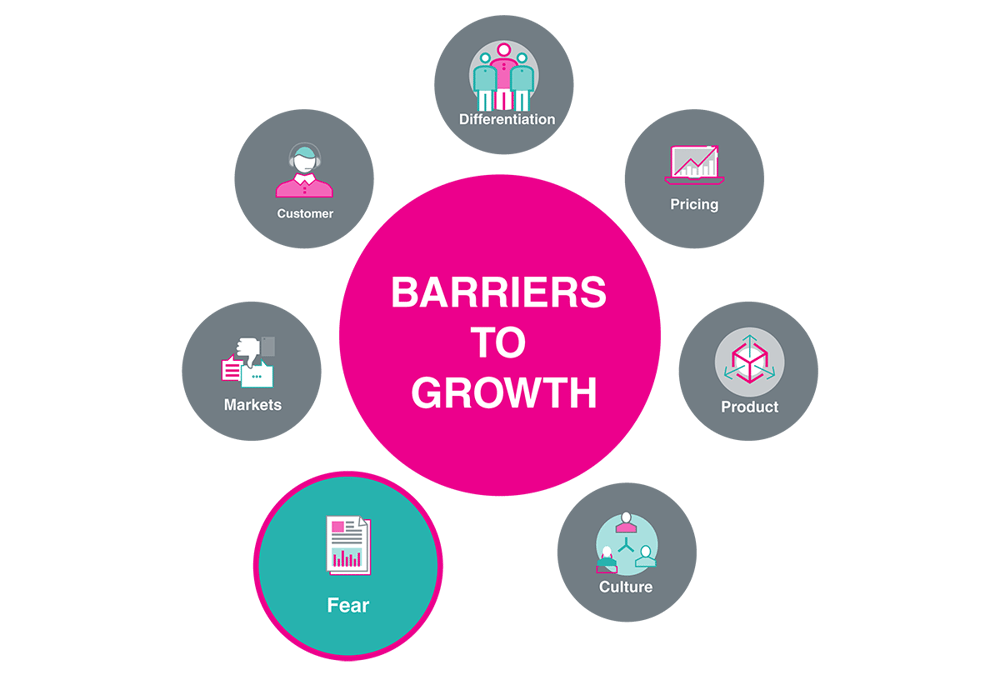

Image courtesy of www.themarketingcentre.com via Google Images

Conclusion

Effective financial management is essential for the success of any business. By creating a budget, tracking expenses, monitoring cash flow, setting financial goals, and seeking professional help, you can ensure the financial health of your business and set yourself up for long-term success. Take action today and start implementing these financial management strategies to improve the financial stability and growth of your business.